Top-quality municipal bonds finished unchanged on Thursday, traders said, as more deals came to market in the last big push of the week.

Primary market

Goldman Sachs priced the Port Authority of New York and New Jersey’s $829.695 million of consolidated bonds.

The $729.695 million of Series 205 bonds were priced as 5s to yield from 0.95% in 2018 to 2.94% in 2037. A 2039 maturity was priced as 5 1/4s to yield 2.88%; a split 2042 maturity was priced as 5 1/4s to yield 2.94% and as 5s to yield 3.10%; a 2047 maturity was priced as 5s to yield 3.10%; and a split 2057 maturity was priced as 5s to yield 3.31% and as 5 1/4s to yield 3.21%.

The $100 million of Series 206 bonds subject to the alternative minimum tax were priced as 5s to yield from 2.64% in 2028 to 3.21% in 2037, 3.28% in 2042 and 3.34% in 2047.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

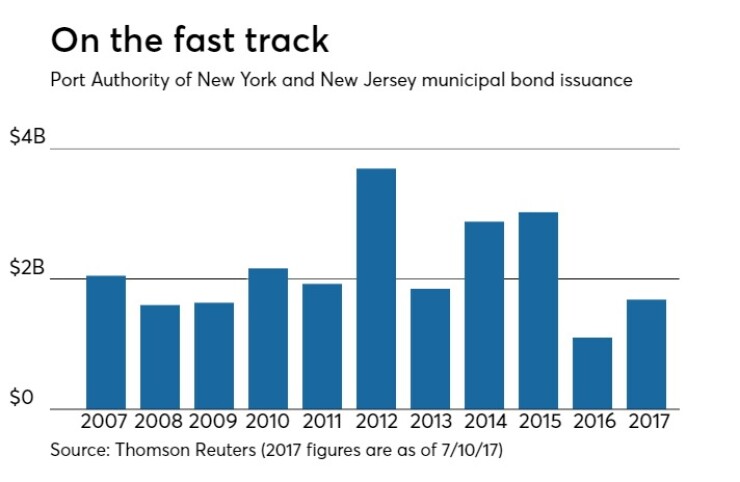

Since 2007, the Port Authority has sold $23.61 billion of securities, with the greatest issuance in 2012 when it sold $3.69 billion. The authority has sold over $1 billion every year during that time span, with the lowest occurring in 2016 when it sold $1.10 billion. With Thursday’s sale, it is over the $1 billion mark for this year and has surpassed last year’s total issuance.

Raymond James & Associates priced

The issue was priced to yield from 1.43% with a 5% coupon in 2019 to 3.73% with a 4% coupon in 2037; a 2042 maturity was priced as 4s to yield 3.83%. The 2018 maturity was offered as a sealed bid

The deal, which was the first since the county emerged from bankruptcy, is rated AA by S&P and A by Fitch.

Jefferson County Commission President Jimmie Stephens said the deal received over $1.7 billion in orders and that the 3.38% all-in TIC beat the 3.6% they had anticipated.

Several traders said the deal garnered widespread attention and was warmly received by the market.

Citigroup priced and repriced the Pennsylvania Turnpike Commission’s $798.425 million of subordinate revenue and motor license fund-enhanced subordinate special revenue refunding bonds.

The $381.455 million of Subseries B-1 of 2017 revenue bonds were repriced to yield from 1.80% with a 5% coupon in 2022 to 3.53% with a 5% coupon in 2037. A term bond in 2042 was repriced to yield 3.65% with a 5% coupon and a term bond in 2047 was repriced to yield 3.61% with a 5.25% coupon. This series is rated A3 by Moody’s and A-minus by Fitch.

The $371.565 million of Subseries B-2 of 2017 revenue bonds were repriced to yield from 1.13% with a 5% coupon in 2018 to 3.36% with a 5% coupon in 2035. The bonds were also repriced to yield from 3.74% with a 4% coupon in 2037 to 3.93% with a 4% coupon in 2039. This series is rated A3 by Moody’s and A-minus by Fitch, with the exception of the 2033-2035 and 2037 maturities totaling $138.43 million, which are insured by Assured Guaranty Municipal Corp. and rated A2 by Moody’s and AA by S&P.

The $45.405 million of motor license fund-enhanced refunding bonds were repriced to yield from 1.86% with a 5% coupon in 2023 to 2.74% with a 5% coupon in 2028. This series was rated A2 by Moody’s and AA-minus by Fitch.

“We did very well today,” Nick Grieshaber CFO of the Turnpike Commission said on Thursday. “We had over $2 billion of orders, from 66 different investor accounts.”

He added that almost $140 million of the deal was insured by AGM and was “yielding benefits of 15 basis points over non-insured maturities,” he said. “We were able to lower the cost of funds by using insurance, making it an investor friendly transaction.”

In the competitive arena, the state of North Carolina sold $106.15 million of Series 2017A general obligation refunding bonds.

Citi won the deal with a true interest cost of 1.39%. The issue was priced as 5s to yield from 0.80% in 2018 to 1.44% in 2023. The deal is rated triple-A by Moody’s, S&P and Fitch.

BAML received the written award on the state of Hawaii’s $249.81 million of Series 2017A taxable airports system customer facility charge revenue bonds.

The issue was priced at par to yield from 1.701% in 2018 to 3.775% in 2032, 3.894% in 2037 and 4.144% in 2047. The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch.

Secondary market

The yield on the 10-year benchmark muni general obligation was unchanged from 2.03% on Wednesday, while the 30-year GO yield was steady from 2.83%, according to the final read of Municipal Market Data's triple-A scale. Shorter maturities were one to three basis points stronger in spots.

Treasuries were weaker on Thursday as Federal Reserve Board Chair Janet Yellen testified before the Senate Banking Committee that the Fed’s balance sheet will be reduced “substantially,” without dropping to the $1 billion level it was at before the financial crisis.

Responding to questions about economic growth, Yellen said 3% gains in GDP “would be wonderful if we could accomplish it” in the next two to five years, but “it will be quite challenging.”

On inflation, she said, “The risk with respect to inflation is two-sided,” but, she added, “It probably remains prudent to remain on a gradual path of rate increases” because monetary policy works with a lag.

The yield on the two-year Treasury rose to 1.36% from 1.35% on Wednesday, the 10-year Treasury yield rose to 2.34% from 2.32% and the yield on the 30-year Treasury bond increased to 2.92% from 2.89%.

The 10-year muni to Treasury ratio was calculated at 86.5% on Thursday, compared with 87.3% on Wednesday, while the 30-year muni to Treasury ratio stood at 96.9% versus 97.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 44,845 trades on Wednesday on volume of $13.63 billion.

Tax-exempt money market funds attract inflows

Tax-exempt money market funds experienced inflows of $365.4 million, bringing total net assets to $130.18 billion in the week ended July 10, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $645.7 million to $129.81 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds dropped to 0.39% from 0.43% in the previous week.

The total net assets of the 852 weekly reporting taxable money funds increased $1.88 billion to $2.468 trillion in the week ended July 11, after an outflow of $1.17 billion to $2.466 trillion the week before.

The average, seven-day simple yield for the taxable money funds inched up to 0.63% from 0.62% in the prior week.

Overall, the combined total net assets of the 1,084 weekly reporting money funds increased $2.24 billion to $2.598 trillion in the week ended July 11, after outflows of $520.9 million to $2.596 trillion in the prior week.

Jacob Schneider and Gary Siegel contributed to this report.