Municipals will see some deals price into a slightly stronger market on the heels of Tuesday's midterm elections.

Munis and Treasury yields dropped post-elections, as the results were pretty much in line with expectations, with Democrats taking control of the House and Republicans expanding their majority in the Senate.

Some market participants said they expect a Democrat-controlled House will likely move quickly to try to incentivize infrastructure spending at the state and local level, in part by reviving the Build America Bonds program under another name.

“I think with a Democratic-controlled House, we have more of a chance to see legitimate infrastructure legislation,” said Jeffrey Lipton, head of municipal research and strategy at Oppenheimer & Co. “I think if you don’t seriously address the infrastructure crisis in this country, it then becomes an issue of national security.”

Lipton said he believes a split Congress could work collaboratively on infrastructure.

“I do think there is bipartisan support among both Democrats and Republicans to get some sort of infrastructure package,” he said.

Lipton said he would not be surprised to see Democrats attempt to revive the Build America Bonds program under a new name. BABs were created under the Obama stimulus package in 2009 to incentivize infrastructure investment. The bonds are federally taxable to bondholders, but proved very attractive to issuers because the U.S. Department of the Treasury pays to issuers a 35% subsidy of the interest owed investors.

In other election results, Democrats' majority control in the House of Representatives is expected to curb the municipal bond market setbacks suffered under the Republican-written Tax Cuts and Jobs Act.

In wednesday's primary market, BB&T Capital Markets is scheduled to price the Industrial Development Authority of the County of St. Louis’ $200.37 million of senior living facilities revenue bonds for the Friendship Village of St. Louis Obligated Group. The deal is rated BB-plus by Fitch Ratings.

Wells Fargo is expected to price the State of New York Mortgage Agency’s $147.465 million of homeowner mortgage revenue bonds. The deal is rated Aa1 by Moody’s Investors Service.

Secondary market

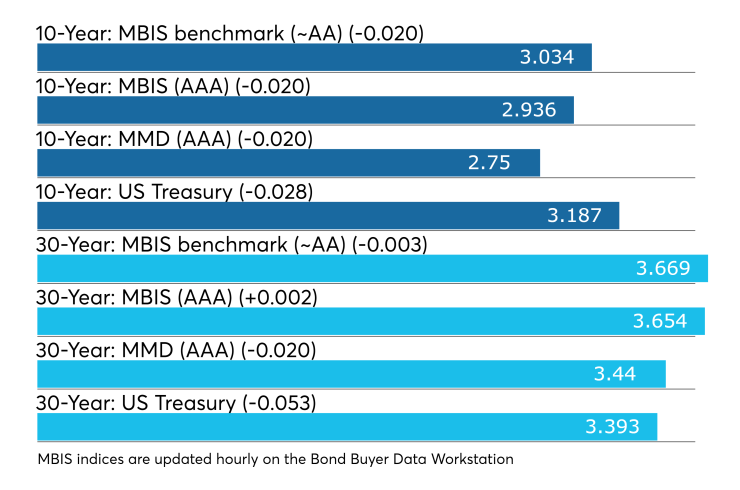

Municipal bonds were stronger on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points in the one- to 30-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yields on both the 10-year and 30-year muni general obligation lower by as many as two basis points.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 86.2% while the 30-year muni-to-Treasury ratio stood at 101.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,737 trades on Tuesday on volume of $11.962 billion.

California, Texas and New York were the municipalities with the most trades, with the Golden State taking 15.016% of the market, the Lone Star State taking 12.345% and the Empire State taking 11.783%.

Kyle Glazier contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.