The second-quarter kicked off with a little more optimism among municipal market participants than the start of the year did, according traders. Monday’s post-holiday trading activity was typically quiet, with yields slipping in moderate activity.

“The first quarter was one of the worst quarters in a long, long time,” a New York trader said. “People are coming into the second quarter with a little more optimism, dealers have cleaned up their inventory, yet people are still being cautious given what is going on,” he said, citing the combination of market and rate volatility and overall uncertainty.

“With the economic boom out there and analysts guaranteeing that Treasury rates were going up to 3% on the 10-year, there’s a lot of crossed signals out there,” he said. “[Monday] the equity market is being crushed, and that does tend to push people toward safer assets, which is good for the Treasury market.”

Others said the second quarter was off to a slow start. Monday featured little trading with few odd lot transactions made -- a typical “sleeper” following a holiday weekend, according to Fred Yosca, managing director of trading at BNY Mellon Capital Markets in New York.

“Between school vacations, the early spring snowstorm, the European close, and being the day after Easter with lots of people out, there is very little to report,” he said Monday afternoon. “There is not much out for the bid from customers, and the Monday new issue pricing is not taking place yet.”

This week, all eyes will be on the $3 billion-plus New Jersey tobacco deal. The New York trader said that the sale will keep the market focused.

“Spreads have come in on tobacco bonds, so it will be interesting to see the reaction to this deal,” he said. “It doesn’t fit everyone, but there will be a lot of focus on it. The high-yield market was mostly positive at the start of the year and the market has been very supportive of the sector, so the deal is coming at a good time.”

Yosca said the tobacco deal is a “different animal” in the high-yield market, which trades apart from the national general obligation market. “There is not much of a correlation,” he said, between the tobacco deal and other high grade state GO deals, such as Wisconsin.

Away from the tobacco deal, the only other large deal of interest in the Northeast region is a New York City water deal. “Take out the tobacco deal and the calendar is not a big week,” he said.

Primary market

Traders said demand should continue to chase new deals given the overall lack of volume and other uncertainty so far this year.

The market will see about $7.9 billion of new deals, a slate that’s composed of $6.62 billion of negotiated deals and $1.23 billion of competitive sales. Average weekly volume so far this year has been around $4.3 billion, and without the big tobacco offering volume this week, the calendar would be about $4.7 billion. In 2017, the average weekly volume was over $6 billion.

Jefferies is set to price the Tobacco Settlement Financing Corp.’s $3.22 billion of Series 2018A senior and Series 2018B subordinate tobacco settlement bonds for retain investors on Tuesday ahead of the institutional pricing on Wednesday.

Siebert Cisneros Shank is set to price the New York City Municipal Water Finance Authority’s $425 million of Fiscal 2018 Series EE water and sewer system second resolution revenue bonds for retain investors on Tuesday ahead of the institutional pricing on Wednesday.

Also Tuesday, Wells Fargo Securities is expected to price the Little Elm Independent School District, Texas' $134 million of unlimited tax school building bonds backed by the Permanent School Fund guarantee program.

In the competitive arena on Tuesday, the biggest deal of the week is coming from Albany County, N.Y., which is selling $152 million of Series 2018 various purpose general obligation bonds.

The California Public Work Board is selling $140 million of lease revenue and refunding bonds on Tuesday.

And Rhode Island is selling over $149 million of general obligation bonds in two sales consisting of $114.28 million of tax-exempts and $35.1 million of taxables on Tuesday.

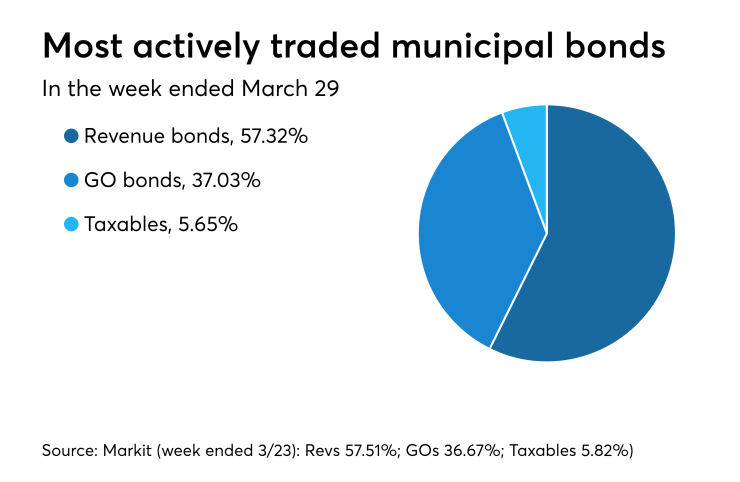

Prior week's actively traded issues

Revenue bonds comprised 57.32% of new issuance in the week ended March 29, down from 57.51% in the previous week, according to

Some of the most actively traded bonds by type were from Puerto Rico, California and New Jersey issuers.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 120 times. In the revenue bond sector, the California Health Facilities Financing Authority 4s of 2042 traded 46 times. And in the taxable bond sector, New Jersey’s Rutgers University 4.146s of 2048 traded 30 times.

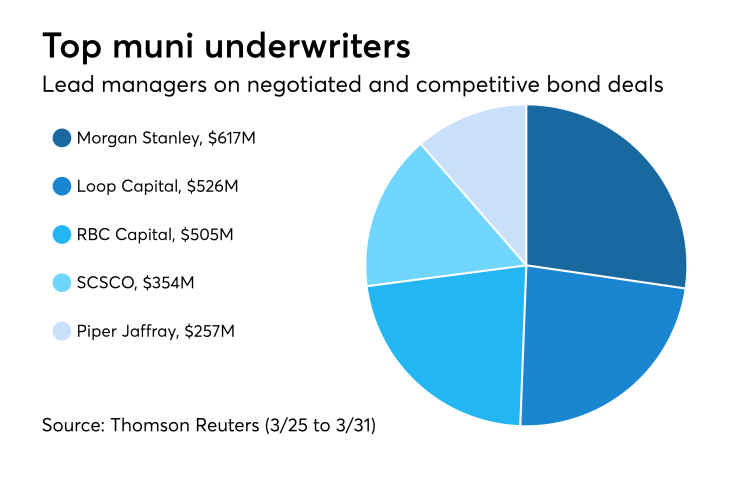

Prior week's top underwriters

The top municipal bond underwriters of last week included Morgan Stanley, Loop Capital Markets, RBC Capital Markets, Siebert Cisneros Shank & Co., and Piper Jaffray, according to Thomson Reuters data.

In the week of March 25 to March 31, Morgan Stanley underwrote $616.8 million, Loop Capital $526.4 million, RBC Capital $504.5 million, SCSCO $354.4 million and Piper Jaffray $257.2 million.

Previous session's activity

The Municipal Securities Rulemaking Board reported 29,387 trades on Thursday on volume of $11.27 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 22.726% of the market, the Empire State taking 11.381% and the Lone Star State taking 7.41%.

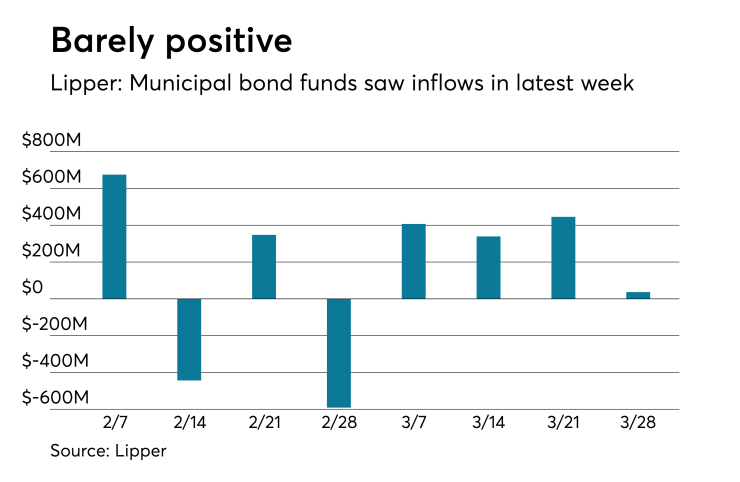

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds continued to put cash into the funds, according to Lipper data released on Thursday.

The weekly reporters saw $36.792 million of inflows in the week of March 28, after inflows of $445.450 million in the previous week.

Exchange traded funds reported inflows of $36.581 million, after inflows of $40.074 million in the previous week. Ex-ETFs, muni funds saw $211,000 of inflows, after inflows of $405.377 million in the previous week.

The four-week moving average remained positive at $307.034 million, after being in the green at $150.101 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $131.694 million in the latest week after inflows of $152.371 million in the previous week. Intermediate-term funds had inflows of $8.581 million after inflows of $358.004 million in the prior week.

National funds had inflows of $132.287 million after inflows of $502.293 million in the previous week. High-yield muni funds reported inflows of $153.850 million in the latest week, after inflows of $65.345 million the previous week.

DiNapoli releases N.Y. $4.29B Q2 bond calendar

New York State Comptroller Thomas DiNapoli on Monday released the tentative scheduled for the bond sales for the state, New York City and their major public authorities during the second quarter of 2018.

The planned sales of $4.29 billion include $3.06 billion of new money and $1.23 billion of refundings or reofferings as follows:

- $2.32 billion scheduled for April, of which $1.29 billion is new money and $1.03 billion is refundings or reofferings;

- $1.95 billion scheduled for May, of which $1.75 billion is new money and $200 million is refundings; and

- $25 million scheduled for June, all of which is new money.

The anticipated sales in the second quarter compare to past planned sales of $3.12 billion during the first quarter of 2018, and $4.68 billion during the second quarter of 2017.

The calendar includes anticipated bond sales by: the City of New York, the Dormitory Authority of the State of New York, New York City Housing Development Corp., New York City Municipal Water Finance Authority, New York City Transitional Finance Authority, the New York State Housing Finance Agency and the Port Authority of New York & New Jersey.

Treasury auctions discount bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the three-months incurred a 1.740% high rate, down from 1.770% the prior week, and the six-months incurred a 1.905% high rate, off from 1.895% the week before.

Coupon equivalents were 1.772% and 1.950%, respectively. The price for the 91s was 99.560167 and that for the 182s was 99.036917.

The median bid on the 91s was 1.710%. The low bid was 1.680%. Tenders at the high rate were allotted 51.97%. The bid-to-cover ratio was 2.88.

The median bid for the 182s was 1.890%. The low bid was 1.850%. Tenders at the high rate were allotted 56.65%. The bid-to-cover ratio was 3.10.

Treasury to sell $55B of bills

The Treasury Department said it will sell $55 billion of four-week discount bills Tuesday. There are currently $84.007 billion of four-week bills outstanding.

Gary Siegel contributed to this report.

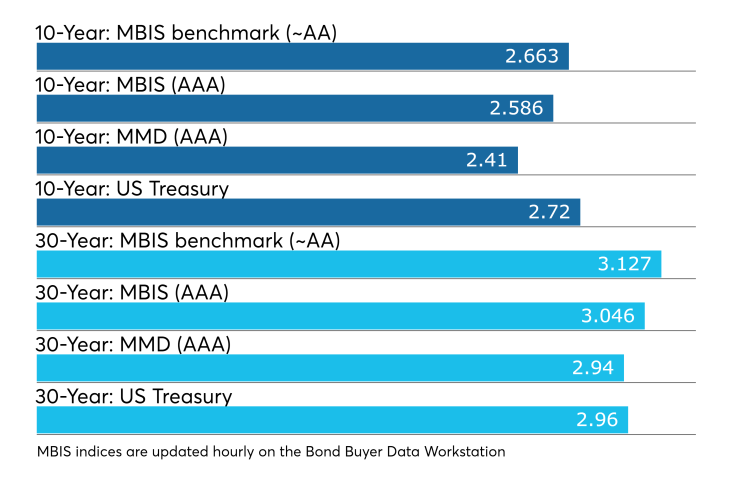

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.