The municipal bond market continued to strengthen as a lone large deal was priced, with the Federal Open Market Committee’s 2 p.m. Eastern Time announcement on interest rates in focus.

Secondary market

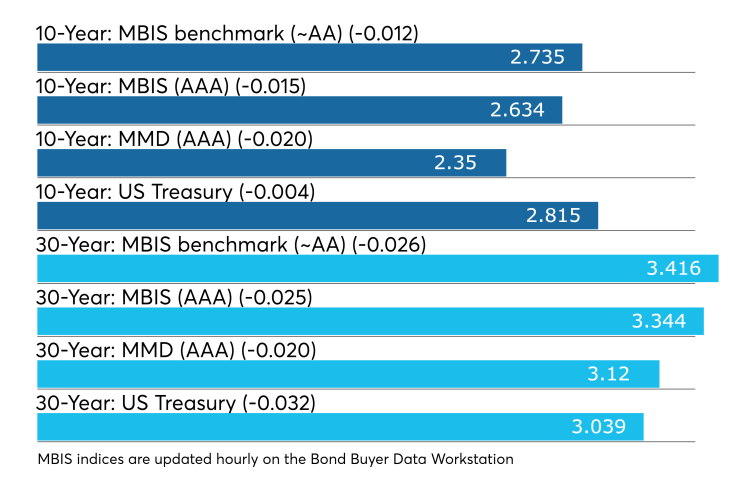

Municipal bonds were stronger on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields dropped as much as five basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale decreasing up to six basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and 30-year muni maturity falling by as much as two basis points.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.0% while the 30-year muni-to-Treasury ratio stood at 101.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Primary Market

Piper Jaffray priced the Colorado Health Facilities Authority’s $129 million of improvement and refunding revenue bonds consisting of Series 2018A-1 for the Bethesda project, Series 2018A-2 taxable bonds and Series 2018B second tier bonds. The deal is rated A-minus by S&P Global Ratings.

Wednesday’s bond sale

BlackRock: U.S. bonds provide income, portfolio ballast

In its global investment outlook for 2019, the BlackRock Investment Institute noted rising interest rates have made shorter-term U.S. bonds an attractive source of income. Short-term Treasuries now offer almost as much yield as the 10-year Treasury.

“That’s with one-fifth the duration risk, we calculate. The picture is similar in credit. We are also warming up to longer-term debt as a portfolio buffer against any late-cycle growth scares and a potential source of capital gains should the yield curve invert,” the report says.

Previous session's activity

The Municipal Securities Rulemaking Board reported 49,799 trades on Tuesday on volume of $13.089 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 14.074% of the market, the Empire State taking 12.675% and the Lone Star State taking 11.059%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.