As the end of the year nears, the municipal bond market will see lots of negotiated deals on next week’s calendar. Ipreo forecasts weekly bond volume will increase to $8.1 billion from a revised total of $6.4 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $6.9 billion of negotiated deals and $1.2 billion of competitive sales.

Primary market

Topping next week’s slate is a $1.7 billion deal from the Dormitory Authority of the State of New York.

Bank of America Merrill Lynch is set to price the DASNY state personal income tax revenue bonds on Tuesday. The offering consists of Series 2018A tax-exempt PITs and Series 2018B taxable PITs.

The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

Goldman Sachs is set to price the Northern California Energy Authority's $525 million of Series 2018 commodity supply revenue bonds.

JPMorgan Securities is expected to price the Illinois State Toll Highway Authority’s $430 million of Series 2018A refunding senior revenue bonds on Tuesday.

The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch Ratings.

In the competitive arena on Tuesday, the Washington Suburban Sanitary District, Md., is selling $390 million of consolidated public improvement bonds of 2018. Proceeds will be used to finance various water and sewer improvements.

The financial advisor is Wye River Group and the bond counsel is McKennon Shelton.

The deal is rated triple-A by Moody’s, S&P and Fitch.

Bond Buyer 30-day visible supply at $11.26B

The Bond Buyer's 30-day visible supply calendar increased $2.19 billion to $11.26 billion for Friday. The total is comprised of $2.33 billion of competitive sales and $8.92 billion of negotiated deals.

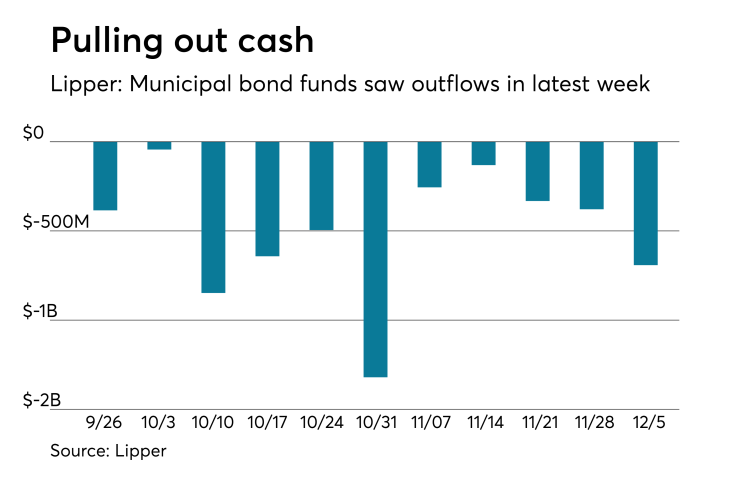

Lipper: Muni bond funds saw outflows

Fort the 11th week in a row, investors in municipal bond funds pulled cash out of the funds, according to Lipper data released on Thursday.

The weekly reporters saw $692.041 million of outflows in the week ended Dec. 5 after outflows of $378.623 million in the previous week.

Exchange traded funds reported inflows of $257.596 million, after inflows of $34.818 million in the previous week. Ex-ETFs, muni funds saw outflows of $949.637 million after outflows of $413.442 million in the previous week.

The four-week moving average remained negative at -$383.506 million, after being in the red at -$274.449 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $516.300 million in the latest week after outflows of $315.870 million in the previous week. Intermediate-term funds had outflows of $256.528 million after outflows of $183.646 million in the prior week.

National funds had outflows of $503.919 million after outflows of $275.862 million in the previous week. High-yield muni funds reported outflows of $146.985 million in the latest week, after outflows of $85.331 million the previous week.

Secondary market

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields dipped as much as two basis points in the one- to 30-year maturities.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale decreasing as much as two basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation falling as much as one basis point while the yield on 30-year muni maturity dropped as much as two basis points.

Treasury bonds were mixed amid continued stock market volatility. The Treasury 30-year was yielding 3.166%, the 10-year yield stood at 2.884%, the five-year was at 2.724%, the two-year was at 2.729% while the Treasury three-month bill stood at 2.399%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 82.4% while the 30-year muni-to-Treasury ratio stood at 98.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 58,715 trades on Thursday on volume of $21.34 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.224% of the market, the Empire State taking 14.783% and the Lone Star State taking 10.731%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Dec. 7 were from Illinois issuers, according to

In the GO bond sector, the Chicago Board of Education 5s of 2046 traded 54 times. In the revenue bond sector, the Chicago O’Hare 5s of 2048 traded 52 times. And in the taxable bond sector, the Chicago O’Hare 4.472s of 2049 traded 35 times.

Week's actively quoted issues

New Jersey, California and the District of Columbia names were among the most actively quoted bonds in the week ended Dec. 7, according to Markit.

On the bid side, the N.J. Economic Development Authority taxable 7.425s of 2029 were quoted by 32 unique dealers. On the ask side, the California taxable 7.55s of 2039 were quoted by 93 dealers. And among two-sided quotes, the D.C. Water and Sewer Authority revenue 5s of 2029 were quoted by 21 dealers.

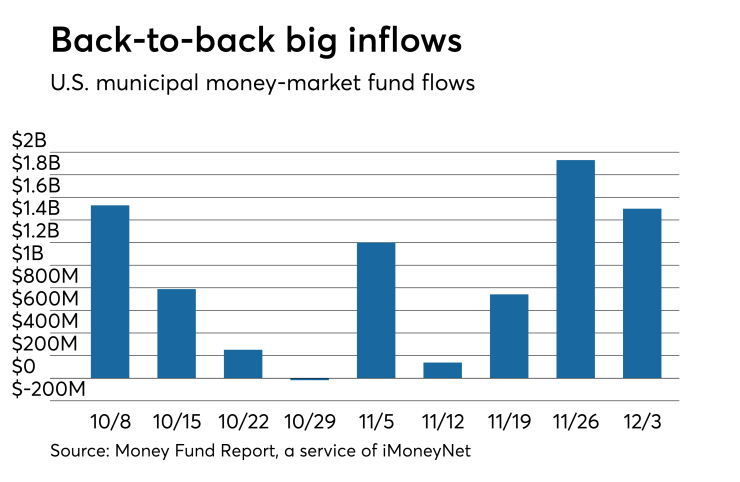

Muni money market funds see big inflow again

Tax-free municipal money market fund assets increased $1.50 billion, raising their total net assets to $139.58 billion in the week ended Dec. 3, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds was unchanged at 1.26% from last week.

Taxable money-fund assets decreased $32.36 billion in the week ended Dec. 4, lowering total net assets to $2.729 trillion.

The average, seven-day simple yield for the 817 taxable reporting funds grew to 1.88% from 1.86% last week.

Overall, the combined total net assets of the 1,007 reporting money funds lost $30.86 billion to $2.908 trillion in the week ended Dec. 4.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.