The tax-exempt market received deals better than expected as the benchmark muni yield scale showed bumps across the curve even as Treasuries weakened.

"Deals were very well received," a Boston trader said. "There are some bumps in the belly of the curve."

To be sure, other East Coast traders were worried about deals – especially with another storm expected to hit tomorrow after the coast has barely recovered from Hurricane Sandy.

"Bid-wanteds are getting worse bids today," a New York trader said Tuesday morning.

"The market is weaker," the trader said. "We are waiting on new deals and another storm is coming," referring to the nor'easter expected to hit the East Coast Wednesday.

"The Connecticut deal was priced cheap and the MTA and Triborough will come real cheap and drag the market down," according to the trader. "Pricing could be bad because of the storm."

In the primary market, Morgan Stanley priced and repriced Utah Transit Authority subordinated sales tax revenue and refunding bonds, rated A1 by Moody's Investors Service, A-minus by Standard & Poor's, and A-plus by Fitch Ratings.

Yields ranged from 0.65% with a 4% coupon in 2015 to 3.45% with a 5% coupon in 2042.

The bonds are callable at par in 2022. Yields were lowered as much as 10 basis points from preliminary pricing.

Bank of America Merrill Lynch priced $184.2 million of Ohio major new state infrastructure project revenue bonds, rated Aa1 by Moody's and AA by Standard & Poor's.

Yields ranged from 0.45% with a 3% coupon in 2014 to 2.43% with 4% and 5% coupons in a split 2024 maturity. Credits maturing in 2013 were offered via sealed bid. The bonds are callable at par in 2022.

Loop Capital Markets priced $128.6 million of New York's Triborough Bridge and Tunnel Authority general revenue bonds, rated Aa3 by Moody's and AA-minus by Standard & Poor's and Fitch.

Yields ranged from 0.20% with a 2% coupon in 2013 to 3.12% with a 5% coupon in 2038. The bonds are callable at par in 2022.

On Tuesday, the Municipal Market Data scale was steady to firmer.

Yields inside seven years were steady while the eight- to 11-year yield fell one and two basis points. Outside 12 years, yields were flat.

Treasuries were much weaker as stocks gained.

The benchmark 10-year yield and the 30-year yield jumped four basis points each to 1.72% and 2.90%, respectively. The two-year yield increased one basis point to 0.28%.

Muni-to-Treasury ratios have risen so far in November as munis have underperformed Treasuries and become relatively cheaper.

The five-year muni yield to Treasury yield ratio jumped to 95.7% from 91.8% at the beginning of the month.

After tightening throughout most of the yield curve, credit spreads have stayed flat so far in November as demand has met supply and most investors wait until uncertainty over the election has subsided.

The two-year triple-A to single-A spread held steady at 34 basis points while the five-year spread traded flat at 53 basis points.

Similarly, the 10-year triple-A to single-A spread traded steady at 70 basis points while the 30-year spread remained at 69 basis points.

To be sure, spreads have compressed this year as yield-hungry investors continue to move down the credit scale in search for yield. The five-year triple-A to single-A spread has compressed to 53 basis points 82 basis points where it started the year.

The 10-year triple-A to single-A spreads compressed to 70 basis points from 96 basis points where it started the year. And the 30-year spread compressed to 69 basis points from where it started the year at 89 basis points.

Similarly, the slope of the yield curve has flattened as investors extend duration of bonds in search of yield. The one- to 30-year slope fell to 261 basis points this week from 265 basis points at the beginning of October.

The one- to 10-year slope has steepened as investors sold bonds in the belly of the curve throughout the last month. The slope steepened to 152 basis points from 150 basis points at the beginning of last month.

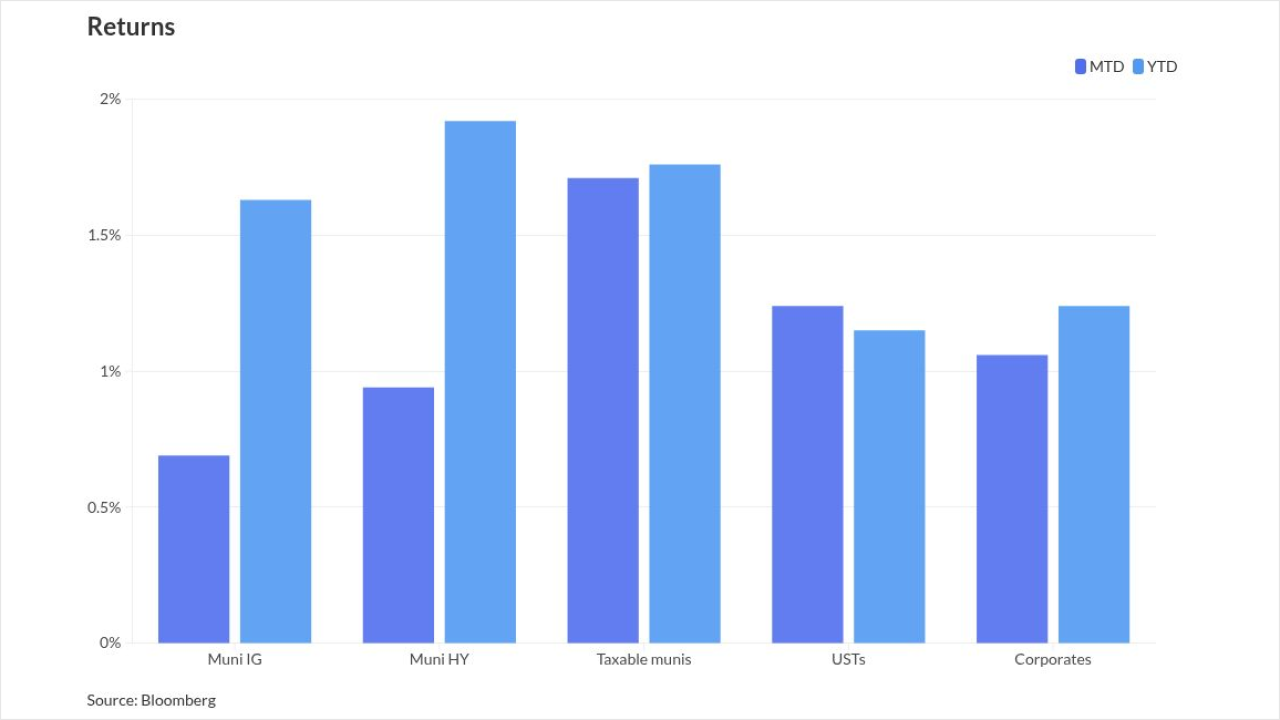

High-yield municipal bonds continue to outperform the investment grade market.

The Standard & Poor's Municipal Bond High Yield Index has returned 15.89% year-to-date and 0.31% month-to-date. That compares to the Standard & Poor's Municipal Bond Investment Grade Index, which returned 6.64% year-to-date and 0.10% month-to-date.

High yield sectors have also largely outperformed the general market.

The Standard & Poor's Municipal Bond Tobacco Index, for example, returned 20.83% year-to-date and 0.39% month-to-date.

Similarly, the Standard & Poor's Municipal Bond Health Care Index returned 10.17% year-to-date and 0.12% month-to-date.

The Standard & Poor's Municipal Bond Housing Index returned 6.67% year-to-date and 0.06% month-to-date.

On a national level, revenue bonds continue to outperform general obligation bonds this year.

The Standard & Poor's Municipal Bond Revenue Index returned 8.40% year-to-date and 0.13% month-to-date.

That compares to the Standard & Poor's Municipal Bond General Obligation Index, which returned 5.80% year-to-date and 0.08% month-to-date.

Local GO bonds have outperformed state GOs. The Standard & Poor's Municipal Bond Local General Obligation Index returned 6.80% year-to-date and 0.08% month-to-date. The Standard & Poor's Municipal Bond State General Obligation Index returned 5.06% year-to-date and 0.09% month-to-date.