At the approach of the last week of the first half of 2019, the beat goes on for municipals as an asset class as it continues to see fundamentals working in its favor.

“A week ago we had a strong new-issuance week and scales backed up two to four basis points, which made some breathe a sigh of relief and others it didn't make a big difference since we are still dealing with the same fundamentals,” Jim Colby, senior municipal strategist and portfolio manager at VanEck, said in an interview.

Strong inflows and vast inequality of supply and demand have led the charge.

“In and of itself, it would be enough to push performance to positive returns, the asset class is on an impressive run, but munis don't act in the vacuum and other events domestically and internationally haves also contributed,” Colby said.

He noted that munis are the asset class with all the right attributes, and right now it doesn't even matter what the muni to Treasury ratio is — the ultimate return is key for investors who are starved for yields.

“Munis are in a pretty good place [as far as returns go], although trying to participate in the new-issue market is always a challenge,” Colby said. “You are not going to get the number of bonds that you want; you just hope to get something close.”

There is great demand out there for municipals, both domestic and foreign. There is as much as 25% of overseas issuance that would be available for reinvestment, which are being represented with negative yields.

“Overseas investors are looking more seriously at munis because the tax-equivalent yields are better than what they would be looking at" elsewhere in the world, he said.

With rates as low as they are and demand as high as it is, the question remains, why is there not more issuance?

“Every state and community needs financing for infrastructure purposes, but I think the fact that at the decision and approval level, they are reluctant to take on more debt and higher taxes, which is what it ultimately boils down to,” Colby said.

Primary market

Overall, IHS Markit Ipreo forecasts weekly bond volume to be $5.59 billion, down from a revised total of $7.3 billion in the prior week, according to updated data from Refinitiv. The calendar is composed of $4.39 billion of negotiated deals and $1.20 billion of competitive sales.

There are 13 long-term bonds deals scheduled that are $100 million and greater and two short-term note deals, one of which eclipsing $1 billion out of Los Angeles.

Raymond James is expected to price New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+) $452.6 million of water and sewer system second general resolution revenue refunding bonds on Tuesday.

JPMorgan is set to price North Carolina Medical Care Commission’s (Aa3/AA-/AA-) $306.175 million of health care facilities revenue bonds for Novant Health Obligated Group on Wednesday.

Competitively, Los Angeles (MIG1/SP-1+/ ) will sell $1.66 billion of 2019 tax and revenue anticipation notes on Wednesday.

JPMorgan is scheduled to run the books on Kentucky Asset/Liability Commission’s (MIG1/NR/F1+) $400 million of general fund tax anticipation notes on Wednesday.

Secondary market

Munis were mixed on the

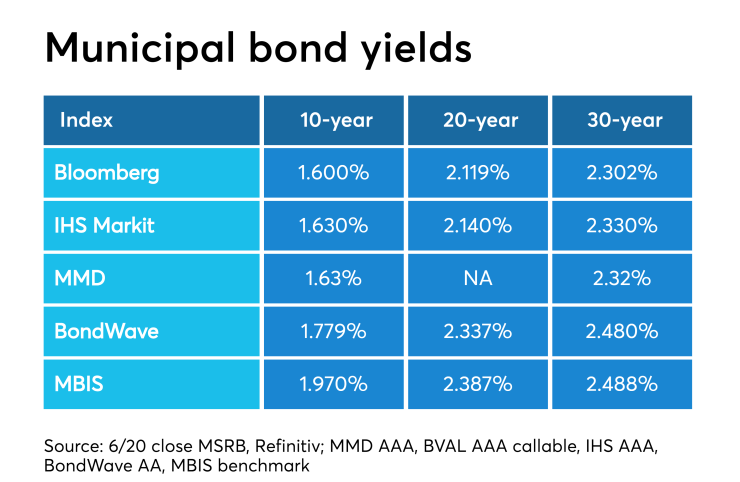

On Refinitiv Municipal Market Data’s AAA benchmark, the yield on both the 10- and 30-year were unchanged at 1.63% and 2.32%, respectively. The 10-year muni-to-Treasury ratio was calculated at 79.0% while the 30-year muni-to-Treasury ratio stood at 89.5%, according to MMD.

Treasuries and stocks traded higher. The Treasury three-month was yielding 2.131%, the two-year was yielding 1.778%, the five-year was yielding 1.802%, the 10-year was yielding 2.006% and the 30-year was yielding 2.593%.

“Munis felt a bit tired today with the exception of the very short end of the curve,” Michael Pietronico, chief executive officer of Miller Tabak Asset Management, said Friday afternoon.

Given the climate and timing of summer reinvestment season and the Federal Reserve Board’s future intentions, he said he expects the next few weeks will be more of the same.

“We expect sideway-type action to take hold in the market until July where we sense another leg lower in yields is in the cards,” Pietronico explained. “There is too much cash around and too few bonds,” he said of the current environment.

Lipper: More inflows into muni funds

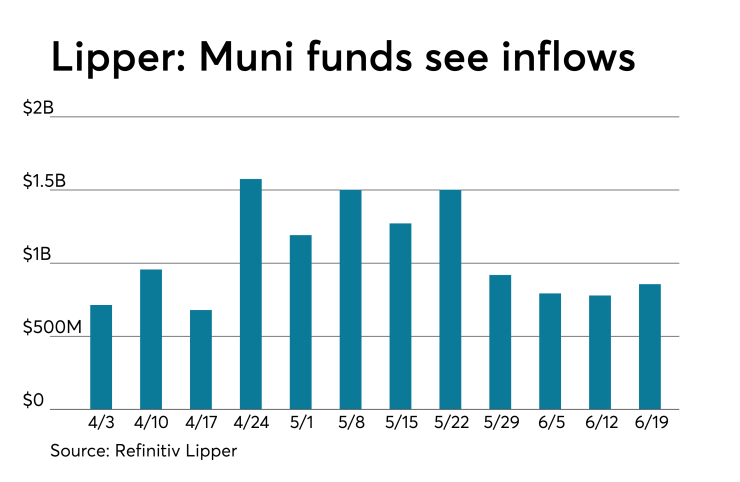

For the 24th straight week, investors remained bullish on municipal bond funds, according to data from Refinitiv Lipper.

Those tax-exempt mutual funds, which report flows weekly, saw $856.009 million of inflows in the week ended June 19 after inflows of $778.412 million in the previous week.

Exchange-traded muni funds reported inflows of $129.732 million after outflows of $108.653 million in the previous week. Ex-ETFs, muni funds saw inflows of $726.277 million after inflows of $887.065 million in the previous week.

The four-week moving average remained positive at $836.540 million, after being in the green at $997.979 million in the previous week.

Long-term muni bond funds had inflows of $738.878 million in the latest week after inflows of $652.507 million in the previous week. Intermediate-term funds had inflows of $41.303 million after inflows of $189.275 million in the prior week.

National funds had inflows of $706.719 million after inflows of $662.490 million in the previous week. High-yield muni funds reported inflows of $273.121 million in the latest week, after inflows of $370.941 million the previous week.

On Wednesday, the Investment Company Institute reported long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.271 billion in the week ended June 12, while long-term muni funds alone saw an inflow of $1.348 billion and ETF muni funds saw an outflow of $77 million.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended June 21 were from Puerto Rico and Pennsylvania issuers, according to

In the GO bond sector, the Puerto Rico 8s of 2035 traded 72 times. In the revenue bond sector, the Pennsylvania Turnpike Commission 4s of 2049 traded 40 times.

In the taxable bond sector, the Puerto Rico GDB Debt Recovery Authority 7.5s of 2040 traded 42 times.

Week's actively quoted issues

Puerto Rico, New York and California names were among the most actively quoted bonds in the week ended June 21, according to IHS Markit.

On the bid side, the Puerto Rico GO 5s of 2041 were quoted by 28 unique dealers. On the ask side, the Suffolk County, N.Y., taxable 5.5s of 2035 were quoted by 61 dealers. Among two-sided quotes, the Bay Area Toll Authority, Calif., taxable 7.043s of 2050 were quoted by 29 dealers.

Previous session's activity

The MSRB reported 40,098 trades Thursday on volume of $15.734 billion. The 30-day average trade summary showed on a par amount basis of $12.82 million that customers bought $6.40 million, customers sold $4.30 million and interdealer trades totaled $2.11 million.

California, Texas and New York were most traded, with the Golden State taking 11.869% of the market, the Lone Star State taking 10.282% and the Empire State taking 9.02%.

The most actively traded security was the Puerto Rico GDB Debt Recovery Authority taxable 7.5s of 2040, which traded 31 times on volume of $65.30 million.

Christine Albano contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.