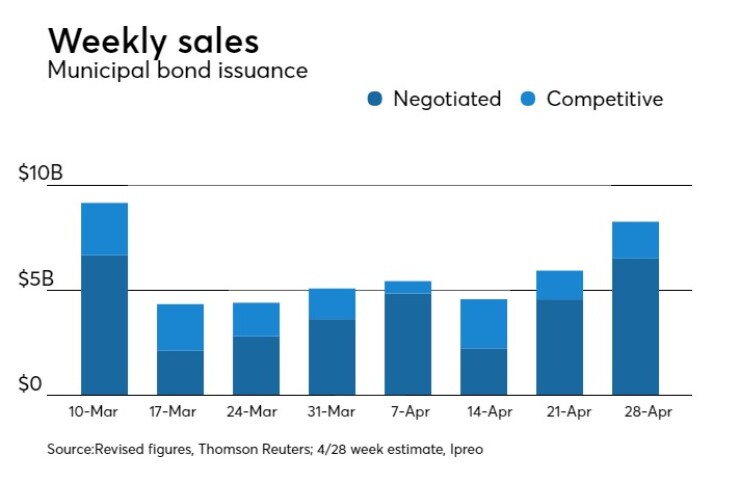

The municipal market is set to see a bump in new supply next week, something that market participants have been craving. The estimated total would be the most since the week ended on March 10.

Ipreo estimates volume will increase to $8.26 billion, from a revised total of $5.94 billion in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $6.51 billion of negotiated deals and $1.75 billion of competitive sales.

“The increase to the extent that volume causes a widening of credit spreads in the secondary market it is much needed as investors [in our view] are not being adequately compensated for credit risk in the current market environment," said Michael Pietronico, CEO of Miller Tabak Asset Management. "It is for that reason that we as a firm, are gravitating towards higher quality credits as we deploy cash.”

Another week and yet another issuer from California is topping the calendar. This time around, Goldman Sachs is set to price the California Health Financing Authority’s $1.9 billion of revenue bonds for Kaiser Permanente and is expected to include a green bond portion. The deal is scheduled to price on Tuesday and is rated AA-minus by S&P Global Ratings and A-plus by Fitch Ratings. Kaiser Permanente is also scheduled to sell $2 billion of corporate CUSIP’s on either Tuesday or Wednesday.

"I don’t recall as large of a corporate CUSIP but I do think [the] California market will easily absorb bond deals,” said Alan Schankel, managing director at Janney Capital Markets. “For one thing, the taxable issues have a wider demand base, since pension funds and non U.S. buyers are in mix. As far as tax free issues, California’s high income tax environment generates ongoing demand which I expect to continue.”

Schankel also said that the tax-exempt should do well, since Kaiser is more of an insurance program than hospital system (although they have hospitals) it may be considered by some investors as a diversification play since little insurance exposure is available in muni space.

“In general, I think muni demand will continue to be solid, as the fund flows continue [to be] positive,” he said.

Wells Fargo is slated to price the Port Authority of New York and New Jersey’s $994.74 million of consolidated, alternative minimum tax and taxable bonds on Wednesday after a one-day retail order period on Tuesday. The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P and Fitch.

Bank of America Merrill Lynch is expected to price the Department of Water and Power of the City of Los Angeles’ $530 million of water system revenue bonds on Thursday after a one-day retail order period on Tuesday. The deal is rated Aa2 by Moody’s, AA-plus by S&P and AA by Fitch.

“There is a standard group of money managers who cannot commit the time to the secondary market that is required, so yes we believe the new issue deals will meet good demand,” said Pietronico.

In the competitive arena, the largest sale will come from the Maryland Department of Transportation. It plans to auction $285 million of consolidated transportation bonds on Wednesday. The deal is rated Aa1 by Moody’s, triple-A by S&P and AA-plus by Fitch.

Rhode Island is set to sell a total of $158.945 million, which is expected to be broken into two portions: $91 million of consolidated capital development loan and $67.945 million of consolidated capital development loan refunding bonds.

“Although Rhode Island has its issues with sub-par economic growth and somewhat elevated pension liabilities, I like the state credit,” Schankel said. “Unlike some of the lower rated states, Rhode Island has maintained relatively stable reserves, and their pension reforms from a few years back were very meaningful, demonstrating willingness to tackle fiscal challenges."

Secondary market

Municipals finished unchanged on Friday. The yield on the 10-year benchmark muni general obligation was flat from 2.05% on Thursday, while the 30-year GO yield was steady at 2.90%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were narrowly mixed on Friday. The yield on the two-year Treasury fell to 1.18% from 1.20% on Thursday, while the 10-year Treasury yield declined to 2.23% from 2.24%, and the yield on the 30-year Treasury bond was unchanged from 2.89%.

The 10-year muni to Treasury ratio was calculated at 92.0%, compared with 91.5% on Thursday, while the 30-year muni to Treasury ratio stood at 100.4%, versus 100.3%, according to MMD.

Week's most actively traded issues

Some of the most actively traded issues by type in the week ended April 21 were from California and Pennsylvania, according to

In the GO bond sector, the California 3.5s of 2027 were traded 23 times. In the revenue bond sector, the Geisinger Authority, Pa., 4s of 2047 were traded 36 times. And in the taxable bond sector, the Riverside County Public Financing Authority, Calif., 4s of 2040 were traded 15 times.

Week's most actively quoted issues

Puerto Rico, New York and New Jersey names were among the most actively quoted bonds in the week ended April 21, according to Markit.

On the bid side, the Puerto Rico Commonwealth GO 5s of 2041 were quoted by 41 unique dealers. On the ask side, the New York City Transitional Finance Authority revenue 3.5s of 2038 were quoted by 230 unique dealers. And among two-sided quotes, the New Jersey Turnpike Authority taxable 7.414s of 2040 were quoted by 30 unique dealers.

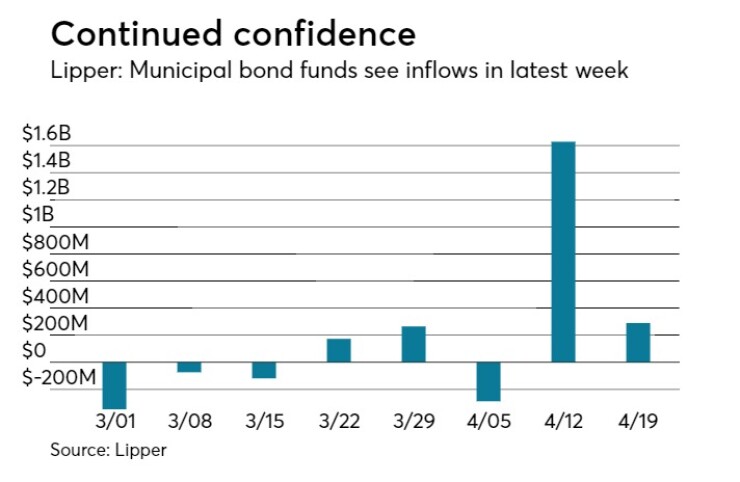

Lipper: Muni bond funds see inflows

Investors in municipal bond funds continued to put cash back into the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $290.227 million of inflows in the week ended April 19, after inflows of $1.628 billion in the previous week.

The four-week moving average was still in the green at positive $473.945 million, after being positive at $444.756 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had inflows, gaining $382.696 million in the latest week after rising $1.094 billion in the previous week. Intermediate-term funds had inflows of $129.744 million after inflows of $505.697 million in the prior week.

National funds had inflows of $317.247 million after inflows of $1.699 billion in the previous week. High-yield muni funds reported inflows of $227.034 million in the latest reporting week, after inflows of $604.105 million the previous week.

Exchange traded funds saw inflows of $96.644 million, after inflows of $113.902 million in the previous week.