Municipals were stronger on Tuesday as Ohio and Nevada issuers came to market with water deals.

“The muni market is not finished rallying," said one New York trader. "It’s going to be either in direct appreciation in price and/or relative value outperformance if Treasuries sell off at all,” he said. “I believe the full impact of tax reform and specifically the cap on the [State and Local Tax] deduction is just beginning to set in as taxes are being filed.” The trader added that while the muni-to-Treasury ratio curve is unusually steep, he believes it can sustain at least current levels, if not widen a bit more.

Municipal bonds were stronger Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the four- to 30-year maturities and rose less than a basis point in the one- to three-year maturities. High-grade munis were also stronger, according to MBIS, with muni yields falling as much as one basis point across the curve.

Investment-grade municipals were stronger on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation falling two basis points while the yield on the 30-year muni maturity dropped four basis points.

“The broader muni curve is lower in yield by as much as two basis points, mostly from the 10-year and longer maturities," ICE Data Services said in a Tuesday market comment. “High-yield and tobaccos are also lower by about one basis point in yield as well. The taxable side of the market is as much as 3.5 basis points lower in yield in the seven-year maturities with the rest of the move being lest pronounced.”

Treasury bonds were stronger as stock prices traded mixed.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 79.1% while the 30-year muni-to-Treasury ratio stood at 98.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasurys with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

COFINA bonds trading

Some of the restructured Puerto Rico Sales Tax Financing Corp. bonds were again actively trading on Tuesday.

The COFINA restructured Series A1 5% bonds of July 1, 2058, dated Aug. 8, 2018, (principal amount of issuance of $3.479 billion), were trading on Tuesday at a high price of 97.659 cents on the dollar and a low price of 93.493 cents. That compared with high and low prices of 98.00 cents and 93.531 cents on Monday, 96.825 cents and 94.761 cents on Friday, 100 cents and 94.4 cents on Thursday, 98.50 cents and 94.05 cents on Wednesday, 98.284 cents and 94.959 cents on Tuesday and 98.637 cents and 95.055 cents last Friday, according to the Municipal Securities Rulemaking Board’s EMMA website.

Trading volume slipped to $50.775 million in 102 trades, from $66.119 million in 120 trades on Monday, $68.352 million in 142 trades on Friday, $99.216 million in 143 trades on Thursday, $57.349 million in 139 trades on Wednesday. Cofina volume totaled $143.321 million in 103 trades on Tuesday and $166.912 million in 49 trades last Friday, EMMA reported.

The COFINA restructured Series Capital Appreciation 0% bonds of July 1, 2046, dated Aug. 8, 2018, (principal amount of issuance of $1.095 billion), were trading on Tuesday at a high price of 19.835 cents on the dollar and a low price of 18.92 cents, compared to high and low prices of 20.118 cents and 16.492 cents on Monday, 20.014 cents and 18.593 cents on Friday, 22.747 cents and 18 cents on Thursday, 20.759 cents and 17.666 cents on Wednesday, 20.836 cents and 18.712 cents on Tuesday and 22.657 cents and 19.835 cents on Friday, according to EMMA.

Trading volume totaled $23.227 million in 102 trades, compared with $26.016 million in 148 trades on Monday, $47.048 million in 153 trades on Friday, $62.957 million in 166 trades on Thursday, $60.229 million in 139 trades on Wednesday, $69.424 million in 74 trades on Tuesday, and $51.76 million in 19 trades the previous Friday, EMMA reported.

The COFINA restructured Series Capital Appreciation 0% bonds of July 1, 2031, dated Aug. 8, 2018, (principal amount of issuance of $252.924 million), were trading on Tuesday at a high price of 57.461 cents on the dollar and a low price of 54.364 cents. That compared with high and low prices of 58.083 cents and 53.356 cents on Monday, 56.895 cents and 52.466 cents on Friday, 56.957 cents and 49.646 cents on Thursday, 57.073 cents and 53.509 cents on Wednesday, 56.38 cents and 53.517 cents on Tuesday and 55.309 cents and 53.651 cents the previous Friday, according to EMMA.

Trading volume totaled $30.376 million in 68 trades compared to $17.983 million in 92 trades on Monday, $4.756 million in 79 trades on Friday, $27.576 million in 93 trades on Thursday, $61.961 million in 97 trades on Wednesday, $66.19 million in 61 trades on Tuesday and $9.62 million in five trades the previous Friday, EMMA reported.

Previous session's activity

The Municipal Securities Rulemaking Board reported 36,174 trades on Monday on volume of $7.17 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.427% of the market, the Empire State taking 11.536% and the Lone Star State taking 10.856%.

A rose by any other name

Bank of America said on Monday that it would be changing the name of its Bank of America Merrill Lynch unit to BofA Securities.

BofA Securities will represent the banks institutional broker-dealer businesses, including global markets, investment banking and capital markets.

The bank said Merrill will remain as its sub-brand for its investing and wealth management units, with Merrill Edge Self-Directed, Merrill Guided Investing, Merrill Lynch Wealth Management and Merrill Private Wealth Management falling under this category.

The Bank of America name will remain as its main brand name and also represent its banking services for people and companies. As part of these changes, its U.S. Trust unit will be renamed as the Bank of America Private Bank.

Primary market

BofA priced and repriced the Ohio Water Development Authority’s $450 million of Series 2019A water pollution control loan fund revenue bonds.

The deal is rated triple-A by Moody’s Investors Service and S&P Global Ratings.

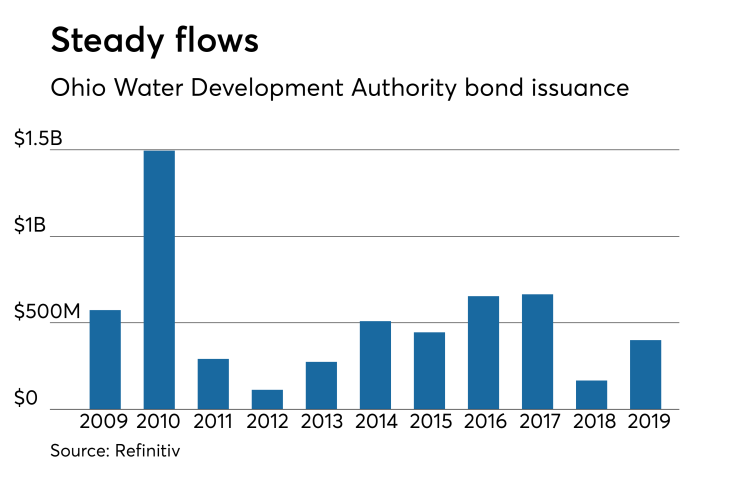

Since 2009, the authority has issued about $5.5 billion of debt, with the most occurring in 2010 when it sold $1.5 billion of bonds. It sold the least amount of debt in 2012, when it issued $112 million.

Clark County, Nevada, competitively sold $100 million of Series 2019 limited tax general obligation flood control bonds additionally secured with pledged revenues.

Morgan Stanley won the issue with a true interest cost of 2.8279%.

The financial advisors are Hobbs, Ong & Associates and PFM Financial Advisors. The bond counsel is Sherman & Howard.

The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Prior to Tuesday’s sale, the county last competitively sold comparable bonds on Feb. 12 when JPMorgan Securities won the $32.225 million of Series 2019B limited tax GO transportation refunding bonds with a TIC of 2.0442%.

On Wednesday, BofA is expected to price the Chandler Industrial Development Authority, Ariz.’s $500 million of Series 2019 industrial development revenue bonds and the Oregon Business Development Commission’s $100 million of Series 250 economic development revenue bonds for Intel Corp.

Also Wednesday, Ramirez & Co. is expected to price the Los Angeles Department of Airports’ $438 million of revenue bonds. The issue consists of Series 2019A subordinate revenue bonds subject to the alternative minimum tax, Series 2019B subordinate revenue bonds not subject to the AMT and Series 2019C subordinate refunding revenue bonds not subject to the AMT. The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch Ratings.

In the competitive arena on Wednesday, the New York City Municipal Water Finance Authority plans to sell $390.415 million of Fiscal 2019 Series EE water and sewer system second general resolution revenue bonds in two offerings. The deals consist of $275 million of Subseries EE-2 bonds and $115.415 million of Subseries EE-1 bonds. The financial advisors are Lamont Financial Services and Drexel Hamilton. The bond counsel are Nixon Peabody and the Hardwick Law Firm. The deals are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Bond sales

Ohio

Nevada

Bond Buyer 30-day visible supply at $7.04B

The Bond Buyer's 30-day visible supply calendar increased $788.9 million to $7.04 billion for Tuesday. The total is comprised of $3.22 billion of competitive sales and $3.82 billion of negotiated deals.

Treasury auctions year bills

The Treasury Department Tuesday auctioned $26 billion of 364-day bills at a 2.470% high yield, a price of 97.502556. The coupon equivalent was 2.559%. The bid-to-cover ratio was 3.60. Tenders at the high rate were allotted 14.47%. The median yield was 2.450%. The low yield was 2.430%.

Treasury also auctioned $32 billion of seven-year notes, with a 2 1/2% coupon and a 2.538% high yield, a price of 99.757691. The bid-to-cover ratio was 2.60. Tenders at the high yield were allotted 47.52%. All competitive tenders at lower yields were accepted in full. The median yield was 2.500%. The low yield was 2.441%.

Treasury to sell $60B 4-week bills

The Treasury Department said it will sell $60 billion of four-week discount bills Thursday. There are currently $35.000 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Treasury said it may announce and auction a 41-day cash management bill on Feb. 28, to be issued on March 1.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.