By the end of 2007, investors recognized the relationship between municipal bond yields and Treasury yields did not mean what it used to.

What was once the predominant benchmark for valuing munis has lost much of its sheen.

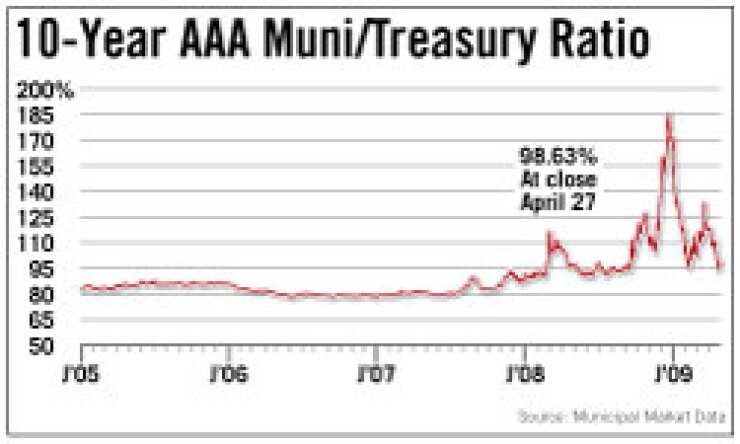

For the 20 years ending in 2007, the yield on 10-year triple-A munis averaged around 80% of the yield on 10-year Treasuries, according to Municipal Market Data.

The ratio stayed within a band of roughly 75% to 90% most of the time.

Investors would use this ratio to decide whether to buy or sell munis, gauging cheapness or richness based on muni yields' relativity to Treasury yields. The credit crisis torpedoed this relationship. The flight to safety shoved down yields on Treasuries and for a time pushed up yields on munis, distorting a ratio that was once the bedrock of a staid asset class.

Once-unthinkable ratios persisted throughout 2008, at one point reaching as high as 186.1%.

While the ratio has since subsided - the 10-year triple-A yielded 95.7% of the 10-year Treasury at yesterday's close, according to MMD - it remains elevated by historical standards.

At Tuesday's close, the 10-year triple-A yielded 2.89%, while the 10-year Treasury yielded 3.02%. An investor in the 35% tax bracket who purchased the 10-year Treasury would pocket a yield of 1.96% after paying taxes. After accounting for taxes, the tax-free muni yield is almost one-and-a-half times the Treasury yield.

Some market participants say they are waiting for the relationship to return to normal. Some have adjusted how they interpret the number, changing their perception of "normal." Others have moved along entirely.

CAST BY THE WAYSIDE

One camp no longer even bothers to check the number sometimes.

"We're completely detached from the Treasury," said Terry O'Grady, who heads trading at FMSbonds Inc. in Florida. "I haven't watched the Treasury as far as it relates to municipals in over a year. ... Occasionally someone will mention it, and then it's good for a belly laugh. We know it's just a ludicrous statement."

If ignoring the once-standard benchmark in the industry seems extreme, consider how aberrant the relationship has been for more than a year.

Based on weekly data from MMD, from 1987 through 2007 the correlation between muni yields and Treasury yields was 0.99 (with 1 being absolute correlation - moving in the same direction by the same magnitude).

Since the beginning of 2008, the correlation on a weekly basis has been 0.37, meaning closer to randomness than to correlation. In 2008, the correlation between the two yields on a weekly basis was negative, meaning a move for one more often meant a move in the opposite direction for the other.

O'Grady said he would reconsider the muni-Treasury ratio if the two yields show correlation again for a few weeks. That has not happened yet.

On a daily basis, the correlation so far in 2009 has been negative. By comparison, the correlation on a daily basis was 0.91 in 2006 and 0.95 in 2005.

Further, the extent to which the ratio distended was stunning. At its peak last year, the ratio was 12 standard deviations from the mean.

"I used to look on my Bloomberg at the Treasury page numerous times during the day," said Fred Yosca, head of trading at BNY Capital Markets. "There are days here where I go home at night not even sure what Treasuries did on the day."

THE MODERATE VIEW

Another camp holds the ratio is still meaningful - it just has a different meaning.

The traditional level of the muni-Treasury ratio reflected the competing attributes of Treasuries and munis.

Treasuries offered unassailable preservation of principal and liquidity, at a taxable rate. Munis offered mostly stellar credit quality at a tax-exempt rate, with relatively poor liquidity.

For decades, the market settled on muni rates a little lower than Treasury rates. This meant the tax exemption for munis was considered a bit more valuable than the credit safety and liquidity of Treasuries.

Treasury yields plummeted last year during a worldwide flight to safety. This has pushed up the yields on munis relative to Treasuries.

Josh Gonze, a portfolio manager at Thornburg Investment Management, has recalibrated his perception of what a normal ratio should look like.

A ratio at 100% would have signaled an unrivaled buying opportunity two years ago. Now, Gonze said, it means investors have placed greater value on the shelter of Treasuries.

"Now we think that munis are expensive if they yield less than 100% and cheap if they yield more than 125% of Treasuries," he said, stressing that these are not hard-and-fast numbers. "The old 80% is today's 100%."

Richard Ciccarone, chief research officer at McDonnell Investment Management in Oak Brook, Ill., said this is not the first time the muni market has adjusted to new benchmarks.

Investors used to give more weight to the 30-year triple-A versus the 30-year Treasury, he said. After the Treasury stopped auctioning 30-year paper, investors shifted to comparisons with 10-year bonds, he said.

Depending how much support the federal government offers municipalities, Ciccarone said some investors are pushing to compare munis with agency bonds, like federally guaranteed housing bonds from Fannie Mae or Freddie Mac. He does not agree that this is an appropriate basis of comparison yet.

Ciccarone, who said he expects the muni-Treasury ratio to revert eventually, said investors also should compare munis to taxable-equivalent corporate bond yields.

WAITING FOR NORMALCY

Joseph Mowrer, a portfolio manager for Karpus Investment Management, said he still thinks it is abnormal for a tax-free muni rate to be higher than a taxable Treasury rate.

While he said the muni-to-corporate ratio is gaining traction, he still infers value in munis when he looks at the current level of the muni-Treasury ratio.

Buck Stevenson, who manages high-yield munis at Silvercrest Asset Management in New York, said he still expects the ratio to return to normal over time. This is a somewhat bolder statement for high-yield munis than for top-notch paper.

Baa-rated munis at the 10-year point of the MMD yield curve scale still yield twice as much as their counterpart Treasuries. Yields on Treasuries and Baa-rated munis roughly matched for several decades.

"I look at it less, but you still have to pay attention to it," Stevenson said.