Municipal bond traders returned to work on Thursday as the market took up where it left off on Tuesday — with muni and Treasury yields falling as stocks continued to slump.

The fixed-income markets were closed on Wednesday for the national day of mourning honoring former President George H.W. Bush.

Secondary market

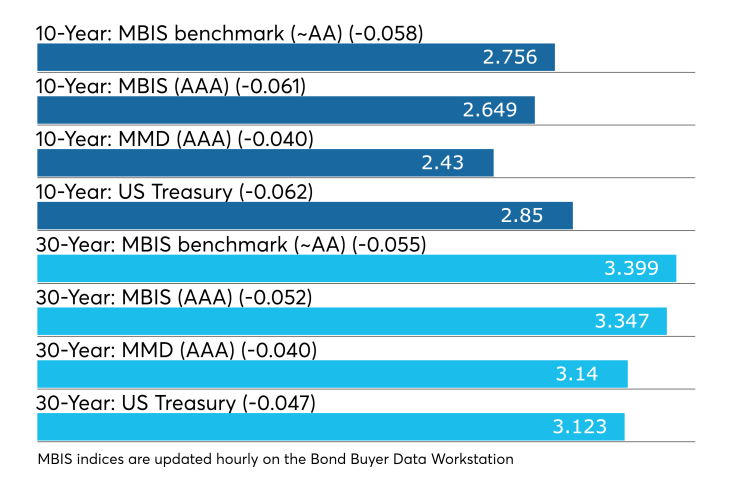

Municipal bonds were stronger, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as six basis points in the one- to 30-year maturities.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale decreasing as much as six basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and on the 30-year muni maturity falling two to four basis points.

Treasury bonds were stronger as stocks plunged.

The Treasury 30-year yield was at 3.123%, the 10-year stood at 2.850%, the five-year was at 2.725%, the two-year was at 2.734% while the Treasury three-month bill stood at 2.414%.

The Dow Jones Industrial Average was off 2.31%, the Nasdaq Composite Index was down 1.41% and the S&P 500 Index dropped 2.04%.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 83.2% while the 30-year muni-to-Treasury ratio stood at 98.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

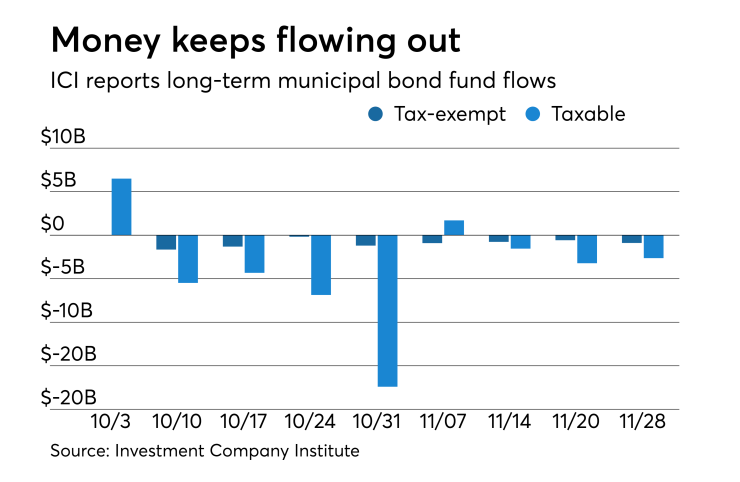

ICI: Long-term muni funds saw $896M outflow

Long-term tax-exempt municipal bond funds saw an outflow of $896 million in the week ended Nov. 28, the Investment Company Institute reported Wednesday.

This followed an outflow of $578 million in the week ended Nov. 20 and outflows of $770 million, $909 million, $1.196 billion, $179 million, $1.310 billion, and $1.653 billion in the previous six weeks.

“The Investment Company Institute did report a 10th week of outflows from municipal mutual funds in the week ended Nov 28th,” Alan Schankel wrote in a Wednesday market comment. “The $1 billion of outflows brings the 10 week total asset reduction to $8.6B, offsetting more than half of the net inflow total gained in 2018 before recent outflows began. Flow data for municipal ETFs paints a more positive picture, with $341MM of inflows in the same 10-week timeframe. On Tuesday, an additional $97MM in new shares of the largest municipal bond ETF, MUB, were created.”

Taxable bond funds saw an estimated outflow of $2.636 billion in the latest reporting week, after seeing outflows of $3.220 billion and $1.543 billion in the previous two weeks.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $13.268 billion after outflows of $6.693 billion and $34 million in the prior two weeks.

Previous session's activity

The Municipal Securities Rulemaking Board reported 54,819 trades on Tuesday on volume of $19.05 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.256% of the market, the Empire State taking 13.628% and the Lone Star State taking 9.573%.

Primary market

Bank of America Merrill Lynch received the official award on the San Francisco Bay Area Tool Authority’s $402.11 million of toll bridge revenue bonds consisting of Series 2018A term rate, Series 2018B term-rate and Series 2018C SIFMA index-rate bonds.

The deal is rated Aa3 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

RBC Capital Markets received the official award on the Maricopa County Industrial Development Authority, Ariz.’s $291.38 million of hospital revenue bonds for Honor Health, consisting of Series 2019A fixed-rate bonds, Series 2019B long-term bonds and Series 2019C SIFMA floating rate note bonds.

The deal is rated A2 by Moody’s and A by Fitch.

Bond Buyer 30-day visible supply at $9.07B

The Bond Buyer's 30-day visible supply calendar decreased $467.3 million to $9.07 billion for Thursday. The total is comprised of $2.27 billion of competitive sales and $6.80 billion of negotiated deals.

Franklin optimistic, yet cautious on market in ‘19

With the potential for rising interest rates on the horizon, the need for tax-exempt income could boost future demand for municipal bonds, according to a report from Franklin Templeton Investments.

Rising yields and a flattening municipal yield curve in 2018 sparked volatility not seen since the fourth quarter of 2016, Sheila Amoroso, director of the municipal bond department of the Franklin Templeton Fixed Income Group, wrote in the report.

“Given the expected path for U.S. Federal Reserve rate hikes and underlying macroeconomic fundamentals in the United States, we expect broader interest rates to continue moving higher during 2019, along with municipal bond yields,” Amoroso said in the Dec. 3 report entitled: “The Case for Municipal Bonds in a Rising Rate Environment.”

Interest rate moves, however, are expected to become more gradual, as opposed to sizable short-term increases, she noted.

Federal Reserve Board Chairman Jerome Powell told The Economic Club of New York last Wednesday that interest rates are nearing the neutral level — the rate that neither stimulates nor restrains economic growth. His comments were seen as a sign the Fed will tighten less than had been expected.

“It is important to remember that as municipal bond yields move higher, the taxable equivalent yield moves exponentially higher, particularly for higher-tax states,” Amoroso wrote. “This new higher base of tax-free income available in the market could help spur demand for the asset class in 2019,” she added.

The impact of tax reform bill passed in 2017 will also support continued demand for municipals in 2019, according to Amoroso.

“Specifically, with the cap on SALT deductions at $10,000, we expect demand to increase for municipal bonds, particularly from higher tax states,” most likely in early 2019 after the impact is felt by investors during the tax period by investors, she noted.

“We also expect that if we were to see such increased demand, it would help to lower yield volatility in a general up-trending yield environment,” Amoroso added.

Overall, Amoroso cautioned investors about a potentially changing municipal credit landscape going forward.

“As we advised our clients during 2018, we believe now is an important time to take a hard look at the municipal market because old norms may not hold true going forward,” she wrote. “More specifically, we believe the increasing financial pressures being placed on state and local governments demand a shift in how these municipal bond credits are analyzed.

“We have seen an increase in the likelihood of issuers choosing to harm bondholders’ interests, rather than make tough financial and political decisions,” she continued.

The director said this practice is a departure from the historical norm, in which there was much more of a willingness to negotiate and compromise with bondholders during periods of stress.

In the coming year, Amoroso said Franklin’s municipal group will remain focused on the overall health of pensions and pension-related financial matters when it comes to analyzing municipal issuers.

“Specifically, we believe the best way to manage this risk is to avoid altogether those issuers who appear to have unsustainable budget situations,” she said. Independent credit analysis remains an important component of investing in the municipal bond market.

“We expect to remain cautious of local government debt in 2019 given the more limited financial flexibility for those issuers versus states,” she wrote.

Treasury auctions bills

The Treasury Department Thursday auctioned $40 billion of four-week bills at a 2.365% high yield, a price of 99.816056. The coupon equivalent was 2.402%. The bid-to-cover ratio was 3.04.

Tenders at the high rate were allotted 61.77%. The median rate was 2.340%. The low rate was 2.300%.

Treasury also auctioned $30 billion of eight-week bills at a 2.390% high yield, a price of 99.628222. The coupon equivalent was 2.432%. The bid-to-cover ratio was 3.01.

Tenders at the high rate were allotted 93.15%. The median rate was 2.370%. The low rate was 2.320%.

Treasury auctions announced

The Treasury Department announced these auctions:

- $16 billion 29-year 11-month 3 3/8% notes selling on Dec. 13;

- $24 billion 9-year 11-month 3 1/8% notes selling on Dec. 12;

- $38 billion three-year notes selling on Dec. 11;

- $36 billion 182-day bills selling on Dec. 10; and

- $39 billion 91-day bills selling on Dec. 10.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.