Top-rated municipals ended mixed on Thursday, according to traders, who spent much of the day looking at Puerto Rico debt, which was recovering from sharp losses suffer the previous day.

Secondary market

The yield on the 10-year benchmark muni general obligation was unchanged from 2.01% on Wednesday, while the 30-year GO yield gained one basis point to 2.83% from 2.82%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Thursday. The yield on the two-year Treasury increased to 1.50% from 1.48% on Wednesday, the 10-year Treasury yield gained to 2.35% from 2.33% and yield on the 30-year Treasury bond increased to 2.90% from 2.88%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 85.6% compared with 86.2% on Wednesday, while the 30-year muni-to-Treasury ratio stood at 97.9% versus 98.0%, according to MMD.

Puerto Rico rising

Puerto Rico bonds were trading higher late Thursday, with some maturities recovering from the losses after President Trump hinted at a debt "wipe-out."

The Puerto Rico Commonwealth benchmark Series 2014A general obligation 8s of 2035 were trading at a low price of 37 cents on the dollar compared to a low price of 30.25 on Wednesday, according to the Municipal Securities Rulemaking Board’s EMMA website. The bonds were trading at a low of 44 on Tuesday.

Activity was significantly lighter than the previous day, with $19.85 million of the 8s trading hands in 29 trades compared to $183.18 million in 105 trades on Wednesday.

Among other actively traded issues reported on EMMA Thursday, the Commonwealth’s Series 2012A public improvement refunding 5s of 2041 were trading at a low price of 30.99 in 15 trades totaling $22.81 million compared to a low of 27.88 in 24 trades totaling $7.31 million on Wednesday. The bonds were trading at a low of 35.21 on Tuesday.

The Puerto Rico Electric Power Authority’s Series 2007TT revenue 5s of 2037 were trading at a low of 27.75 in 15 trades totaling $7.40 million compared to a low of 27.581 in nine trades totaling $1.39 million of Tuesday and a low of 35.988 in 11 trades totaling $585,000 on Tuesday.

The Puerto Rico Buildings Authority Series 2012U revenue refunding 5.25s were trading at a low price of 28.599 in 14 trades totaling $13.64 million compared to a low price of 24.085 in 21 trades totaling $9.33 million on Wednesday. The bonds were trading at a low of 29.773 on Tuesday.

The Puerto Rico Sales Tax Financing Corp.’s Series 2009 First Subseries A revenue 5.25s of 2027 were trading a low price of 12.33 cents on the dollar in 20 trades totaling $1.36 million compared to a low of 11.849 in eight trades totaling 180,000 on Wednesday. The bonds were trading at 16.125 on Tuesday.

“The muni market is very much concerned about the sanctity of the debt contract, especially as it has been under attack in places like Detroit. Furthermore, there is an implied attack on the security of U.S. Treasury debt here -- which is a really big deal,” said one trader. “Wiping out Puerto Rico debt isn’t the answer, because then how could the island ever borrow again?”

The trader added, however, that there needs to be an intelligent discussion about Puerto Rico debt and recovery.

“The island needs a Marshall Plan and there are plenty of precedents - both nationally and internationally, regarding placating borrowers and lenders,” he said.

Another market participant said he was glad he didn’t own any Puerto Rico debt “because it will be on a roller coaster ride for the next few months,” adding that “I also don’t think wiping out the debt is realistic. That being said, this obviously does not bode well for the price of Puerto Rico debt going forward. How can the Commonwealth afford any restructuring after this horrific event?”

Another market source agreed that the debt won’t be wiped out.

“I do believe that this strengthens the hand of the Commonwealth in negotiations…There has been a small recovery, I think partly in response to the strong negative price reaction, and also perhaps as existing holders buy bonds to support pricing.”

He said he'd heard that was good volume at these new levels, which can mean that the debt’s near a level where it can stabilize. He said it was difficult to know what was a fair price “until we understand the Commonwealth’s situation post-hurricane.”

BlackRock: Broader market no reaction to Puerto Rico

While Puerto Rico bonds fell on Wednesday to record lows amid active trading, the broad muni market did not react, which showed just how strong market fundamentals and technicals are, said Peter Hayes, head of the municipal bonds group at BlackRock.

“The broad market was firm and I think that is indicative of who owns the risk, generally retail has gotten out of Puerto Rico starting back in 2013,” Hayes said on Thursday morning at BlackRock’s fixed-income reporters’ roundtable. “That fact the rest of the market did not react, shows how healthy the market is.”

Hayes also said that he believes the debt will not be forgiven, since the oversight broad was put into place for a reason.

“While the humanitarian crisis the island is facing is sure to prolong what was already going to be a long process, an orderly debt restructuring is still the way to go,” he said. “Essential services have been impaired and I think with this scenario, all rules and precedence’s from the past go out the window. We don’t know what it all means, how much federal funds will they get? There are a lot of unknowns.”

Beside Puerto Rico, Hayes said that the year thus far in municipals is a surprising one as index returns have exceeded expectations. Going forward BlackRock expects to have a cautious approach.

“We expect the summer’s net negative supply to turn positive as issuance picks up in the fall," he said. "We prefer the A-rated space, longer-dated issues and revenue bonds.”

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 42,466 trades on Wednesday on volume of $13.36 billion.

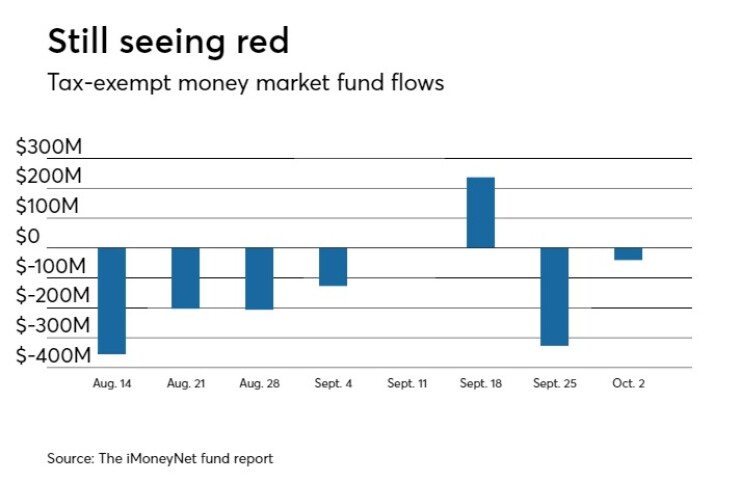

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $40.3 million, lowering total net assets to $127.86 billion in the week ended Oct. 2, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $327.1 million to $127.90 billion in the previous week.

The average, seven-day simple yield for the 224 weekly reporting tax-exempt funds grew to 0.44% from 0.40% the previous week.

The total net assets of the 830 weekly reporting taxable money funds decreased $2.49 billion to $2.585 trillion in the week ended Oct. 3, after an inflow of $30.27 billion to $2.587 trillion the week before.

The average, seven-day simple yield for the taxable money funds remained at 0.68% from the prior week.

Overall, the combined total net assets of the 1,054 weekly reporting money funds decreased $2.53 billion to $2.712 trillion in the week ended Oct. 3, after inflows of $29.94 million to $2.715 trillion in the prior week.

Primary market

Fitch Ratings said it assigned an AA-minus rating to California’s $1.6 billion of general obligation bonds, expected to be sold competitively on Tuesday, Oct. 17.

The state's deals consist of $508.57 million federally taxable various purpose GOs, $198.655 million of tax-exempt various purpose GOs, and $881.09 million tax-exempt various purpose GO refunding bonds. Fitch said the rating outlook is stable.

“California's AA-minus rating reflects its large and diverse economy that supports strong, albeit cyclical, revenue growth prospects, solid ability to manage expenses through the economic cycle, and a moderate level of liabilities,” Fitch said. “The state has demonstrated strong budget management during this period of economic recovery and expansion, using temporary tax revenues to eliminate the overhang of budgetary borrowing that had accumulated through two recessions."

Fitch added that California's economy is “unmatched among U.S. states in its size and diversity and is generally stable despite a considerable presence in industries prone to cyclicality.”