The municipal market strengthened Monday, with benchmark yields falling eight to 10 basis points across the curve as market participants settle into a Fed-supported short end.

All signs point to more dealers coming around to pricing deals in the primary as the new-issue calendar continues to grow. The Fed’s Municipal Liquidity Facility assuages fears that at least in the short-term, support for munis will be there.

Patrick Luby, senior municipal strategist at CreditSights and Howard Sitzer, senior analyst of municipals at CreditSights, said they expect that many issuers will want to take advantage of the facility to manage their cash flow and liquidity needs until the longer-term financial effects of the pandemic are better understood.

“But at the current time, unless the scope of this program is expanded to include secondary market purchases or longer-term debt, we do not envision a broad impact on the municipal market,” they said. “The Facility has been structured in such a way that issuers confronting fiscal challenges prior to the pandemic will still have to find ways to address those pre-existing conditions. We believe that the absence of explicit authorization to purchase eligible notes from governmental subdivisions not meeting the facility's population thresholds or from public authorities indirectly tied to the state governments will leave the market in doubt over the near-term liquidity needs of such issuers.”

Municipal confidence is also somewhat tied to stocks right now and some participants expect that if equities dive amid more coronavirus fears or re-test March lows, munis could be rattled once again.

Regardless, the new Fed special purchase vehicle, while mostly expected to support the short end of the market into the foreseeable future, is creating a “bull steepener in the interim,” said Kim Olsan, FHN Financial senior vice president.

Benchmark yields out to 2025 have already rallied to under 1%, revisiting their range from a month ago, she noted.

“Some inquiry that had come into the market during the dislocation has been stranded at new levels, forcing distribution back to more traditional outlets,” Olsan said. “There is some expectation that defensive positioning will be maintained as crossover interest from equity allocations may find its way into the municipal sector.”

In the secondary Monday, large blocks of high-grade names inside of 10 years showed strength and were moving benchmark yields lower.

Montgomery County, Maryland GOs, 5s of 2021, traded at 0.92%- 0.88%. Wake County, NC GOs, 5s of 2022, traded at 0.90%. North Carolina GOs, 5s of 2023, traded at 0.92%. Virginia GOs, 5s of 2023, traded at 0.96%. They traded at 1.09% Thursday.

Stronger trades were not limited to the short-term however, as yields fell across all benchmarks.

To look at how much the market has moved, Washington GOs traded at 1.13% on 5s of 2030. In the middle of the mid-March sell-off, those GOs traded at 3.75%. When the sell-off began on March 13, they were at 0.84%. Fairfax County GOs, 5s of 2039, traded at 1.69% and began March at 1.36%. Out long, Washington GOs, 5s of 2043 traded at 2.11% Monday. On March 24, they traded at 3.39%-3.38%. Fort Lauderdale, Florida, 3s of 2049 traded at 2.77%-2.74%.

State tax collections will weigh on primary market

William Glasgall, senior vice president and director of state and local initiatives at the Volcker Alliance, noted that the cash-flow problems are severe for state and local governments. States, counties, and cities are currently facing cash-flow problems because many are joining the federal government’s move to delay 2019 income tax filing from April 15 to July 15 and that April is usually the biggest month for income tax collections for states and localities, and the federal filing postponement may force them to borrow until the delayed payments arrive.

“Governments are facing sharply reduced tax withholding payments and unprecedented drawdowns of cash from state unemployment trust funds as businesses shut down and millions of Americans are laid off,” Glasgall said. “New York State’s recently enacted plan to borrow as much as $11 billion in the current fiscal year to cover revenue shortfalls is a harbinger of similar moves that are being contemplated by other states and localities. The Fed’s action today will throw them a welcome lifeline to help preserve critical government services.”

BofAS received the verbal award on the Department of Water and Power for the City of Los Angeles' (Aa2/ /AA-/ ) $343.325 million of power system revenue bonds.

The bonds mature from 2025 with a 5% coupon yielded 1.05% to 2029 with 5% coupons yielding 1.19%.

Johnson County unified school district No.229, Kansas (Aa2/ / / ) sold $125 million of GO school bonds and were won by Bank of America Securities with a true interest cost of 2.1512%.

The 10-year maturity was priced as 3s to yield 1.71% and long-bond (2040) maturity was priced as 2.5s to yield 2.62%.

As time passes and more states announce tax-deadline changes, bidsides are becoming bifurcated and trying to separate the names that will experience more revenue impacts vs. those that stand to better weather the financial effects, Olsan noted. Two trends are showing up in the primary market since early April, she said.

New-issue pricings in early April are occurring at much higher yield sets. In 3%- and 4%-coupons, 20-year maturities have been priced at yields above 3%, over 100 basis points wide to comparable issues in February. Similar couponing in 25-year maturities have widened out by 75 basis points or more — Aa3/A+ Goodyear AZ Water/Sewer 3s due 2045 priced at 3.10%. Taxable-equivalent yields are materially higher along the entire curve, gaining more than 100 basis points from levels earlier in the year.

Relative-value ratios have skewed well higher than recent averages and beyond more historical high points in AA- and AAA-rated names. Intermediate ratios have moved from a low of 72% in February to current values in the 200%-range and higher.

Secondary market

Munis were stronger on the MBIS benchmark scale Monday, with yields falling by seven basis points in the 10-year maturity and by five basis points in the 30-year maturities. High-grades were also mixed, with yields on MBIS' AAA scale decreasing by 10 basis points in the 10-year and increasing by three basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO fell 10 basis points to 1.10% while 30-year decreased eight basis points to 1.93%.

The MMD muni to taxable ratio was 146.5% on the 10-year and 138.7% on the 30-year.

On the ICE muni yield curve late in the day, the 10-year yield was down 10 basis points to 1.16% while the 30-year was down nine basis points to 1.94%.

The ICE muni to taxable ratio on the 10-year was 158% and the 30-year was 135%.

BVAL saw the 10-year fall nine basis points to 1.16% and the 30-year dropping 10 basis points to 1.99%.

The IHS muni curve saw the 10-year down to 1.18% and the 30-year lowering to 1.93%.

Stocks were in the red as Treasury yields were a mixed bag.

The Dow Jones Industrial Average fell about 1.91%, the S&P 500 index decreased roughly 1.63% and the Nasdaq lost roughly 0.36%.

The three-month Treasury was yielding 0.229%, the Treasury two-year was yielding 0.239%, the five-year was yielding 0.427%, the 10-year was yielding 0.749% and the 30-year was yielding 1.396%.

SIFMA Index Continues to Normalize

The Federal Reserve's Money Market Mutual Fund Liquidity Facility (MMLF), which began operations on Monday, March 23 and started accepting variable rate municipal securities on March 25 had quickly expanded to $52.7 billion in loans as of April 1st and grew by a net of $504 million to $53.7 billion as of April 8, according to Luby.

Luby also noted that at the same time that the MMLF has been helping the market investors were adding over $6 billion in new money to tax-exempt money market mutual funds in each of the last two weeks and the supply of VRDOs on Bloomberg declined to the lowest level since February 17. As a result the SIFMA Index fell 109 basis points last week to 0.74%, which is the lowest since June of 2017.

“The normalization of the SIFMA Index and the strength at the short end of the market presents an opportunity for investors with bonds scheduled to mature or get called in early June— the traditional start of the annual ‘summer redemption season,’” Luby said. “June redemptions are estimated to total $41.7 billion, of which $19.4 billion will be returned to bond holders on the first.”

He added that the strong demand for low-duration bonds that has emerged may allow holders of bonds coming up for redemption to sell them now in order to have cash available should market volatility continue and attractive reinvestment opportunities present themselves.

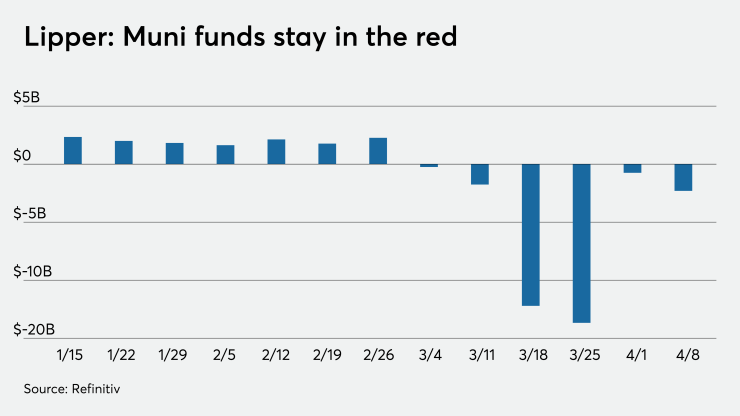

Lipper reports 6th consecutive week of outflows

For the sixth week in a row, investors pulled cash from the municipal market as volatility stemming from the COVID-19 pandemic.

In the week ended April 8, weekly reporting tax-exempt mutual funds suffered $2.306 billion of outflows, after outflows of $749.185 million in the previous week, according to data released by Refinitiv Lipper late on Thursday.

Exchange-traded muni funds reported outflows of $462.099 million, after outflows of $23.772 million in the previous week. Ex-ETFs, muni funds saw outflows of $1.844 billion after outflows of $725.413 million in the prior week.

The four-week moving average was negative yet again at $7.237 billion, after being in the red at $7.100 billion in the previous week.

Long-term muni bond funds had outflows of $1.618 billion in the latest week after inflows of $122.638 million in the previous week. Intermediate-term funds had outflows of $328.773 million after outflows of $226.620 million in the prior week.

National funds had outflows of $1.948 billion after outflows of $464.366 million while high-yield muni funds reported outflows of $960.168 million in the latest week, after inflows of $279.969 million the previous week.