BRADENTON, Fla. - The Miami-Dade County Expressway Authority plans to price $340 million of new money toll revenue bonds June 3 and 4, as analysts see value in the toll-road sector amid the lack of supply.

Bond proceeds will go toward $880 million of system improvements in the five-year work program, and include the final conversion of the authority's remaining system to open-road tolling, which is expected to boost revenues significantly.

Other projects being financed include expressway connections and extensions, managed lane and widening projects, and intelligent transportation systems improvements, among others.

Retail orders will be taken Tuesday, followed by institutional sales on Wednesday.

The negotiated deal is expected to have maturities between 2020 and 2044, and will be structured with capitalized interest for one year and level debt service after a construction period.

The deal by its very nature could tempt investors. The toll road sector is one area where long-dated bonds continue to offer value "despite partaking in the sustained rally across the fixed income landscape," said a Citi Research report May 23.

"Highly rated toll road bonds backed by large metropolitan areas have richened fairly drastically with the rest of the high grade municipal sector, and while there is no doubt that these bonds aren't exactly suitable for investors looking for yield pick-up, we still consider them cheap versus high grade bonds in essential service categories such as gas, power and electric utilities," Citi analysts said.

The Expressway Authority expects "strong interest" in the deal from investors, with about $30 million in sales from the retail sector, said Chief Financial Officer Marie Schafer.

"The financing plan reflects strong coverage," she said.

Senior debt service coverage for the Miami-Dade bonds is projected to be 1.58 times in the current fiscal year and 2.07 times in fiscal 2015 before dropping to 1.88 times in 2016. Thereafter, coverage gradually rises annually to 1.98 times in 2025.

The authority plans to implement toll rates based on the consumer price index in fiscal 2018, though that plan could be deferred three years. If inflation-based toll increases are employed, coverage levels are projected to be 1.84 times in 2018 then steadily rise to 2.47 times in 2025, according to bond documents.

"The authority will be taking a major step in the upcoming months by completing the final stage of converting all of its expressways to open-road tolling or all electronic," she said. "This means everyone will pay a toll based upon how much of the expressway they drive."

Open-road tolling, or cashless collections, will provide additional funding for infrastructure and ensure that all drivers pay their share of tolls, Schafer said.

The bonds are rated A-minus by Fitch Ratings and Standard & Poor's, and A3 by Moody's Investors Service. All three affirmed their ratings and stable outlooks on $1.25 billion of outstanding bonds.

The Miami-Dade Expressway Authority is a mature system serving a critical need in south Florida, rating agency analysts said in reviewing the upcoming transaction.

The primary system consists of five expressways covering 33.6 miles.

In their sector report, the City analysts said toll revenue bonds offer a "strong defensive play against a darkening of the municipal credit landscape," cautioning investors to consider risks such as toll roads that are not threatened by freeways.

In Miami-Dade, "limited alternative routes enhance the importance of the system to the region," said Fitch analyst Daniel Adelman. The expressways have a stable commuter base and account for more than 237 million in annual toll transactions, he added.

Moody's said its rating reflects strong management oversight and a board policy of maintaining an annual senior debt service coverage ratio of 1.5 times, which is higher than the 1.2 times rate covenant requirement. The authority also has strong liquidity compared to other A-rated toll roads at 1,739 days cash on hand.

"We also note possible traffic diversion and revenue collection risks associated with implementation of open road tolling and video tolling, or toll-by-plate, which represented 11.4% of transactions in fiscal 2013, though these risks are mitigated by new processing and enforcement systems by a proven vendor since October 2013," said Moody's analyst Maria Matesanz.

The rating also considers an ongoing legal dispute with a prior vendor, Electronic Transaction Consultants Corp., which was hired in 2009 to design, implement and manage open-road tolling and enforcement, she said.

"The dispute could have some negative financial implications, though the court has ruled in the authority's favor thus far and the authority has now transitioned to a new processing system with experienced vendors providing key services," said Matesanz.

Schafer said the dispute with ETCC has increased some of the authority's costs, and delayed implementation of open-road tolling on two of three remaining expressways. Those two systems are expected to "go live" toward the end of this year.

The Expressway Authority terminated ETCC in December 2012 for failing to cure contractual defaults. After a mediation impasse occurred, ETCC sued for breach of contract and the authority filed counter-claims.

On Sept. 3, 2013, the court entered a partial summary judgment striking down ETCC's $30 million claim against the authority for failing to comply with its contract, according to the preliminary official statement. The order could be appealed, and the remainder of the suit is expected to go to trial later this year.

Meanwhile, the authority is experiencing positive results from the successful conversion of three expressways to open-road tolling in 2010, which closed off all avenues for drivers to escape paying tolls. Drivers previously could exit before they reached the toll booth.

The conversions and closure to free movements "dramatically" increased transactions year-over-year in fiscal 2011 by 88%," said S&P analyst Adam Torres. Transactions in fiscal 2012 increased by 5.7% and another 2.1% in 2013, to 238 million, he said.

After ORT conversion of the remaining two expressways this year and other improvements, transaction growth is projected to increase 48% in 2015, and another 26% in 2016, which is the first full year of implementation, according to studies reviewed by S&P.

In December, Moody's revised its outlook for the toll road industry to stable from negative based on slow and steady recovery in traffic growth.

"We expect 2014 traffic growth of about 1.5% on a median basis for rated toll roads, as the U.S. economy strengthens," analysts Matesanz and Chee Mee Hu said in an industry outlook report. "This traffic growth rate marks what we believe is a sustainable comeback from a nearly 3% decline in 2009, when our outlook turned negative on the industry."

Of the 42 government-owned U.S. toll roads tracked by Moody's, roads in high-growth states such as Florida and Texas stand out in terms of traffic growth rates, the analysts said.

Underwriters selling the new money bonds next week are Morgan Stanley & Co., Citi, RBC Capital Markets, and Rice Financial Products Co.

First Southwest Co. is financial advisor.

Squire Sanders LLP and D. Seaton and Associates are co-bond and disclosure counsel. Underwriters' counsel is Greenburg Traurig PA.

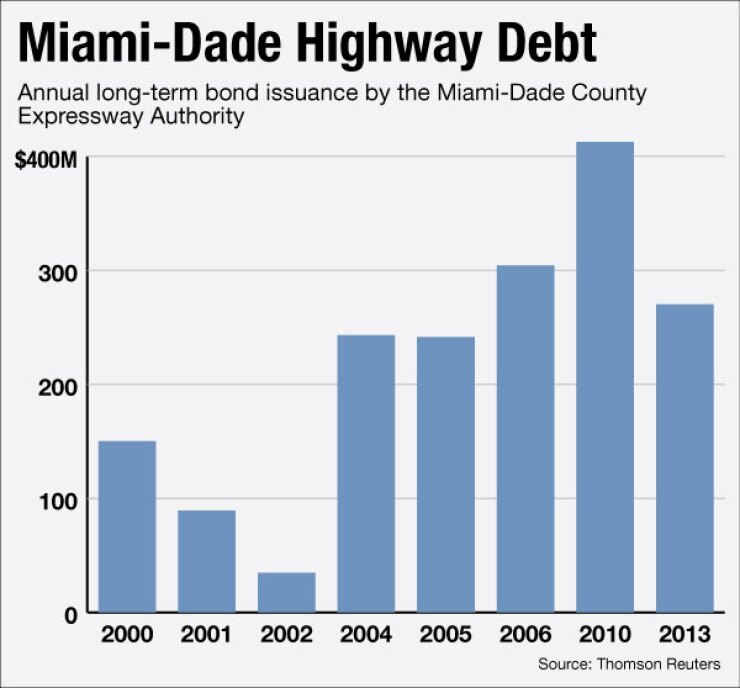

The Miami-Dade Expressway Authority was last in the market for a $270.2 million refunding in March 2013.

The deal resulted in present value savings of $28.8 million or 9.7% of refunded par within existing maturities.

The refunding bonds sold with yields ranging from 0.4% and a 3% coupon in 2014, to 2.93% with a 5% coupon in 2024, to 3.72% with a 5% coupon in 2033.