Investor worries about the continued volatility in the stock market helped keep alive the rally in municipal and Treasury bonds on Thursday. Yields fell as much as five basis points according to the MBIS benchmark scale and as much as seven basis points on the MMD AAA scale.

Lower rates and global volatility are providing a challenging backdrop forinvestors as they ease into the New Year, according to one New York trader.

“There are so many cross currents from China and the trade wars to the government shutdown, and the House changing hands today,” the trader said. Thrown into the mix is the equity market volatility that could spark a flight to quality ahead of a large bounty of $9 billion in new issuance expected to hit the market next week, he said.

The new issue market is providing the best opportunity to find value in the municipal market. The current low rates, he said, are less than opportunistic for municipal investors. “A lot of people don’t really see themselves losing a lot by not participating.”

He said next week’s deals will have to come somewhat attractive compared with the secondary market for deals to get done, and should do well as long as Treasuries continue to get steady bids.

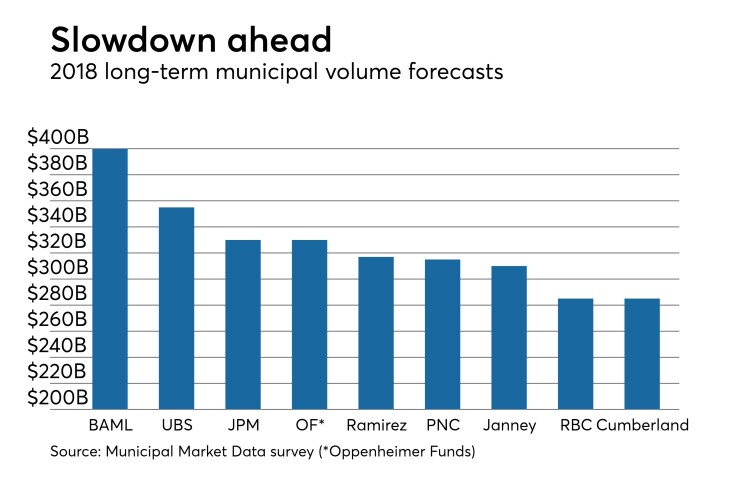

Winterstein says $375B issuance possible in ‘19

In his latest weekly market review, Stephen Winterstein, managing director and head of municipal strategy at Wilmington Trust, said he forecasts roughly $375 billion of issuance for the muni market in 2019, but added that several issues could factor into that number as the year progresses.

“First, while state and local governments remain stable, looming underfunded pension issues may repress the political will to borrow,” he said. “On the other hand, the need to maintain, improve, and expand infrastructure is omnipresent, and is unlikely to abate over the next year. These two countervailing forces may serve to offset one another, leaving the desire and need to issue debt untouched from last year.”

He also said that while looking at the current level and drift of interest rates, some may believe the economic cycle is approaching a near-term crest, and borrowing costs may stay flat or even edge slightly lower. And, if that sentiment materializes and endures, issuers could take a wait-and-see posture.

“Finally, with mid-term elections bringing control of the House to Democrats, Richard Neal, D-Mass., will serve as chair of House Ways and Means Committee. Unlike outgoing chair Kevin Brady, Neal is considered by most to be a friend of the municipal bond market,” he wrote. “We remind you that the negotiations and penning of the Tax Cuts and Jobs Act of 2017 sparked fears of an unchecked attack on the tax-exemption of municipal bonds in general, or private activity bonds in specific, and resulted in a deluge of issuance in December of that same year.”

He noted that as a result, fatigue characterized the first months of 2018, and resulted in first quarter new issuance of only $65.72 billion. A recurrence of such an episode doesn’t appear likely for 2019, so we expect first quarter 2019 supply to exceed that of the same period in 2018.

“While the first weeks of 2019 should see relatively light trading and modest supply, the market’s constructive tone could continue into the next week,” he said.

Secondary market

Municipal bonds were stronger on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as five basis points in the one- to 30-year maturities. High-grade munis were also stronger, with yields calculated on MBIS' AAA scale falling as much as five basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation falling seven basis points while the 30-year muni maturity dropped six basis points.

Treasury bonds were stronger amid continuing stock market volatility. The Treasury 30-year was yielding 2.911%, the 10-year yield stood at 2.571%, the five-year was at 2.376%, the two-year was at 2.387% while the Treasury three-month bill stood at 2.420%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 86.0% while the 30-year muni-to-Treasury ratio stood at 100.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Muni money market funds sees another inflow

Tax-free municipal money market fund assets increased $712.3 million, raising their total net assets to $144.94 billion in the week ended Dec. 31, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds increased to 1.28% from 1.25% last week.

Taxable money-fund assets gained $22.18 billion in the week ended Jan. 1, bringing total net assets to $2.849 trillion.

The average, seven-day simple yield for the 805 taxable reporting funds rose to 2.04% from 1.98% last week.

Overall, the combined total net assets of the 995 reporting money funds gained $22.89 billion to $2.994 trillion in the week ended Jan. 1.

Primary market

Jersey City, N.J., sold $83.4 million of Series 2019A bond anticipation notes on Thursday. Morgan Stanley won the BANs with a net interest cost of 1.936%. NW Financial Group was the financial advisor; GluckWalrath was the bond counsel.

Next week, the primary springs back to life with JPMorgan Securities expected to price the San Francisco Airport Commission’s $1.78 billion of tax-exempt and taxable revenue and revenue refunding bonds.

The deal, which consists of bonds subject to the alternative minimum tax and non-AMT bonds, is rated A1 by Moody’s Investors Service, and A-plus by S&P Global Ratings and Fitch Ratings.

Also next week, Bank of America Merrill Lynch set to price Massachusetts’ $967 million of tax-exempt and taxable general obligation and GO refunding bonds.

Wells Fargo Securities is expected to price the New Jersey Transportation Trust Fund Authority’s $500 million of transportation program bonds and the state of Mississippi’s $279 million of gaming tax revenue bonds.

And Morgan Stanley is set to price Texas A&M University’s $220 million of tax-exempt and taxable revenue financing system bonds.

Bond Buyer 30-day visible supply at $5.23B

The Bond Buyer's 30-day visible supply calendar increased $144.8 million to $5.23 billion for Thursday. The total is comprised of $2.03 billion of competitive sales and $3.20 billion of negotiated deals.

ICI: Long-term muni funds see $913M inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $913 million in the week ended Dec. 26, the Investment Company Institute reported on Wednesday.

This followed an outflow of $512 million from the tax-exempt mutual funds in the week ended Dec. 19, an inflow of $178 million in the week ended Dec. 12 and an outflow of 635 million in the week ended Dec. 4.

Long-term muni funds alone saw an inflow of $268 million while ETF muni funds saw an inflow of $645 million in the week ended Dec. 26.

Taxable bond funds saw estimated outflows of $10.14 billion in the latest reporting week after experiencing outflows of $11.71 billion in the previous week.

ICI said the total combined estimated outflows to long-term mutual funds and exchange-traded funds were $37.84 billion for the week ended Dec. 26 after outflows of $31.10 billion in the prior week. Estimated mutual fund outflows were $46.20 billion in the latest week while estimated net issuance for ETFs was $8.36 billion.

Treasury announces auctions

The Treasury Department on Thursday announced these auctions:

- $16 billion of 29-year 10-month 3 3/8% notes selling on Jan. 10;

- $24 billion of 9-year 10-month 3 1/8% notes selling on Jan. 9;

- $38 billion of three-year notes selling on Jan. 8;

- $36 billion of 182-day bills selling on Jan. 7; and

- $39 billion of 91-day bills selling on Jan. 7.

Treasury sells 4- and 8-week bills

The Treasury Department Thursday auctioned $40 billion of four-week bills at a 2.390% high yield, a price of 99.814111.

The coupon equivalent was 2.428%. The bid-to-cover ratio was 2.81. Tenders at the high rate were allotted 24.17%. The median rate was 2.350%. The low rate was 2.300%.

Treasury also auctioned $30 billion of eight-week bills at a 2.375% high yield, a price of 99.630556.

The coupon equivalent was 2.417%. The bid-to-cover ratio was 3.14. Tenders at the high rate were allotted 75.09%. The median rate was 2.355%. The low rate was 2.320%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.