As Massachusetts lawmakers weigh Gov. Charlie Baker’s $45.6 billion budget proposal, a study shows significant wealth migration to Florida and New Hampshire.

In their report,

The data show a “persistent trend of wealth” leaving high-tax states for low-tax ones, especially to the Sun Belt.

“The result is that the commonwealth is increasingly reliant on migration to continue to expand its tax base and pay for the healthcare and retirement benefits of a rapidly aging population,” the report said.

“We live in a society that is more mobile than ever before, and that is especially true for those on the higher rungs of the socio-economic ladder.”

Pioneer last month released

“Long the wealthiest state in the country in terms of per capita income, Connecticut today is suffering from a corporate revolt that has seen mainstays like General Electric and Alexion Pharmaceuticals move valuable headquarters operations out of state,” Sullivan and Mikula wrote.

“Less visible but still very real has been a steady outflow of wealth to other states, with high earners increasingly moving to low-tax states like Florida and North Carolina.”

Other troubling economic indicators, they said, include a stubbornly higher-than-average jobless rate and billions of dollars of unfunded public employee pension obligations.

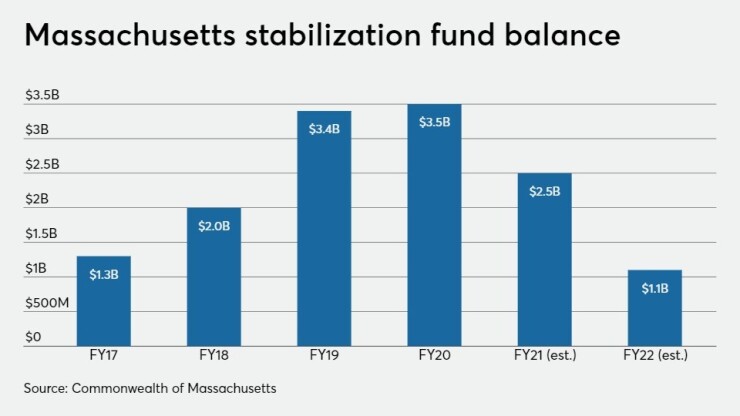

Baker’s fiscal 2022 spending plan authorizes a withdrawal of up to $1.6 billion from the commonwealth’s stabilization, or rainy-day fund, which would leave a roughly $1.1 billion balance. Deposits in recent years, Baker said, have enabled the commonwealth to cope with expenses related to COVID-19.

The amount of the withdrawal could hinge on aid Massachusetts receives in the next federal rescue bill.

Reactions were mixed.

“Using federal dollars and rainy-day funds are all acceptable maneuvers to balance a strained budget, but more is required if we are to build an equitable recovery that benefits everyone,” said the liberal-leaning Massachusetts Budget and Policy Center.

According to the conservative Massachusetts Taxpayers Foundation, Baker’s proposal leaves lawmakers with much to consider. “The use of $1.6 billion from the stabilization fund would put a significant dent in available reserves,” it said in a statement.

Moody's Investors Service rates the commonwealth's general obligation bonds Aa1. S&P Global Ratings and Fitch Ratings rate them AA and AA-plus, respectively.

The governor based his budget on a $30.12 billion consensus tax revenue estimate, which anticipates a 3.5% growth in total tax collections over revised fiscal 2021 tax estimates. The $45.6 billion in gross spending represents a decrease of 0.7% from fiscal 2021 projected spending, excluding transfer to the Medical Assistance Trust Fund.

This, Baker said, accounts for current tax projections and is primarily driven by caseload and cost decreases at MassHealth, the state’s Medicaid program, which previously experienced significant cost increases in fiscal 2021 due to the pandemic.

The budget, which has no broad-based tax increases, assumes up to $35 million from sports betting, which the legislature would have to authorize.

Under the state's budget process, the Senate and House of Representatives enact separate spending plans before a concurrence panel of three members from each branch works out a compromise. The governor also makes adjustments.