New issues dominated the municipal market Thursday as investors swarmed to large and attractively priced new issues, according to Bill Walsh, president of Hennion & Walsh.

“Demand in the secondary market has been relatively slow,” he said. “The focus has been on the numerous new issues that have been coming to market.”

Walsh mentioned the New York State Thruway Authority deal as an actively sought-after deal based on its yields.

“It had some big cuts on the long end, which makes them attractive,” he said.

Over the past few weeks the market has been volatile, but he noted that quality issues are still holding at or near all-time-high prices. “We see this trend continuing through year-end,” he said.

Primary market

Goldman Sachs priced and repriced the New York State Thruway Authority’s (A2/A-/NR/NAF) $1.69 billion of Series 2019B tax-exempt general revenue junior indebtedness obligations. Assured Guaranty Municipal insured $72.235 million of the 2040 maturity, $65 million of a 2045 maturity, $7 million of a 2046 maturity, $80 million of a 2050 maturity and $137.95 million of a 2053 maturity.

Siebert Cisneros Shank is a lead manager with Barclays Capital, Citigroup, JPMorgan Securities, Morgan Stanley, RBC Capital Markets, Academy Securities, Drexel Hamilton, BofA Securities, Loop Capital Markets, Jefferies, Raymond James & Associates, Oppenheimer & Co. and Roosevelt & Cross as co-managers. PRAG and Acacia financial Group are the financial advisors. Hawkins Delafield & Wood is the bond counsel.

Citigroup priced the NYS Thruway’s $857.625 million of taxable Series M (A1/A/NAF/NAF) general revenue bonds.

Citi also priced San Antonio, Texas’ (Aa2/AA-AA+/NR) $261.85 million of electric and gas systems junior lien revenue refunding bonds.

RBC Capital Markets priced the Arlington Higher Education Finance Corp., Texas’ (PSF: NR/AAA/NR/NR) $106.185 million of education revenue bonds for Kipp Texas Inc.

Goldman priced the school district of Philadelphia’s (MIG1/NR/F1+/NR) $347.08 million of Series C of 2019-2020 tax and revenue anticipation notes. On Wednesday, BofA Securities priced the school district’s $481.08 million of GOs and also priced the State Public School Building Authority’s $187.73 million of school lease revenue refunding bonds for the school district.

Ramirez & Co. received the written award on the New York State Housing Finance Agency’s (Aa2/NR/NR/NR) $100.92 million of affordable housing revenue bonds, Series 2019N Climate Bond Certified/Sustainability Bonds and Series 2019O sustainability bonds.

In the competitive arena, the Board of Water Works of the Louisville/Jefferson County Metro Government, Ky., (Aaa/AAA/NR/NR) sold $155.54 million of Series 2019 Louisville Water Co. water system revenue and refunding revenue bonds. Citi won the issue with a TIC of 2.2315%.

Raymond James & Associates was the financial advisor. Stites & Harbison was the bond counsel. Proceeds will finance the Series 2019 Project, partially fund the bond fund reserve account and currently refund outstanding Series 2009 bonds.

Charleston County, S.C., (Aaa/AAA/AAA) sold $111.475 million of Series 2019B GOs. Morgan Stanley won the issue with a TIC of 2.24%. First Tryon Advisors was the financial advisor. Howell Linkous was the bond counsel. Proceeds will be used for capital improvements to various county buildings.

Citi received the award on the $100.345 million of King County, Wash., (Aaa/AAA/NR) Series 2019 limited tax GOs payable from sewer revenues that were sold on Wednesday.

Thursday’s bond sales

Calif. Treasurer details bond sale results

California State Treasurer Fiona Ma announced the results of the state’s sale Wednesday of $1.14 billion of

The $457.4 million of refunding bonds attracted bids from 10 broker-dealers with Morgan Stanley submitting the winning bid with a true interest cost of 2.39%.

Proceeds will be used to refund $300 million of outstanding variable rate GOs to effect a favorable reorganization of the debt structure of the state and to current refund $164.23 million of outstanding fixed-rate GOs for debt service savings.

The bonds issued for debt service savings will save taxpayers $37.8 million over the next 20 years, or $31.6 million on a present value basis. The refunded bonds were originally issued in 2009 and 2017.

Since Ma took office in January 2019, the state has issued $5.8 billion of refunding GO bonds that are expected to save taxpayers more than $2.1 billion over the next 20 years, or $1.7 billion on a present value basis.

"I am excited to be in a position to save Californians money and implement the will of the voters," Ma said.

The $680.13 million of bonds for voter-approved projects and programs attracted bids from 11 broker-dealers with the winning bid submitted by BofA Securities with a TIC of 2.359%, Ma said.

Proceeds will fund the Safe, Reliable High-Speed Passenger Train Bond Act for the 21st Century (2008) and the California Stem Cell Research and Cures Bond Act of 2004, and provide funds to pay down certain outstanding GO commercial paper notes that provided interim financing for 14 bond acts approved by voters between 2000 and 2018, the Treasurer’s Office said.

Secondary market

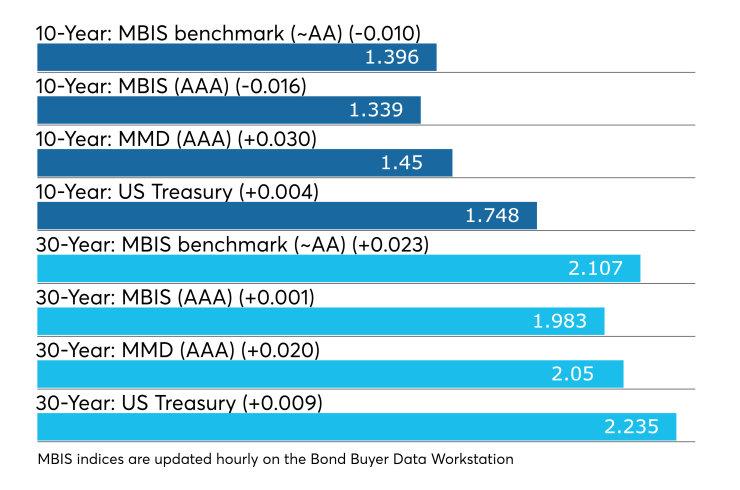

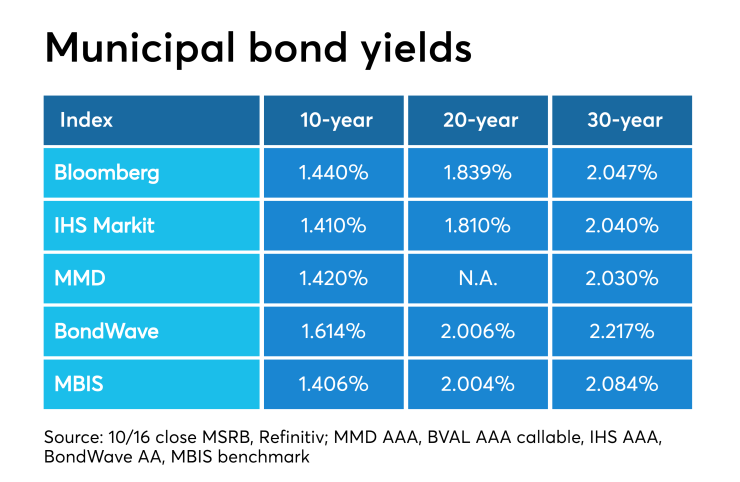

Munis were mixed on the MBIS benchmark scale, with yields falling one basis point in the 10-year maturity and rising two basis points in the 30-year maturity. High-grades were mixed, with yields on MBIS AAA scale falling one basis point in the 10-year maturity and rising by less than a basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO rose three basis points to 1.45% while the 30-year rose two basis points to 2.05%.

“The ICE muni yield curve is two to three basis points higher in a quiet secondary market. Reports indicate that activity is concentrated in the shorter end,” ICE Data Services said in a market comment. “High-yield is one basis point higher along with tobaccos. Taxables are unchanged.”

The 10-year muni-to-Treasury ratio was calculated at 82.6% while the 30-year muni-to-Treasury ratio stood at 91.5%, according to MMD.

Stocks and Treasuries were little changed. The Treasury three-month was yielding 1.672%, the two-year was yielding 1.586%, the five-year was yielding 1.569%, the 10-year was yielding 1.748% and the 30-year was yielding 2.235%.

Previous session's activity

The MSRB reported 33,320 trades Wednesday on volume of $9.85 billion. The 30-day average trade summary showed on a par amount basis of $10.89 million that customers bought $5.91 million, customers sold $3.11 million and interdealer trades totaled $1.87 million.

California, Texas and New York were most traded, with Golden State taking 18.001% of the market, the Lone Star State taking 11.304% and the Empire State taking 10.032%.

The most actively traded securities were the Chicago Series 2014 GO 6.314s of 2044, which traded nine times on volume of $43 million. The bonds, which were originally priced at par, traded at a high price of 129.923 cents on the dollar.

Bond Buyer yield indexes move higher

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 3.59% for the week ended Oct.17 from 3.55% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was higher by 11 basis points to 2.70% from 2.59% from the week before. The 11-bond GO Index of higher-grade 11-year GOs also gained 11 basis points, to 2.24% from 2.13% the prior week. The Bond Buyer's Revenue Bond Index increased 11 basis points to 3.18% from 3.07% last week.

The yield on the U.S. Treasury's 10-year note rose to 1.76% from 1.66% the week before, while the yield on the 30-year Treasury increased to 2.24% from 2.15%.

Muni money market funds see inflows

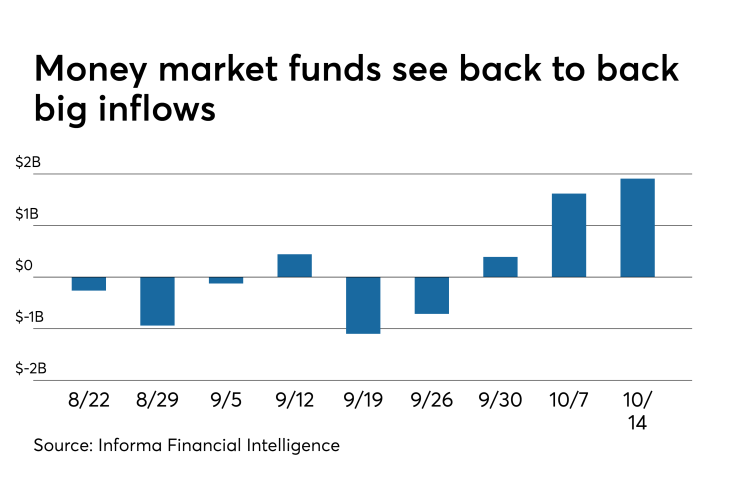

Tax-exempt municipal money market fund assets gained $1.91 billion, raising total net assets to $137.18 billion in the week ended Oct. 14, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 191 tax-free and municipal money-market funds fell to 0.99% from 1.06% from the previous week.

Taxable money-fund assets were down $7.63 billion in the week ended Oct. 15, bringing total net assets to $3.282 trillion. The average, seven-day simple yield for the 807 taxable reporting funds slipped to 1.54% from 1.56% in the prior week.

Overall, the combined total net assets of the 998 reporting money funds decreased $5.72 billion to $3.419 trillion in the week ended Oct. 15.

Treasury auctions announced

The Treasury Department announced these auctions:

- $32 billion seven-year notes selling on Oct. 24;

- $41 billion five-year notes selling on Oct. 23;

- $40 billion two-year notes selling on Oct. 22;

- $20 billion two-year floating rate notes selling on Oct. 23;

- $42 billion 182-day bills selling on Oct. 21; and

- $45 billion 91-day bills selling on Oct. 21.

Treasury auctions bills

The Treasury Department Thursday auctioned $55 billion of four-week bills at a 1.720% high yield, a price of 99.866222. The coupon equivalent was 1.751%. The bid-to-cover ratio was 2.50. Tenders at the high rate were allotted 43.28%. The median rate was 1.685%. The low rate was 1.650%.

Treasury also auctioned $40 billion of eight-week bills at a 1.665% high yield, a price of 99.741000. The coupon equivalent was 1.697%. The bid-to-cover ratio was 2.99. Tenders at the high rate were allotted 11.47%. The median rate was 1.640%. The low rate was 1.610%.

Additionally, Treasury sold $17 billion of five-year inflation-indexed notes with a 1/8% coupon, at a 0.054% high yield, an adjusted price of 100.348367. The bid-to-cover ratio was 2.75. Tenders at the high yield were allotted 87.48%. All competitive tenders at lower yields were accepted in full. The median yield was 0.015%. The low yield was zero.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.