Top-rated municipal bonds ended steady on Thursday, traders said, as the last big deals of the week came to market.

Secondary market

The yield on the 10-year benchmark muni general obligation was unchanged from 1.92% on Wednesday, while the 30-year GO yield declined one basis point to 2.77% from 2.78%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were stronger on Thursday. The yield on the two-year Treasury dipped to 1.30% from 1.33% on Wednesday, the 10-year Treasury yield slipped to 2.20% from 2.23% and the yield on the 30-year Treasury bond decreased to 2.78% from 2.81%.

The 10-year muni-to-Treasury ratio was calculated at 87.4% on Thursday, compared with 86.3% on Wednesday, while the 30-year muni-to-Treasury ratio stood at 99.7% versus 99.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 42,748 trades on Wednesday on volume of $10.09 billion.

Primary market

Citigroup priced the Colorado Health Facilities Authority’s $220 million of Series 2017 health facilities revenue and revenue refunding bonds for the Evangelical Lutheran Good Samaritan Society project.

The issue was priced as 5s to yield from 1.31% in 2018 to 3.72% in 2037, 3.82% in 2042 and 3.84% in 2047.

The deal is rated BBB by S&P Global Ratings and A-minus by Fitch Ratings.

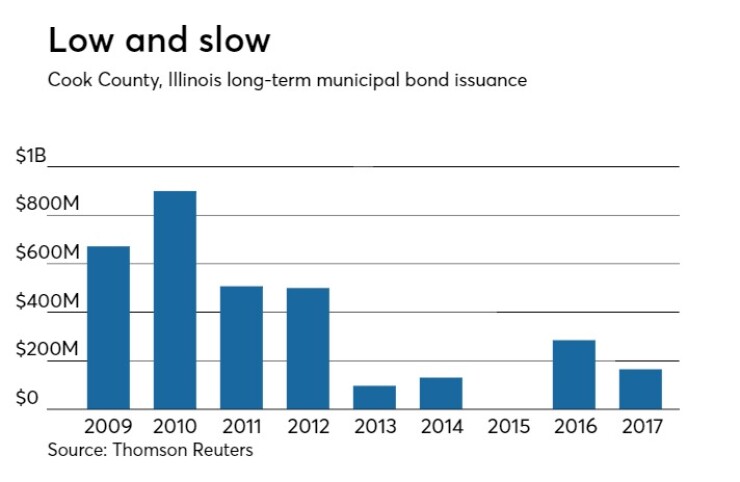

Citi also priced Cook County, Ill.’s $165 million of Series 2017A sales tax revenue bonds.

Pricing information was not available.

The deal is rated AAA by S&P.

Since 2009 the county has sold $3.26 billion of securities, with the most issuance occurring in 2010 when it sold $900 million. It did not come to market at all in 2015.

Barclays Capital Markets priced the Massachusetts Development Finance Agency’s $96.83 million of Series 2017A revenue bonds for Emerson College.

The bonds were priced to yield from 1.90% with a 5% coupon in 2024 to 3.30% with a 5% coupon in 2037. A term bond in 2040 was repriced to yield 3.39% with a 5% coupon.

The deal is rated Baa2 by Moody’s Investors Service and BBB-plus by S&P.

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $355.4 million, bringing total net assets to $130.37 billion in the week ended Aug. 14, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an inflow of $493.5 million to $130.73 billion in the previous week.

The average, seven-day simple yield for the 227 weekly reporting tax-exempt funds was declined to 0.33% from 0.34% the previous week.

The total net assets of the 851 weekly reporting taxable money funds increased $14.86 billion to $2.543 trillion in the week ended Aug. 15, after an inflow of $37.39 billion to $2.528 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.67% from 0.66% the prior week.

Overall, the combined total net assets of the 1,078 weekly reporting money funds increased $14.51 billion to $2.673 trillion in the week ended Aug. 15, after inflows of $37.88 million to $2.658 trillion in the prior week.