Municipal bond traders are set to see the last of this week’s new issue supply hit the screens on Thursday amid a volatile rate environment.

Secondary market

Treasuries were mixed on Thursday. The yield on the two-year Treasury was unchanged from 1.33% on Wednesday, the 10-year Treasury yield dipped to 2.23% from 2.24% and the yield on the 30-year Treasury bond decreased to 2.81% from 2.82%.

Top-quality municipal bonds finished stronger on Wednesday. The yield on the 10-year benchmark muni general obligation fell three basis points to 1.90% from 1.93% on Tuesday, while the 30-year GO yield dropped one basis point to 2.74% from 2.75%, according to the final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 84.9%, compared with 84.5% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 97.3% versus 95.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,440 trades on Wednesday on volume of $11.895 billion.

Primary Market

Action picks up on Thursday, when Goldman Sachs prices Miami-Dade County, Fla.’s $647.79 million of AMT Series B and taxable Series D aviation revenue and revenue refunding bonds.

The deal is rated A by S&P Global Ratings and Fitch Ratings and AA-minus by Kroll Bond Rating Agency.

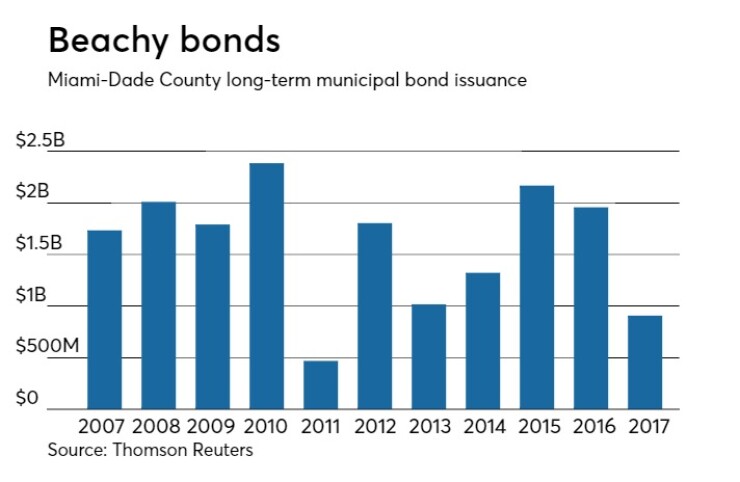

Since 2007 Miami-Dade County has sold $17.82 billion of securities, with the most issuance occurring in 2010 when it sold $2.38 billion. The county saw a low of $469 million back in 2011.

Bank of America Merrill Lynch is expected to price the Ohio Water Development Authority’s $250 million of Series 2017B water pollution control loan fund revenue notes on Thursday.

In the short-term competitive sector, Woodbridge Township, N.J., is selling $147 million of bond anticipation notes, consisting of $95.8 million general BANs, $38 million of sewer utility BANs and $13.45 million of recreation utility BANs.

The deal is rated SP1-plus by S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $492.4 million to $8.47 billion on Thursday. The total is comprised of $4.52 billion of competitive sales and $3.95 billion of negotiated deals.

Tax-exempt money market funds see inflows

Tax-exempt money market funds experienced inflows of $493.5 million, bringing total net assets to $130.73 billion in the week ended Aug. 7, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $231.2 million to $130.23 billion in the previous week.

The average, seven-day simple yield for the 227 weekly reporting tax-exempt funds decreased to 0.34% from 0.37% the previous week.

The total net assets of the 850 weekly reporting taxable money funds increased $37.39 billion to $2.528 trillion in the week ended Aug. 8, after an inflow of $10.72 billion to $2.490 trillion the week before.

The average, seven-day simple yield for the taxable money funds was unchanged at 0.66% from the prior week.

Overall, the combined total net assets of the 1,077 weekly reporting money funds increased $37.88 billion to $2.658 trillion in the week ended Aug. 8, after inflows of $10.95 million to $2.621 trillion in the prior week.