SAN FRANCISCO -Moody's Investors Service Monday upgraded San Francisco's general obligation credit to Aa2 from Aa3 as the city prepares to sell $43 million of GOs for its parks system.

"The upgrade primarily reflects the decade-long, and likely continuing, steady upward trend in the city's assessed valuation; the relative mildness of the current economic downturn, which demonstrates the city's fundamental economic strength and resilience; and the city's now-improved prospects for reduced fiscal volatility," Moody's analyst Eric Hoffmann said in a report. The upgrade affects $1.9 billion of outstanding debt.

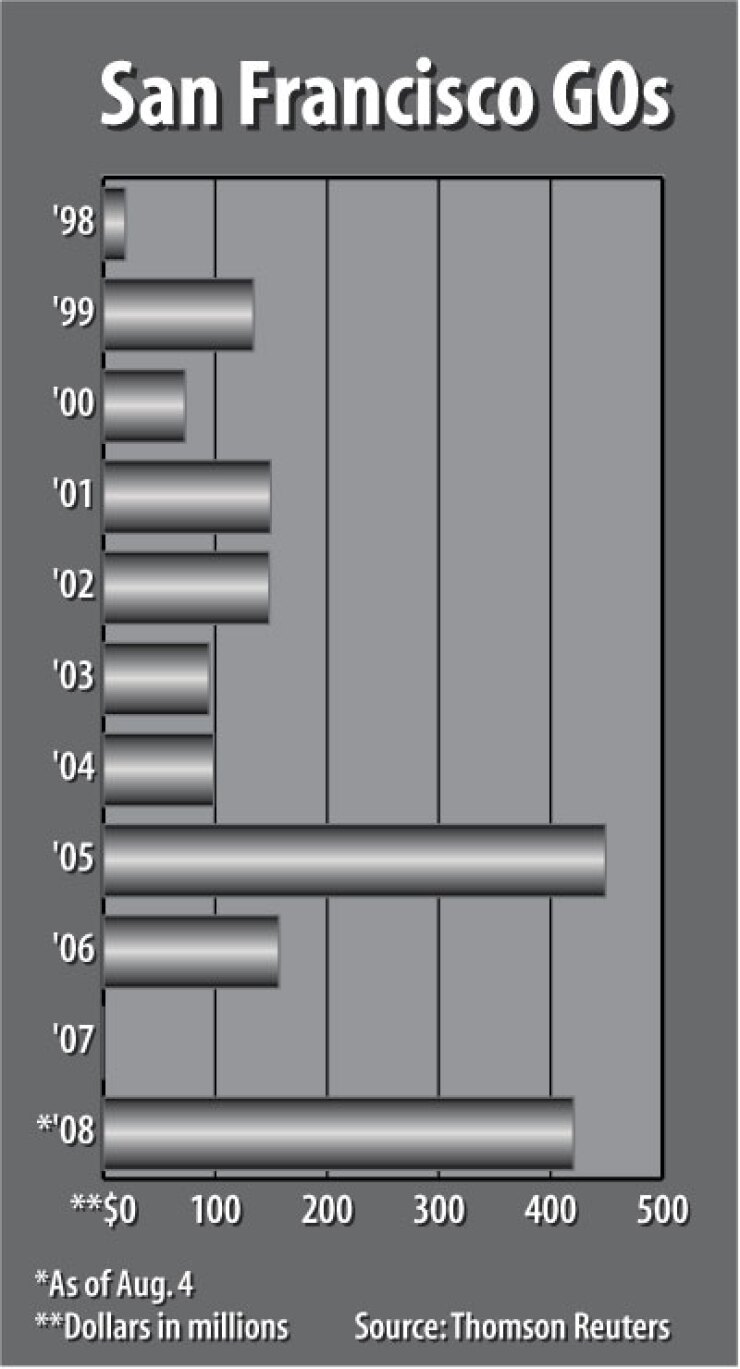

San Francisco - which is both a city and a county - plans to sell $43 million of GOs competitively on Aug. 14, said Nadia Sesay, director of the Office of Public Finance. The bonds will mature over 20 years. They are the first of $185 million of bonds voters approved in June to renovate the city's crumbling park infrastructure.

San Francisco, California's fourth-largest city, has not been hit as hard as many other municipalities by the housing bust, Moody's said. Even though the real estate market has softened, the city - with its traditional aversion to development and already densely built landscape - has no swathes of new homes sitting vacant, and tourism, its biggest industry, is getting a boost as the weak dollar increases international travel.

"With continued recent employment growth in the San Francisco metro area, particularly in business services and technology industries, and a robust international tourism sector in the city, San Francisco has largely escaped the effects of the current national and state economic downturns," Moody's said, citing continued growth in economically sensitive revenues like sales, business, and hotel taxes.

The city's total assessed valuation more than doubled over the past decade, rising at a "relatively steady and moderate" pace to $136 billion from $62 billion, Moody's said.

"None if any of these gains appear likely to be reversed, despite the slowing real estate market," Hoffmann said.

The city has also begun to address its chronic lack of reserves. Its balance sheet was "exceptionally strong" compared to past years at the end of fiscal 2007, Moody's said.

San Francisco voters approved the creation of a new rainy-day fund in 2003. The fund captures a portion of revenue growth in boom years, when revenues grow more than 5%, as they did in 2006 and 2007. The city's unreserved fund balance was 5.2% at the end of fiscal 2007, compared to 16.2% for other large, Aa2-rated cities, Moody's said.

The city has also moved to limit future increases in its $4 billion unfunded liability for retiree health care with voters approving a charter amendment in June that would stop the growth of the liability by offering new workers less generous retirement benefits. The city has not yet decided how to deal with the accrued liability.

San Francisco has some room to maneuver in the face of such large liabilities because it has high wealth and low poverty levels. Median household incomes were 135% of the national average in 2006, according to the Census Bureau, and only 6.8% of the city's families lived in poverty, compared to 9.8% nationally.

The city is rated AA by Standard & Poor's and AA-minus by Fitch Ratings.