Municipal CUSIP requests rose 16.7% in February, signaling possible near-term growth in new issuance.

The aggregate total of all municipal securities – including municipal bonds, long-term and short-term notes, and commercial paper – increased to 944 last month from 809 in January.

Request for municipal bond identifies rose to 766 in February from 650 in the prior month, while long-term notes increased to 35 from 32 and short-term notes declined to 72 from 83 as commercial paper and other securities gained to 71 from 44.

“It should come as little surprise that issuers of corporate and municipal debt are continuing to seize the opportunity presented by the current low interest-rate environment to raise new capital," said Gerard Faulkner, CUSIP’s director of operations. “While volumes have been relatively strong so far this year, we do expect continued volatility as interest rates start to rise and geopolitical uncertainty persists.”

On a year-over-year basis, total muni requests rose 19.1% to 1,753 from 1,472 in the first two months of 2018,

Among top state issuers, CUSIPs for scheduled public finance offerings from Texas, New York and California were the most active in February, with Texas on top with 92 requests.

Insatiable demand

Too much cash chasing too few bonds is keeping flows into municipal bond mutual funds healthy, and supporting municipal outperformance, according to Jeffrey Lipton, Head of Municipal Research and Strategy and Municipal Capital Markets at Oppenheimer & Co.

Citing data from Refinitiv Lipper, he noted that flows have been positive for nine consecutive weeks.

“New-issue volume seems poised to move higher, but we are not certain that it will be sufficient to meet what appears to be insatiable demand,” Lipton said in an interview. “As taxpayers are filing their 2018 tax returns, many are being confronted with unexpected liabilities given the full impact of revised withholding tables and the limitations on SALT deductibility, with particular reality coming from those taxpayers in high income, high-tax states,” he explained.

This new-found awareness has made the tax-exemption on municipal bonds even more appealing as a way to shelter income, Lipton said.

“Away from market technicals, the backdrop for munis is very supportive,” Lipton added, pointing to a more dovish Fed bias, a slowing global economy with a close focus on China and Europe, decelerating U.S. growth as the effects of fiscal stimulus begin to wane and the impact of the government shutdown and the U.S.-China trade conflict take hold.

“We expect flows to remain positive over the near-term, with possible variability further out,” he said. “We do believe that fund flows will finish the year in a net-positive position as market technicals provide enduring support for municipal bonds.”

Meanwhile, Lipton believes persistent volatility within the risk asset classes will contribute to ongoing and healthy municipal flows, but sentiment could shift if emerging economic data motivate the Fed to return to its tightening sequence, and/or supply accelerates beyond expectation, he predicted.

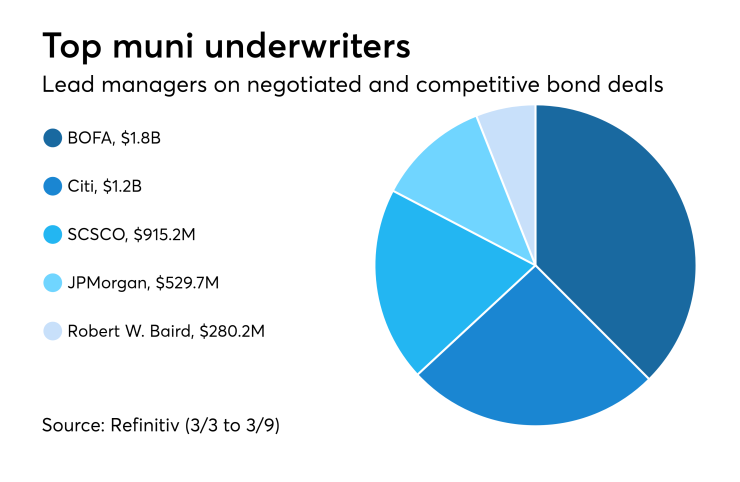

Prior week's top underwriters

The top municipal bond underwriters of last week included BofA Securities, Citigroup, Siebert Cisneros Shank & Co., JPMorgan Securities and Robert W. Baird, according to Refinitiv data.

In the week of March 3 to March 9, BofA underwrote $1.8 billion, Citi $1.2 billion, SCSCO $915.2 million, JPMorgan $529.7 million and Robert W. Baird $280.2 million.

Primary market

Weekly bond volume is estimated at $5.5 billion, consisting of $4.0 billion of negotiated deals and $1.5 billion of competitive sales.

Topping the calendar is a $654 million deal from the Regents of the University of California (Aa2/AA/AA).

UBS Financial Services will price the Regents of the University of California’s $654 million general revenue Series 2019 BB tax-exempts and Series 2019 BC & BD taxable on Tuesday.

On Wednesday, Citigroup will price Texas’ Lower Colorado River Authority’s (/A/A-plus) $370 million contract refunding revenue bonds for the LCRA Transmission Services Corp.

In the competitive market, New York State is selling $115.69 million of Series 2019A tax-exempt new-money transportation, education and environmental purposes general obligation bonds on Wednesday. The financial advisor is Public Resources Advisory Group.

In the short-term market, the New York Metropolitan Transportation Authority (//F1+) is competitively selling $750 million of Series 2019A dedicated tax fund bond anticipation notes on Tuesday. The financial advisors are PRAG and Backstrom McCarley Berry. The bond counsel are Nixon Peabody and D. Seaton & Associates.

Bond Buyer 30-day visible supply at $7.08B

The supply calendar rose $151.2 million to $7.08 billion for Monday, composed of $2.81 billion of competitive sales and $4.27 billion of negotiated deals.

Prior week's top FAs

The top municipal financial advisors of last week included Public Resources Advisory Group, PFM Financial Advisors, Hilltop Securities, Frost National Bank and CSG Advisors, according to Thomson Reuters data.

In the week of March 3 to March 9, PRAG advised on $2.8 billion, PFM $786.1 million, Hilltop $227.5 million, Frost $171.1 million and CSG $168.2 million.

Secondary market

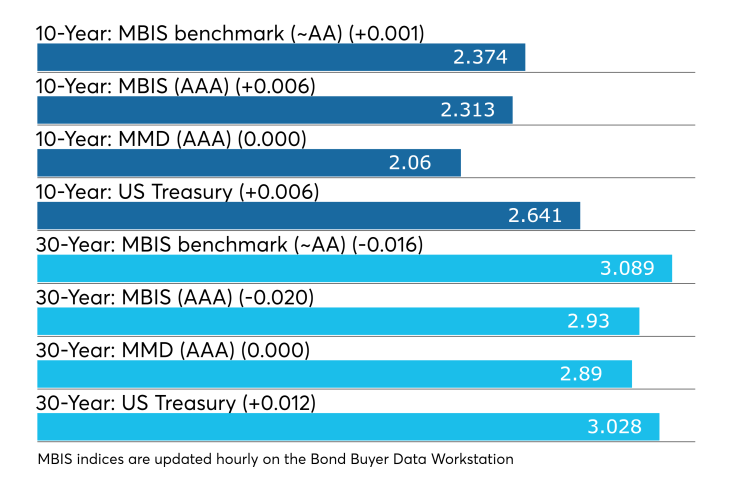

Municipal bonds were mixed on Monday, according to the MBIS benchmark scale, with muni yields rising less than one basis point in the 10-year maturity and falling one basis point in the 30-year maturity. High-grade munis were also mixed, with yields rising less than one basis point in the 10-year maturity and falling two basis points in the 30-year maturity.

Investment-grade municipals were steady on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year and the 30-year muni were unchanged.

Treasuries were weaker as equities rose.

The 10-year muni-to-Treasury ratio was calculated at 78.0% while the 30-year muni-to-Treasury ratio stood at 95.4%, according to MMD.

“The ICE Muni Yield Curve is ½ basis point lower in yield at the 10-year,” ICE Data Services said in a Monday market comment. “The high-yield sector is very quiet and unchanged. Taxables are up 1.5 basis points in yield at the 10-year and 2.1 basis points in yield at the 30-year maturities.”

Previous session's activity

The MSRB reported 42,850 trades on Friday on $10.43 billion of volume. California, New York and Texas were most traded, with the Golden State taking 15.627% of the market, the Empire State taking 13.635% and the Lone Star State taking 11.893%. The most active issue was the Illinois Series 2017D GO 5s of 2021 which traded 15 times on volume of $54.03 million.

Week's actively traded issues

Revenue bonds made up 55.10% of total new issuance in the week ended March 8, up from 55.03% in the prior week, according to

Some of the most actively traded munis by type were from California and Puerto Rico issuers. In the GO bond sector, the California 5s of 2049 traded 72 times. In the revenue bond sector, the Puerto Rico Sales Tax Financing Corp. 5s of 2058 traded 49 times. In the taxable bond sector, the Puerto Rico GDB Debt Recovery Authority 7.5s of 2040 traded 32 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $48 billion of three-months incurred a 2.405% high rate, down from 2.410% the prior week, and the $39 billion of six-months incurred a 2.455% high rate, off from 2.460% the week before. Coupon equivalents were 2.460% and 2.527%, respectively. The price for the 91s was 99.392069 and that for the 182s was 98.758861.

The median bid on the 91s was 2.385%. The low bid was 2.350%. Tenders at the high rate were allotted 4.97%. The bid-to-cover ratio was 3.02. The median bid for the 182s was 2.440%. The low bid was 2.400%. Tenders at the high rate were allotted 24.27%. The bid-to-cover ratio was 3.09.

The Treasury also auctioned $38 billion of three-year notes with a 2 3/8% coupon at a 2.448% high yield, a price of 99.790084. The bid-to-cover ratio was 2.56. Tenders at the high yield were allotted 41.89%. All competitive tenders at lower yields were accepted in full. The median yield was 2.410%. The low yield was 2.320%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.