Municipal bond traders will be eyeing rising yields on Thursday as they prepare for the last of the week's large deals to hit the screens.

Secondary Market

U.S. Treasuries were weaker on Thursday. The yield on the two-year Treasury rose to 1.14% from 1.11% on Wednesday, the 10-year Treasury gained to 2.43% from 2.37%, while the yield on the 30-year Treasury bond increased to 3.09% from 3.01%.

Top-shelf municipal bonds finished substantially weaker on Wednesday. The yield on the 10-year benchmark muni general obligation rose seven basis points to 2.52% from 2.45% on Tuesday, while the yield on the 30-year increased 10 basis points to 3.26% from 3.16%, according to the final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 106.9% compared to 106.5% on Tuesday while the 30-year muni to Treasury ratio stood at 108.2% versus 107.2%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 56,840 trades on Wednesday on volume of $15.11 billion.

Primary Market

Morgan Stanley is expected to price the Alabama Economic Settlement Authority's $546.94 million of Series 2016B taxable BP settlement revenue bonds on Thursday.

The deal is rated A2 by Moody's Investors Service and A-minus by S&P Global Ratings.

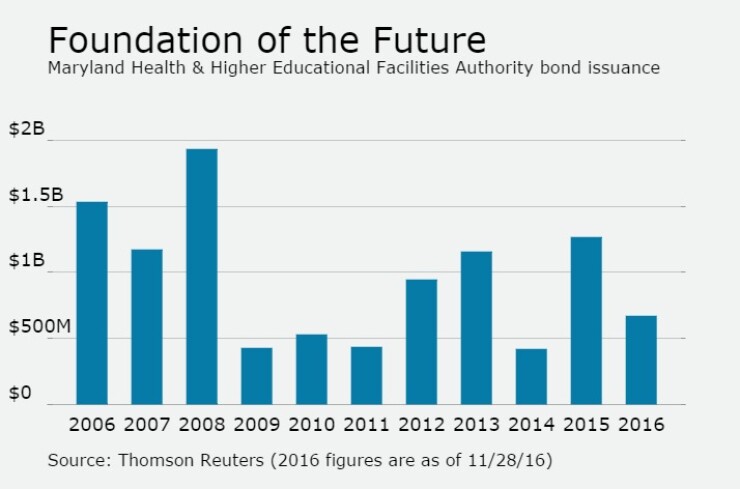

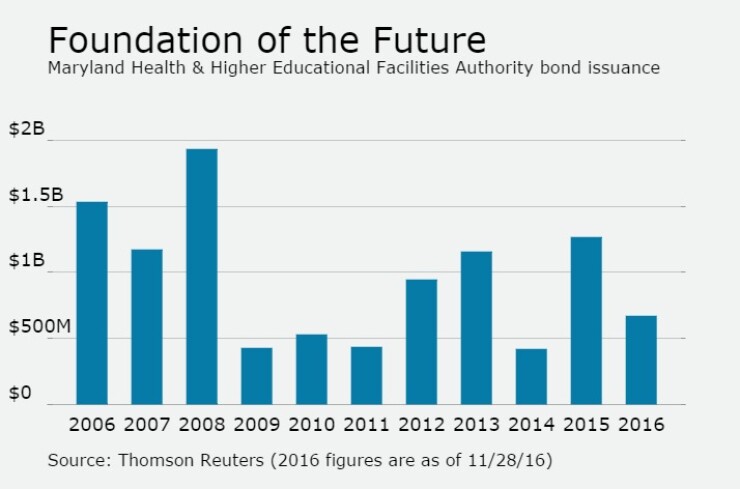

Ziegler is set to price the Maryland Health and Higher Educational Facilities Authority's $269.75 million of Series 2016A revenue bonds for Adventist Healthcare. The deal is rated Baa3 by Moody's.

Since 2006, the Maryland HHEFA has sold roughly $10.5 billion of securities, with the largest issuance occurring in 2008, when it sold $1.9 billion. Its lightest year was 2014, when the authority issued $424 million.

RBC Capital Markets is expected to price the Folsom Cordova Unified School District, Calif.'s $118 million of general obligation bonds in three series, SFID Nos. 3, 4 and 5.

In the competitive arena, Texas is selling $157.14 million of Series 2016 general obligation college student loan bonds, subject to the alternative minimum tax. The deal is rated triple-A by Moody's and S&P.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $4.99 billion to $12.28 billion on Thursday. The total is comprised of $4.01 billion of competitive sales and $8.27 billion of negotiated deals.

Tax-Exempt Money Market Fund Inflows

Tax-exempt money market funds experienced inflows of $54.8 million, bringing total net assets to $130.09 billion in the week ended Nov. 28, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $447.0 million to $130.04 billion in the previous week.

The average, seven-day simple yield for the 237 weekly reporting tax-exempt funds was unchanged at 0.16% from previous week.

The total net assets of the 867 weekly reporting taxable money funds increased $20.59 billion to $2.568 trillion in the week ended Nov. 29, after an inflow of $23.02 billion to $2.547 trillion the week before.

The average, seven-day simple yield for the taxable money funds was steady at 0.15% from the previous week.

Overall, the combined total net assets of the 1,104 weekly reporting money funds rose $20.64 billion to $2.698 trillion in the week ended Nov. 29 after inflows of $23.46 billion to $2.677 trillion in the prior week.