The municipal bond market will see a plethora of deals for both institutions and retail, as sellers look for a change in buyer psychology from last week.

After a week of rich prices and soft reception last week, Monday's market started with a positive tone, according to Dan Heckman, of U.S. Bank Wealth Management.

“Flows were not great last week and the muni market has had a significant positive move from December to the first week of 2019,” Heckman he said. “Some give back or weakness last week should not come as a surprise, especially with the rebound for risk-on assets — for example, stocks and high yield.”

If the municipal market gets better pricing and weakness in stocks, demand for new deals this week should be decent, according to Heckman.

While he said the overall municipal market climate is positive, that may be short-lived.

“The market is due for a pause here,” he said.

According to Sean Carney, managing director and head of municipal strategy at BlackRock, right now, the muni market is being plagued by a feeling of apathy among buyers in this lower rate environment.

“Flows in mutual funds were negative for quite some time, and although recent inflows will help, it’s on a lag,” he said. “It just feels like people are looking for a catalyst to get involved and rates, ratios, flows are creating little direction or impetus thus far, but it can change in a moment’s notice.”

The action will get started on Tuesday, with eight deals scheduled $100 million or larger, including the biggest deal of the week and even some retail order periods.

Topping the week’s slate is the Chicago Sales Tax Securitization Corp.’s $551 million taxable sale. Citigroup is slated to price the bonds on Wednesday in two fixed-rate term bonds, with the $222 million maturity due in 2038 and the $329 million maturity due in 2048. The deal is rated AA-minus by S&P Global Ratings and AAA by Fitch Ratings and Kroll Bond Rating Agency.

Barclays Capital will price the New York City Municipal Water Finance Authority’s $450 million of tax-exempt fixed-rate second general resolution revenue bonds on Wednesday after a one-day retail order period on Tuesday. The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P and Fitch.

Citi is also set to price the Massachusetts Department of Transportation’s $441 million of metropolitan highway system revenue refunding bonds on Tuesday. The bonds are rated Aa2 by Moody’s, AA by S&P and AA-plus by Fitch.

Secondary market

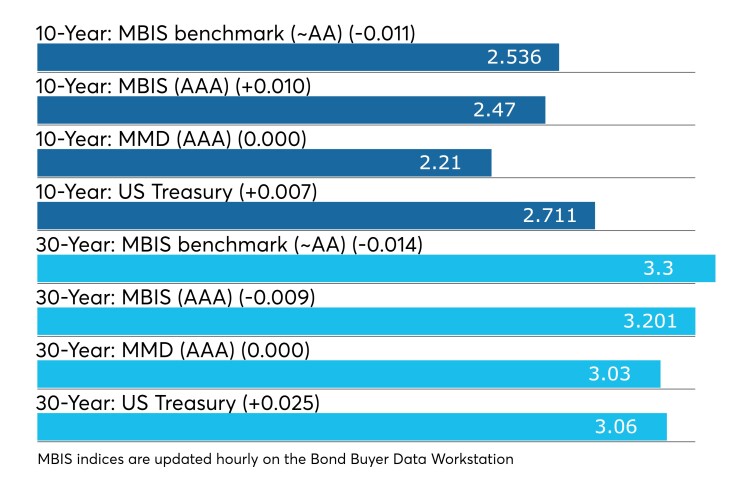

Municipal bonds were stronger on Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points in the one- to eight-year and 13-year to 30-year maturities. The nine-year, 10-year and 11-year maturites saw yields rise by no more than one basis point. The 12-year maturity was unchanged.

Municipals were flat on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity unchanged.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 81.5% while the 30-year muni-to-Treasury ratio stood at 99.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

BlackRock’s big picture: great expectations for munis in 2019

Peter Hayes, managing director and head of the muni group, and Sean Carney, the head of muni strategy, at Blackrock believe 2019 is shaping up to be an even stronger year for muni bond performance, according to the firm’s recently published 2019 outlook.

“Given the steeper municipal yield curve relative to Treasuries, investors can still benefit from taking on duration (interest rate risk),” the report said. “Additionally, investors who buy and hold muni bonds throughout the year will be better positioned to capture coupon income, which we expect to make up the majority of total return in 2019.”

The report also said although markets tend to focus on gross supply numbers, what actually influences market performance is net supply — the total amount of new issuance minus the total amount of debt that is called, refunded or reaches maturity. Net supply turning negative generally provides a powerful tailwind for muni bond performance.

“On the whole, 2018 was a net negative supply year and we expect the same in 2019,” Hayes and Carney said in the report. “Forward supply estimates are only marginally higher than last year, and Congressional gridlock is likely to impede the approval of government spending on infrastructure projects.”

Additionally, the heavy selling among banks in 2018 ahead of tax and accounting-related changes, which added significant “shadow supply,” should be nearly played out at this point. After back-to-back years of disrupted seasonal trends, we foresee a more traditional year coming up, which likely means more predictable patterns around both supply and demand.

“From a strategy perspective, we would lean toward longer duration (taking more interest rate risk) heading into periods of net negative supply, and shorter duration when supply is poised to outpace demand.”

Week's actively traded issues

Revenue bonds comprised 56.50% of total new issuance in the week ended Jan. 11, according to

Some of the most actively traded munis by type were from New York, Texas and Puerto Rico issuers.

In the GO bond sector, the Suffolk County, N.Y., 5s of 2019 traded 99 times. In the revenue bond sector, the Texas 4s of 2019 traded 41 times. And in the taxable bond sector, the Puerto Rico Government Development Bank Recovery Authority 7.5s of 2040 traded 14 times.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,248 trades on Friday on volume of $12.212 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 16.732% of the market, the Empire State taking 13.436% and the Lone Star State taking 10.84%.

Treasury auctions bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $39 billion of three-months incurred a 2.405% high rate, off from 2.410% the prior week, and the $36 billion of six-months incurred a 2.460% high rate, down from 2.470% the week before.

Coupon equivalents were 2.453% and 2.526%, respectively. The price for the 91s was 99.392069 and that for the 182s was 98.756333.

The median bid on the 91s was 2.380%. The low bid was 2.350%.

Tenders at the high rate were allotted 83.05%. The bid-to-cover ratio was 2.90.

The median bid for the 182s was 2.440%. The low bid was 2.410%.

Tenders at the high rate were allotted 70.97%. The bid-to-cover ratio was 3.22.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.