Sporadic trading and price firmness drove the municipal market on Thursday as summer doldrums continued to plague activity in both the new issue and secondary markets, two municipal veterans said.

“We see the market unchanged today with a decent tone,” Pete State of Hilltop Securities in Dallas said Thursday afternoon.

A lack of new issue pricing on Thursday made for a slow day. “Secondary market trading is somewhat limited,” he said, with most people already looking ahead to next week’s calendar, since most of this week’s new deals were priced on Tuesday and Wednesday.

The lackluster mood was also felt elsewhere, according to Rick Calhoun, first vice president of sales and trading at Crews & Associates in Little Rock, Ark.

"`There ain't no cure for the summertime blues,'" he said, quoting lyrics from a 1950s rock 'n' roll song by Eddie Cochran. “The lack of supply due to the low volume of new issues is certainly putting a damper on trading and is keeping prices firm.

“In our region, the supply of Texas bonds remains reasonable, but elsewhere across the south new issues are few-and-far-between — especially in Louisiana, Mississippi, and other states where the supply remains extremely thin.”

Earlier in the day, John Mousseau, chief executive officer at Cumberland Advisors, said that price stability was outweighing trading activity and volume.

“I would characterize the market as slow in trading, low in supply, and solid in price. I certainly would expect supply to pick up as we get towards the end of the summer,” when long yield ratios are expected to grind lower, he said.

Secondary market

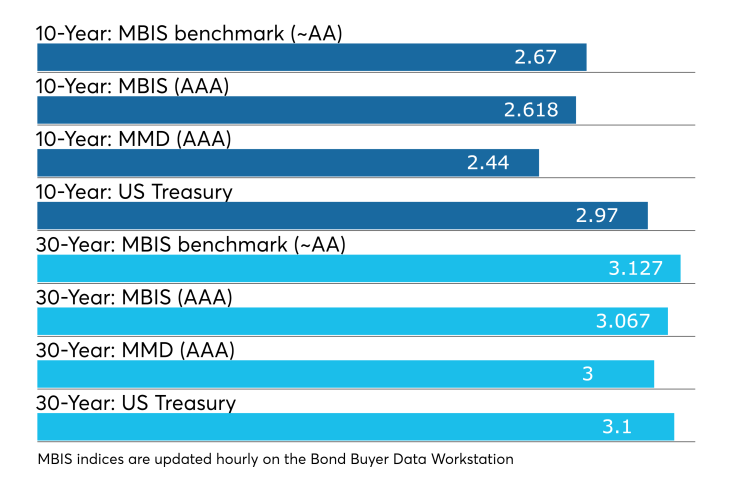

Municipal bonds were mixed on Thursday, according to a late day read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the seven- to 12-year maturities, rose less than a basis point in the one- to six-year, 13- to 17-year, 19- to 25-year and 27- to 30-year maturities and remained unchanged in the 18-year and 26-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS’ AAA scale falling less than one basis point in the nine- to 11-year and 17- to 25-year maturities, rising less than a basis point in the one- to seven-year, 13-to 15-year and 27- to 30-year maturities and remaining unchanged in the eight-year, 12-year, 16-year and 26-year maturities.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the 10-year muni general obligation yield rising one basis point and the yield on the 30-year muni maturity gaining two basis points.

Treasury bonds were stronger as stocks traded mixed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 82.0% while the 30-year muni-to-Treasury ratio stood at 96.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

ICI: Long-term muni funds see $1.765B inflow

Long-term tax-exempt municipal bond funds saw an inflow of $1.765 billion in the week ended July 18, the Investment Company Institute reported.

This followed an inflow of $1.028 billion into the tax-exempt mutual funds in the week ended July 11 and inflows of $356 million, $525 million, $742 million, $326 million, $648 million, $661 million, $185 million and $450 million in the eight prior weeks.

Taxable bond funds saw an estimated inflow of $6.894 billion in the latest reporting week, after seeing an inflow of $6.416 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $8.013 billion for the week ended July 18 after inflows of $3.343 billion in the prior week.

Tax-exempt money market funds saw outflows

Tax-exempt money market funds saw outflows of $2.97 billion, lowering total net assets to $134.58 billion in the week ended July 23, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $1.74 billion to $137.55 billion in the prior week.

The average, seven-day simple yield for the 201 weekly reporting tax-exempt funds fell to 0.54% from 0.60% the previous week.

The total net assets of the 832 weekly reporting taxable money funds rose $9.23 billion to $2.675 trillion in the week ended July 24, after an outflow of $7.51 billion to $2.666 trillion the week before.

The average, seven-day simple yield for the taxable money funds rose to 1.55% from 1.54% from the prior week.

Overall, the combined total net assets of the 1,033 weekly reporting money funds rose $6.26 billion to $2.810 trillion in the week ended July 24, after outflows of $8.52 billion to $2.803 trillion in the prior week.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,920 trades on Wednesday on volume of $13.93 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 16.437% of the market, Empire State taking 11.762% and Lone Star State taking 9.205%.

Primary market

RBC Capital Markets received the official award on the Patriots Energy Group Financing Agency’s $832.35 million of Series 2018 gas supply revenue bonds. The deal is expected to be rated Aa2 by Moody’s Investors Service and is rated AA by Fitch Ratings.

Citigroup received the written award on the University of Colorado Hospital Authority’s $197.35 million of Series 2018A, B and C refunding revenue bonds. The deal is rated Aa3 by Moody’s, AA-minus by S&P and AA by Fitch.

Late Wednesday, the New York City Transitional Finance Authority announced details on its sale of about $1.15 billion of future tax secured subordinate bonds, comprised of about $850 million of tax-exempt fixed rate bonds and $300 million of taxable fixed rate bonds.

“During a two-day retail order period for the tax-exempt bonds, TFA received $116 million of retail orders, of which approximately $97 million was usable,” the TFA said in a statement. “During the institutional order period, TFA received approximately $2.1 billion of priority orders, representing 2.8 time the bonds offered for sale to institutional investors.”

The TFA said because of strong demand, yields were cut in 15 maturities -- by two to four basis points in 2022 through 2024, one basis point in 2025 through 2030, two basis points in 2032 through 2034 and two to six basis points in 2040 through 2042.

The final yields ranged from 1.63% in 2020 to 3.55% in 2041 for a 4.00% coupon bond, 3.22% in 2042 for a 5.00% coupon bond and 3.68% in 2043 for a 3.50% coupon bond.

The tax-exempt bonds were sold via negotiated sale by TFA’s underwriting syndicate, led by book- running lead manager JPMorgan Securities and joint lead manager Rice Financial Products Co. with Bank of America Merrill Lynch, Citigroup, Goldman Sachs, Jefferies, Loop Capital Markets, Ramirez & Co., RBC Capital Markets and Siebert Cisneros Shank & Co. serving as co-senior managers.

TFA also sold $300 million of taxable fixed rate bonds, comprised of two subseries, via competitive bid. The first subseries of about $134 million of bonds due 2025 to 2028 attracted nine bidders, with Goldman Sachs winning the deal with a true interest cost of 3.537%. The second subseries of around $166 million, due 2029 to 2032 attracted eight bidders, with Barclays Capital winning the deal with a TIC of 3.888%.

Proceeds from the bond sale will be used to fund capital projects.

Thursday’s bond deals

Colorado

South Carolina

New York

Treasury auctions $30B 7-year notes

The Treasury Department Thursday auctioned $30 billion of seven-year notes, with a 2 7/8% coupon and a 2.930% high yield, a price of 99.654192. The bid-to-cover ratio was 2.49.

Tenders at the high yield were allotted 58.91%. All competitive tenders at lower yields were accepted in full. The median yield was 2.870%. The low yield was 2.820%.

Treasury to sell discount bills

The Treasury Department said Thursday it will auction $51 billion 91-day bills and $45 billion 182-day discount bills Monday.

The 91s settle Aug. 2, and are due Nov. 1, and the 181s settle Aug. 2, and are due Jan. 31, 2019. Currently, there are $41.996 billion 91-days outstanding and $19.995 billion 182s.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.