Municipal CUSIP requests rebounded in October following a dip in September, signaling possible near-term growth in new issuance.

The aggregate total of all municipal securities requested, which include municipal bonds, long- and short-term notes and commercial paper, rose 9.6% to 1,210 in October after a 9.6% decline to 1,104 in September, CUSIP Global Services reported on Tuesday.

Requests for municipal bond identifiers rose to 979 in October from 886 in September.

"CUSIP request volume for October is consistent with the trend toward increased levels of capital markets activity we've been seeing throughout most of the second half of the year," said Gerard Faulkner, director of operations for CUSIP Global Services. "While we did see a great deal of volatility in the CUSIP indicator in the early months of 2018, current readings suggest we'll see a relatively healthy volume of new securities issuance as we make our way through the fourth quarter."

On a year-over-year basis, total municipal identifier request volume is down 12.3% to 10,915, from 12,449 in the same period last year. Requests for municipal bond CUSIPS have fallen 14.1% year-over-year to 8,782 from 10,218.

Among the top state issuers in October, CUSIPs for scheduled public finance offerings from Texas, New York, and California were the most active in October.

Primary market

The market will see about $7.3 billion of offerings come to market this week, with a calendar composed of $5.8 billion of negotiated deals and $1.5 billion of competitive sales.

On Tuesday, the Special School District No. 1 sold $97.19 million of general obligation bonds backed by the Minnesota School District Credit Enhancement Program in two offerings.

Morgan Stanley won the $55.07 million of Series 2018B long-term facilities maintenance GOs with a true interest cost of 3.537%. Morgan Stanley also won the $42.12 million of Series 2018A school building GOs with a TIC of 3.189%.

Proceeds of the Series 2018B bonds will be used to provide funds for repair and facility projects at certain district schools while proceeds of the Series 2018A GOs will be used to fund various capital improvements, equipment, and bus replacements.

PFM Financial Advisors is the financial advisor while Dorsey & Whitney is the bond counsel.

On Wednesday, Bank of America Merrill Lynch is expected to price the Michigan Strategic Fund’s $595 million of limited obligation revenue bonds for the I-75 improvement project. The deal is rated Baa2 by Moody’s Investors Service and BBB by Kroll Bond Rating Agency.

Also Wednesday, Wells Fargo Securities is set to price South Carolina Jobs and Economic Development’s $587 million of hospital revenue bonds for the Prisma Health Obligated Group. The deal is rated A2 by Moody’s and A by S&P Global Ratings.

RBC Capital Markets is expected to price the Los Angeles Department of Water and Power’s $426 million of water system revenue bonds on Thursday after a one-day retail order period. The deal is rated Aa2 by Moody’s, AA-plus by S&P and AA by Fitch Ratings.

BAML is set to price the New Jersey Economic Development Authority’s $401 million of school facilities construction and refunding bonds on Thursday. The deal is rated Baa1 by Moody’s, BBB-plus by S&P and A-plus by Fitch.

A New York trader said there was a special focus on this week’s calendar of over $7 billion since it’s one of the last remaining full weeks of regular activity before the holiday season kicks in.

“Everyone is waiting for that, with over $6 billion in negotiated volume — there are a lot of deals people will go in on,” he explained.

He predicted the deals will be fairly tight given last week’s market climate. “Seems like it’s a great time for issuers coming to the market,” he said. “There was not a not a ton of supply [last] week with the FOMC meeting and the election.”

Demand is greater for new issues than for bonds in the secondary market, the trader said. “People who want to buy would rather go into the new-issue market rather than paying up in the secondary.”

At the same time, there is a swell of high-grade odd lot paper in the secondary market — and some are finding a home with investors looking for bonds to round out their portfolios at year end, he added.

Prior week's top underwriters

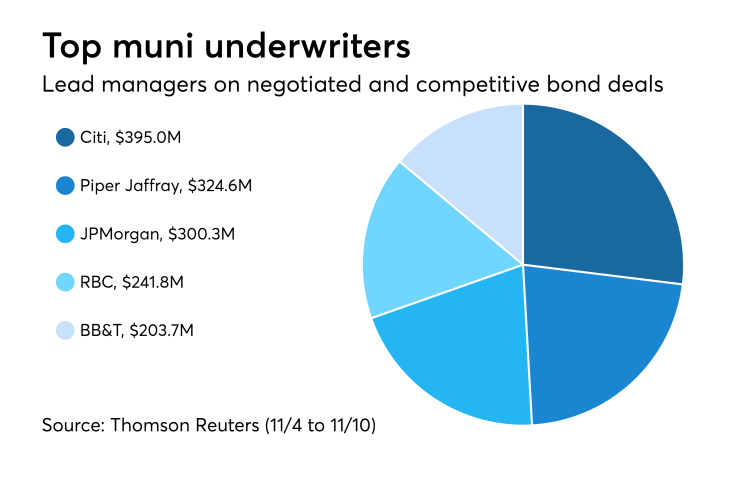

The top municipal bond underwriters of last week included Citigroup, Piper Jaffray, JPMorgan Securities, RBC Capital Markets and BB&T Capital Markets, according to Thomson Reuters data.

In the week of Nov. 4 to Nov. 10, Citi underwrote $395.0 million, Piper Jaffray $324.6 million, JPMorgan $300.3 million, RBC $241.8 million and BB&T $203.7 million.

Bond Buyer 30-day visible supply at $9.34B

The Bond Buyer's 30-day visible supply calendar increased $328.2 million to $9.34 billion for Tuesday. The total is comprised of $2.48 billion of competitive sales and $6.86 billion of negotiated deals.

Secondary market

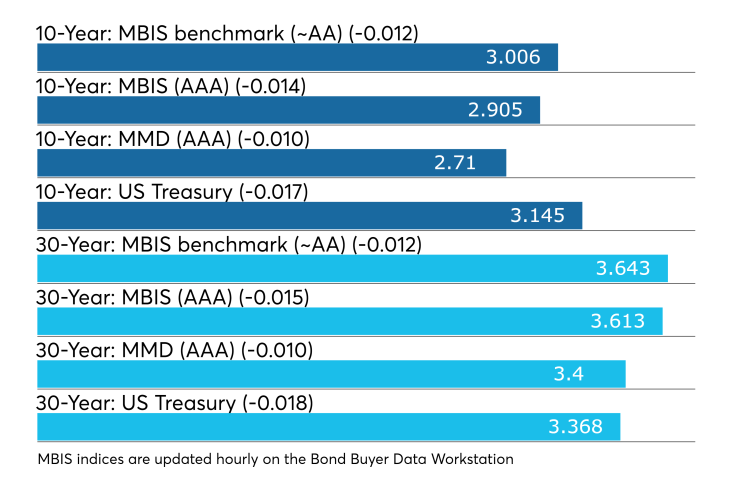

Municipal bonds were stronger on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale decreasing as much as one basis point across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity falling one basis point.

Treasury bonds were stronger as stocks traded mixed. The Treasury 10-year stood at 3.145% while the Treasury three-month bill was at 2.352%.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 86.3% while the 30-year muni-to-Treasury ratio stood at 101.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

A move up in interest rates could increase demand among retail investors, some market participants said.

“While mutual fund flows are a headwind for the municipal market at the moment from our perspective demand from individuals for separately managed municipal bond accounts has ticked up as absolute rates have moved higher,” Michael Pietronico, chief executive officer at Miller Tabak Asset Management said Friday afternoon.

More specifically, Friday ended the week on a firmer note as the Treasury market “seemingly” has found some stability around current yields, Pietronico said.

“Municipals were helped by the outcome of the election as the potential for further cuts in the tax rate for individuals seemed to be diminished greatly with a change of leadership in the House of Representatives,” he added.

The bond market is also noticing the recent collapse in oil prices and what that may mean about the health of the global economy, according to Pietronico.

“Our sense is that some rotation into fixed-income could be sizeable should signs emerge that the U.S. economy is downshifting a bit due to a generalized slowdown in global growth,” he explained.

Prior week's top FAs

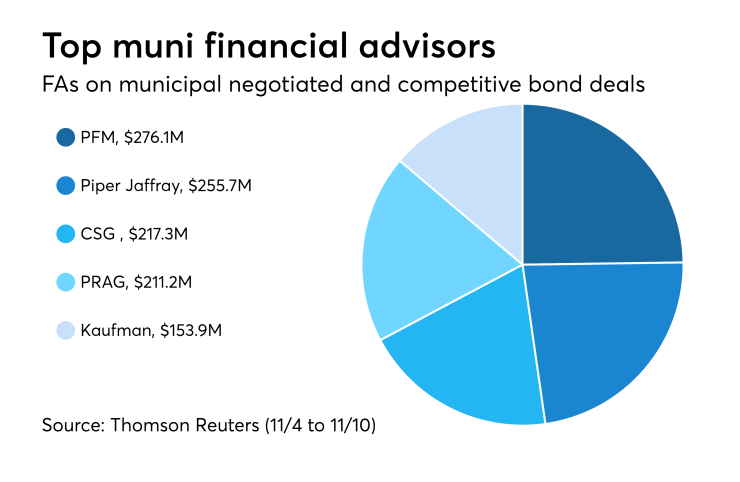

The top municipal financial advisors of last week included PFM Financial Advisors, Piper Jaffray, CSG Advisors, and Public Resources Advisory Group, and Kaufman Hall & Associates, according to Thomson Reuters data.

In the week of Nov. 4 to Nov. 10, PFM advised on $276.1 million, Piper Jaffray $255.7 million, CSG $217.3 million, PRAG $211.2 million and Kaufman $153.9 million.

Previous session's activity

The Municipal Securities Rulemaking Board reported 37,026 trades on Friday on volume of $9.92 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 18.73% of the market, the Empire State taking 15.264% and the Lone Star State taking 10.932%.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended Nov. 9, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 6s of 2042 were quoted by 40 unique dealers. On the ask side, the California taxable 7.55s of 2039 were quoted by 121 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 21 dealers.

Last week's actively traded issues

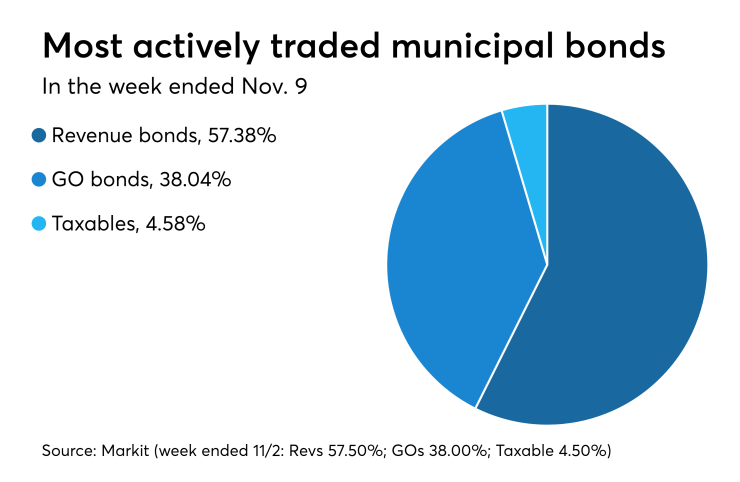

Revenue bonds comprised 57.38% of total new issuance in the week ended Nov. 9, down from 57.50% in the prior week, according to

Some of the most actively traded munis by type in the week were from New York, California and Oregon issuers.

In the GO bond sector, the New York City zeros of 2038 traded 26 times. In the revenue bond sector, the San Mateo County Joint Power Financing Authority, Calif., 4s of 2052 traded 35 times. And in the taxable bond sector, the Portland Community College District, Ore., 4.637s of 2038 traded 14 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the $45 billion of three-months incurred a 2.340% high rate, up from 2.320% the prior week, and the $39 billion of six-months incurred a 2.465% high rate, up from 2.450% the week before.

Coupon equivalents were 2.387% and 2.531%, respectively. The price for the 91s was 99.408500 and that for the 182s was 98.753806.

The median bid on the 91s was 2.320%. The low bid was 2.270%. Tenders at the high rate were allotted 14.05%. The bid-to-cover ratio was 3.14.

The median bid for the 182s was 2.450%. The low bid was 2.415%. Tenders at the high rate were allotted 48.72%. The bid-to-cover ratio was 3.26.

Treasury sells 4-, 8-week bills

The Treasury Department Tuesday auctioned $50 billion of four-week bills at a 2.200% high yield, a price of 99.841111. The coupon equivalent was 2.234%. The bid-to-cover ratio was 2.78. Tenders at the high rate were allotted 72.54%. The median rate was 2.175%. The low rate was 2.150%.

Treasury also auctioned $30 billion of eight-week bills at a 2.285% high yield, a price of 99.657250. The coupon equivalent was 2.325%. The bid-to-cover ratio was 3.13. Tenders at the high rate were allotted 39.99%. The median rate was 2.270%. The low rate was 2.240%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.