Moody’s Investors Service has placed its Aa1 rating on the Massachusetts Bay Transportation Authority’s senior sales tax bonds on review for possible downgrade, affecting roughly $3.8 billion in debt.

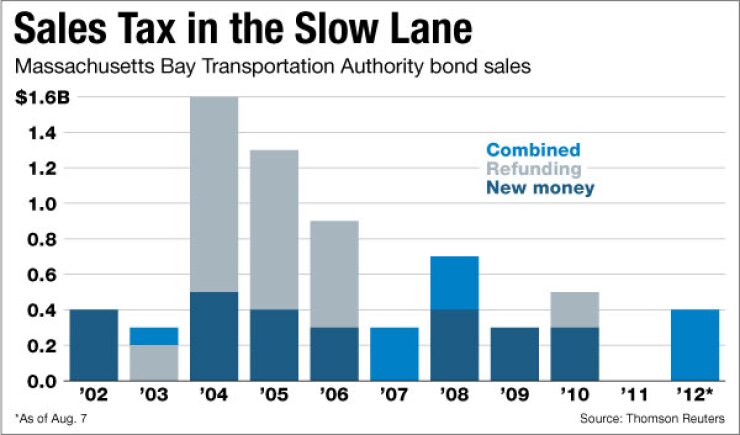

Moody’s cited lack of sales-tax growth. It said the MBTA, which oversees Greater Boston’s transportation system, should implement a debt-service improvement plan and mitigate its exposure to variable-rate debt to avoid a downgrade.

“The action reflects reduced debt service coverage due to cumulative sales tax underperformance over the past decade; a complex variable rate debt and swap portfolio combined with modest liquidity; heightened risk in the variable rate portfolio related to liquidity facilities with banks that have been downgraded recently; and strained financial operations,” Moody’s said in a statement late Tuesday.

The rating agency expects to complete its review within 90 days.

“This warning from Moody’s is a reflection of the MBTA’s strained financial situation. The administration and legislative leaders are committed to addressing this and other transportation funding needs in the coming year,” the Massachusetts Department of Transportation, which oversees the MBTA, said in a statement.

Moody’s warned about one-time actions such as debt restructurings and deficit financings to lower debt-service costs for budget relief.

In June, the authority plugged its latest gap with a $51 million under-the-radar revenue surplus from a motor-vehicle inspection sticker fee fund, and about $1.5 million of unused snow-removal money.

The MBTA, the nation’s oldest transportation system,

Senior sales tax bonds are secured by a first claim, before transit operations, on 1% of the first 5% of statewide sales tax allocated from the commonwealth’s existing sales tax. The state raised the sales tax to 6.25% from 5% in 2009. The bonds also have a subordinate lien on assessment revenues -- which Moody’s rates Aa1 with a stable outlook -- that 175 cities and towns within the MBTA’s authority pay.

Moody’s called the guaranteed sales-tax floor a credit strength because it insulates the authority from sales-tax fluctuations; it also called the 23% fare increase, which took effect July 1, a stabilizing factor.

Standard & Poor’s rates those sales-tax bonds AAA, with a stable outlook.