The municipal market was firm, but cautious on Wednesday morning as the quiet summer cycle continues to leave much to be desired by hungry investors, according to one New York trader.

Municipal yields in 10-years and under were unchanged in early trading as some of the week’s new deals gained a little momentum and the market looked for a continued positive tone, he said. “I think the market is comfortable with where it’s positioned in the backdrop of positive technicals.”

Demand remains heavy even though volume continues to be down for the year — and investors are being picky when it comes to completing trades in the intermediate slope of the yield curve.

“If it’s any example, we have seven to eight solid buyside inquiries for paper in the five- to 15-year range that are very specific and we are having a hard time filling those,” he said.

In addition, he said dealers are “a little light,” and arbitrage accounts are showing less inventory during the summer months when there is less liquidity.

“They likely feel there may be some improvement on a relative basis going forward, so they are only putting out selective offerings right now,” until summer ends, he added.

Primary market

In the competitive arena, Maryland sold two deals totaling over $500 million on Wednesday.

Goldman Sachs won the $275.3 million of Bidding Group 1 state and local facilities loan of 2018 second series tax-exempt bonds with a true interest cost of 2.3281%.

Citigroup won the $234.71 million of Bidding Group 2 state and local facilities loan of 2018 second series tax-exempt bonds with a TIC of 3.1246%.

The Maryland bonds are rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

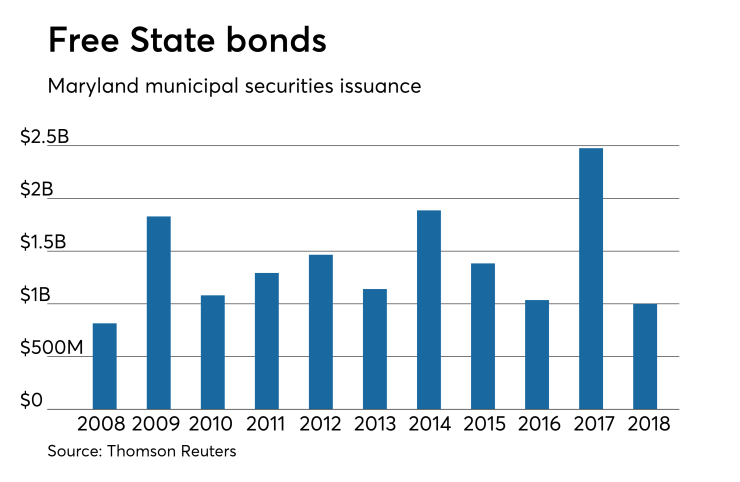

Since 2008, the Free State has sold over $15 billion of bonds, with the most issuance occurring in 2017 when it offered nearly $2.5 billion of debt. It sold the least amount of bonds in 2008 when it issued $815 million of bonds.

Citigroup is set to price the Washington State Convention Center Public Facilities District’s $974 million of Series 2018 lodging tax bonds and subordinate lodging tax bonds. The bonds will finance part of an addition.

Citi received the written award on the Forsyth County School District, Ga.’s $147.5 million of Series 2018 general obligation bonds. The deal is rated triple-A by Moody’s and S&P.

Wednesday’s bond sales

Maryland:

Georgia

Bond Buyer 30-day visible supply at $8.87B

The Bond Buyer's 30-day visible supply calendar decreased $1.15 billion to $8.87 billion for Wednesday. The total is comprised of $3.30 billion of competitive sales and $5.57 billion of negotiated deals.

NYC to sell $871M bonds next week

New York City plans to sell next week about $871 million of general obligation bonds, comprised of approximately $811 million of tax-exempt fixed-rate bonds and $60 million of taxable fixed-rate bonds.

Proceeds from the sale will be used to refund outstanding bonds, with the exception of proceeds from around $41 million of the tax-exempt fixed-rate bonds, which will be used to convert outstanding floating rate bonds into fixed rate bonds.

The deal is expected to be priced in a negotiated transaction on Wednesday, Aug. 8, by the city’s underwriting syndicate led by book-running senior manager RBC Capital Markets, with Bank of America Merrill Lynch, Citigroup, Goldman Sachs, JPMorgan Securities, Jefferies, Loop Capital Markets, Ramirez & Co., and Siebert Cisneros Shank & Co. serving as co-senior managers. There will be a two day retail order perrid beginning on Monday, Aug. 6.

Also on Aug. 8, the city expected to competitively sell about $60 million of taxable fixed-rate bonds.

Secondary market

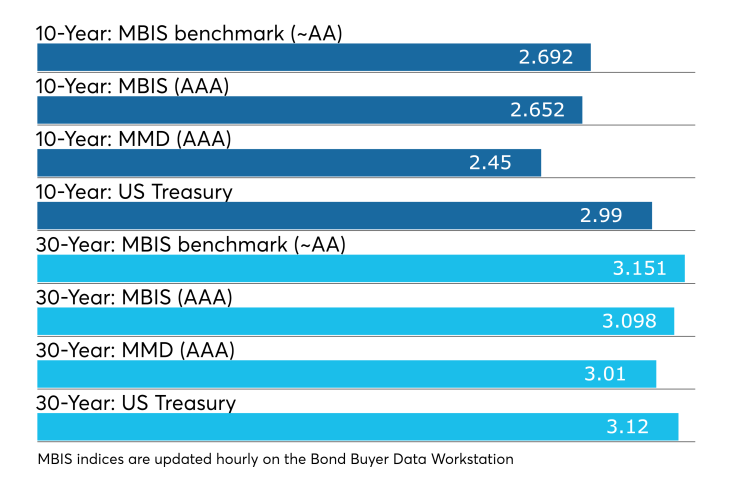

Municipal bonds were weaker on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities.

High-grade munis were mostly weaker, with yields calculated on MBIS’ AAA scale rising as much as one basis point across most of the scale except for one-year, eight-year and nine-year maturities where yields fell as much as one basis point.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising as much as two basis points and the yield on the 30-year muni maturity gaining one to three basis points.

Treasury bonds were weaker as stocks traded mixed.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 82.7% while the 30-year muni-to-Treasury ratio stood at 97.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,205 trades on Tuesday on volume of $12.40 billion.

Puerto Rico bonds ease off after rally

In midday trading on Wednesday, the Puerto Rico Electric Power Authority’s Series 2007 TT 5% revenue bonds of 2037 were trading at a high price of 60.25 cents on the dollar down from a high price of 60.525 cents on Tuesday but still sharply higher than the high of 43.75 cents seen on Monday, according to the Municipal Securities Rulemaking Board’s EMMA website. Trading was active with volume totaling $5.555 billion in nine trades compared to $3.065 million in 37 trades on Tuesday and $350,000 in eight trades on Monday.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.