Municipal bond traders will be looking at next week’s new issue calendar as they ponder the ramifications from Friday’s mixed employment report for May.

The Labor Department reported that non-farm payrolls rose 138,000 in May, less that the 185,000 gain expected by economists polled by IFR Markets.

However, the unemployment rate dropped to 4.3% last month from 4.4% in April, its lowest level since May 2001. Economists survey by IFR Markets had expected the jobless rate to remain steady.

Secondary market

U.S. Treasuries were stronger after the jobs report. The yield on the two-year Treasury dipped to 1.28% from 1.29% on Thursday as the 10-year Treasury yield dropped to 2.17% from 2.21% while the yield on the 30-year Treasury bond decreased to 2.83% from 2.87%.

Municipal bonds finished mixed on Wednesday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.90% on Wednesday, while the 30-year GO yield rose one basis point to 2.75% from 2.74%, according to the final read of Municipal Market Data's triple-A scale.

On Thursday, the 10-year muni to Treasury ratio was calculated at 85.8%, compared with 92.5% on Wednesday, while the 30-year muni to Treasury ratio stood at 95.8% versus 95.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 46,687 trades on Thursday on volume of $14.40 billion.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended June 2 were from Iowa, Maryland and Illinois issuers, according to

In the GO bond sector, the Coralville, Iowa, 4s of 2037 were traded 20 times. In the revenue bond sector, the Baltimore, Md., Convention Center 5s of 2046 were traded 46 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 41 times.

Week's actively quoted issues

Illinois, New York and California names were among the most actively quoted bonds in the week ended June 2, according to Markit.

On the bid side, the Illinois taxable 5.1s of 2033 were quoted by 52 unique dealers. On the ask side, the New York Hudson Yards Infrastructure Corp. revenue 4s of 2036 were quoted by 226 unique dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 22 unique dealers.

Week’s primary market

Morgan Stanley priced Connecticut’s $355.22 million of state revolving fund general revenue bonds consisting of $250 million of Series 2017A SRF green bonds and $105.22 million of Series 2017B refunding bonds.

The deal is rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

Barclays Capital priced the Connecticut Health and Educational Facilities Authority’s $224.2 million of Series 2017B revenue bonds for Yale University. The deal is rated triple-A by Moody’s and S&P.

JPMorgan Securities priced the Colorado High Performance Transportation Enterprise’s $165.5 million of Series 2017 C-470 express lane senior revenue bonds. The deal is rated BBB by Fitch and has a provisional BBB rating from DBRS.

Bank of America Merrill Lynch priced the Louisiana Local Government Environmental Facilities and Community Development Authority’s $249.09 million of Series 2017A tax-exempt and Series 2017B taxable hospital refunding revenue bonds for the Women’s Hospital Foundation. The deal is rated A2 by Moody’s and A by S&P.

Piper Jaffray priced the Austin Independent School District, Texas’ $219.36 million of Series 2017 unlimited tax school building and refunding bonds. The deal, which is backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and Fitch.

Morgan Stanley priced the Northampton County General Purpose Authority, Pa.’s $136.65 million of refunding and revenue bonds for Lafayette College. The deal is rated Aa3 by Moody’s and A-plus by S&P.

Citigroup priced Clark County, Nev.’s $146.3 million of Series 2017C airport system junior subordinate lien revenue bonds, subject to the alternative minimum tax. The deal is rated A1 by Moody’s and A-plus by S&P.

Citi priced the Houston Independent School District’s $149.96 million of variable rate limited tax schoolhouse bonds, Series 2014A-2. The deal is backed by the Permanent School Fund Guarantee Program and rated triple-A by Moody’s and S&P.

BAML priced the Build NYC Resource Corp.’s $90.58 million of Series 2017 revenue bonds for Manhattan College. The deal is rated A-minus by S&P and Fitch.

In the competitive arena, Arlington County, Va., sold $185.1 million of Series 2017 general obligation public improvement bonds. JPMorgan Securities won the bonds with a true interest cost of 2.496%. The deal is rated triple-A by Moody’s, S&P and Fitch.

Loudoun County, Va., sold $108.13 million of Series 2017A general obligation public improvement bonds. JPMorgan won the bonds with a true interest cost of 2.45%. The deal is rated triple-A by Moody’s, S&P and Fitch.

Nassau County, N.Y., competitively sold $90.08 million of Series 2017B general improvement bonds. Citigroup won the bonds with a TIC of 3.19%. The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch. JPMorgan won the county’s $45 million of Series 2017A bond anticipation notes with a bid of 1.56% and a $5,400 premium, an effective rate of 1.552015%. The BANs are rated SP1-plus by S&P and A1-plus by Fitch.

Boston sold $59.31 million of Series 2017B general obligation refunding bonds. BAML won the bonds with a TIC of 1.40%. The deal is rated triple-A by Moody’s and S&P.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $660.1 million to $11.75 billion on Friday. The total is comprised of $4.81 billion of competitive sales and $6.94 billion of negotiated deals.

Lipper: Muni bond funds see outflows

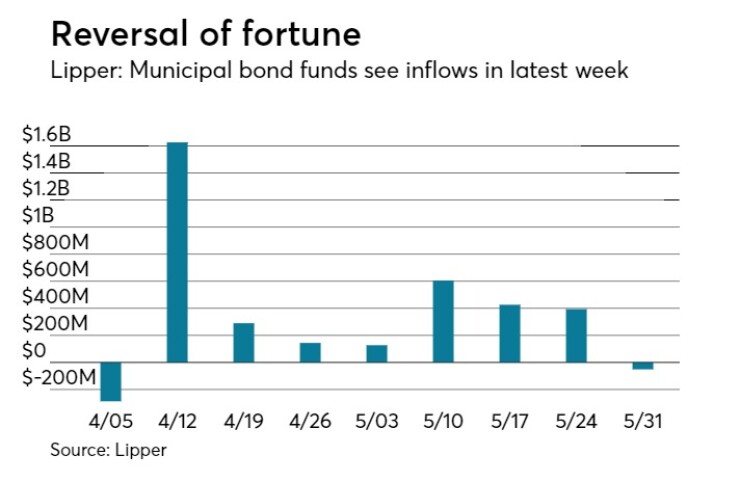

Investors in municipal bond funds changed course and took their cash out of the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $50.837 million of outflows in the week ended May 31, after inflows of $394.498 million in the previous week.

The four-week moving average was in the green at positive $344.028 million, after being positive at $388.683 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had outflows, losing $106.029 million in the latest week after rising $238.275 million in the previous week. Intermediate-term funds had outflows of $96.676 million after inflows of $8.640 million in the prior week.

National funds had inflows of $77.134 million after inflows of $447.135 million in the previous week. High-yield muni funds reported outflows of $7.485 million in the latest reporting week, after inflows of $171.583 million the previous week.

Exchange traded funds saw inflows of $64.657 million, after inflows of $50.978 million in the previous week.