Municipal bond traders are waiting to see the institutional pricing of the big DASNY deal as a host of other offerings hit the market on Wednesday.

Secondary market

Treasuries were narrowly mixed on Wednesday. The yield on the two-year Treasury fell to 1.35% from 1.37% on Tuesday, the 10-year Treasury yield rose to 2.21% from 2.20% and the yield on the 30-year Treasury bond increased to 2.76% from 2.74%.

Top-quality municipal bonds ended weaker on Tuesday. The yield on the 10-year benchmark muni general obligation rose three basis points to 1.88% from 1.85% on Monday, while the 30-year GO yield increased three basis points to 2.70% from 2.67%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 85.6% on Tuesday, compared with 86.7% on Monday, while the 30-year muni to Treasury ratio stood at 98.5% versus 99.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 44,053 trades on Tuesday on volume of $9.10 billion.

Primary market

Morgan Stanley is set to price the Dormitory Authority of the State of New York’s $1.75 billion of Series 2017A general purpose state personal income tax revenue bonds for institutional investors after holding a one-day retail order period.

On Tuesday, the issue was priced for retail to yield from 0.97% with a 2% coupon in 2019 to approximately 3.345% with a 3.25% coupon in 2040. The 2018 maturity was offered as a sealed bid.

The deal is rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings.

Also in the New York region, Citigroup is expected to price the New York Metropolitan Transportation Authority’s $500 million of climate bond certified Series 2017B transportation revenue green bonds for retail investors ahead of the institutional pricing on Thursday.

The deal is rated A1 by Moody’s and AA-minus by S&P and Fitch Ratings

On the other coast, Goldman Sachs is set to price the Los Angeles Department of Water & Power’s Series 2017C power system revenue bonds for retail investors ahead of the institutional pricing on Thursday.

The deal is rated Aa2 by Moody’s and AA-minus by S&P and Fitch.

Elsewhere, Raymond James is expected to price the Comal Independent School District, Texas’ $263.5 million of unlimited tax school building bonds.

The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and Fitch.

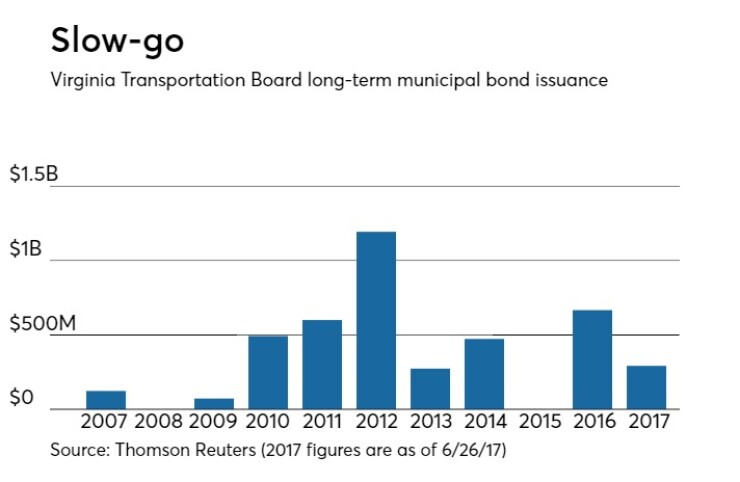

In the competitive arena on Wednesday, the Virginia Transportation Board is selling $255.41 million of Series 2017 transportation capital projects revenue bonds.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Since 2007 the board has sold about $4.19 billion of securities, with the highest issuance in 2012 when it sold roughly $1.19 billion. It did not come to market at all in 2008 or 2015.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.3 billion to $7.24 billion on Wednesday. The total is comprised of $1.44 billion of competitive sales and $5.80 billion of negotiated deals.