Light new issue supply ahead of the Thanksgiving holiday led to demand in the secondary market as prices rose, fueled by mixed trading of Jefferson County, Ala., sewer debt after last week’s pricing.

Various CUSIPS of the sewer debt traded with both stronger and weaker prices after the county issued $1.78 billion of debt while in bankruptcy. The county gained approval to exit Chapter 9 on Thursday. By Monday afternoon, $67.7 million was traded, with 45.8%, or $31 million, traded between dealers.

Dealers sold to customers $20.2 million while dealers bought from customers $16.6 million of the County’s debt.

The most actively traded CUSIP of Jefferson County debt was senior lien sewer revenue convertible capital appreciation bonds. A customer bought from a dealer 0s of 2038 at 6.33%, down from 6.38% in the morning. Yields were also lower from where a customer bought the bonds on Friday at 6.40% in block size trading.

Bonds in an interdealer trade of subordinate lien 6.5s of 2053 yielded 7.02% on Monday, up one basis point from where the bonds traded Friday, but down four basis points from where the bonds traded in a separate transaction Friday morning.

A customer sold to a dealer senior lien revenue 5.5s of 2053 at 5.78%, up 11 basis points from where the bonds traded Friday.

Bonds in an interdealer trade of senior lien sewer capital appreciation 0s of 2025 yielded 5.48%, eight basis points lower than where the bonds traded Friday.

Another CUSIP of senior lien 5s of 2044 were bought from a customer at 5.30%, down two basis points from where the bonds were sold Friday.

“Jefferson County came at an attractive price and if you get past the credit, I’d imagine people will look at it like an attractive piece of paper,” a New Jersey trader said.”

Only two issuers were more actively traded than Jefferson County New York City general obligation bonds and California GOs. New York City GOs had $84.4 million traded, with 25.6%, or $21.6 million, coming from interdealer trades. Dealers sold to customer $33.7 million and bought from customer $29.1 million.

California GOs were the second most actively traded issue with $81.5 million. Interdealer trading made up $39.4 million, or 48.4%, followed by $25.6 million of customer buy trades and $16.5 million of customer sell trades.

In the general market, activity remained subdued. “We are not seeing a whole lot of change here,” the New Jersey trader said. “It might be a little firmer but there is not a lot of activity. After Tuesday, the market will virtually be shut down.”

“It’s quiet and I’d expect this week will be that way the whole time,” a Chicago trader said. Treasuries were two basis points firmer while munis were steady.

Total volume fell more than 6% from the average of the previous five Monday trading sessions with $4.1 billion traded. Dealer sell trades to customer made up the majority of trading with $1.6 billion following by dealer buy trades from customers at $1.3 billion. Interdealer trading accounted for 29.4%, or $1.2 billion, of all activity.

Trades compiled by data provider Markit showed strengthening.

Yields on Camden County, N.J., Improvement Authority 4s of 2023 and New York City Municipal Water Finance Authority 5s of 2046 slid two basis points each to 3.35% and 4.66%, respectively.

Yields on Louisiana Gas & Fuels Tax 5s of 2045 slid two basis points to 4.53% and Judson, Texas, Independent School District 5s of 2039 fell one basis point to 4.21%.

Yields on Tennessee’s Metropolitan Government of Nashville and Davidson County 5s of 2027 and Los Angeles Department of Water and Power 5s of 2029 fell one basis point each to 3.38% and 3.86%, respectively.

Supply is expected to be light this week ahead of Thanksgiving. The market can expect $538.2 million of bonds, down from last week’s revised $6.19 billion. The negotiated market can expect $133 million, down from a revised $5.08 billion. On the competitive calendar, $405.2 million should be auctioned, down from last week’s revised $1.11 billion.

On Monday, the triple-A Municipal Market Data scale ended as much as one basis point stronger after posting gains on Friday. The 30-year yield slid one basis point to 4.13%. The 10-year was steady for the third session at 2.66% and the two-year closed unchanged for the eighth session at 0.33%.

Yields on the Municipal Market Advisors benchmark scale ended steady to one basis point firmer. The two-year and 30-year yields fell one basis point each to 0.37% and 4.36%, respectively. The 10-year was steady at 2.72%.

Treasuries were stronger on Monday. The benchmark 10-year and 30-year yields slid one basis point each to 2.74% and 3.83%, respectively. The two-year was steady at 0.30%.

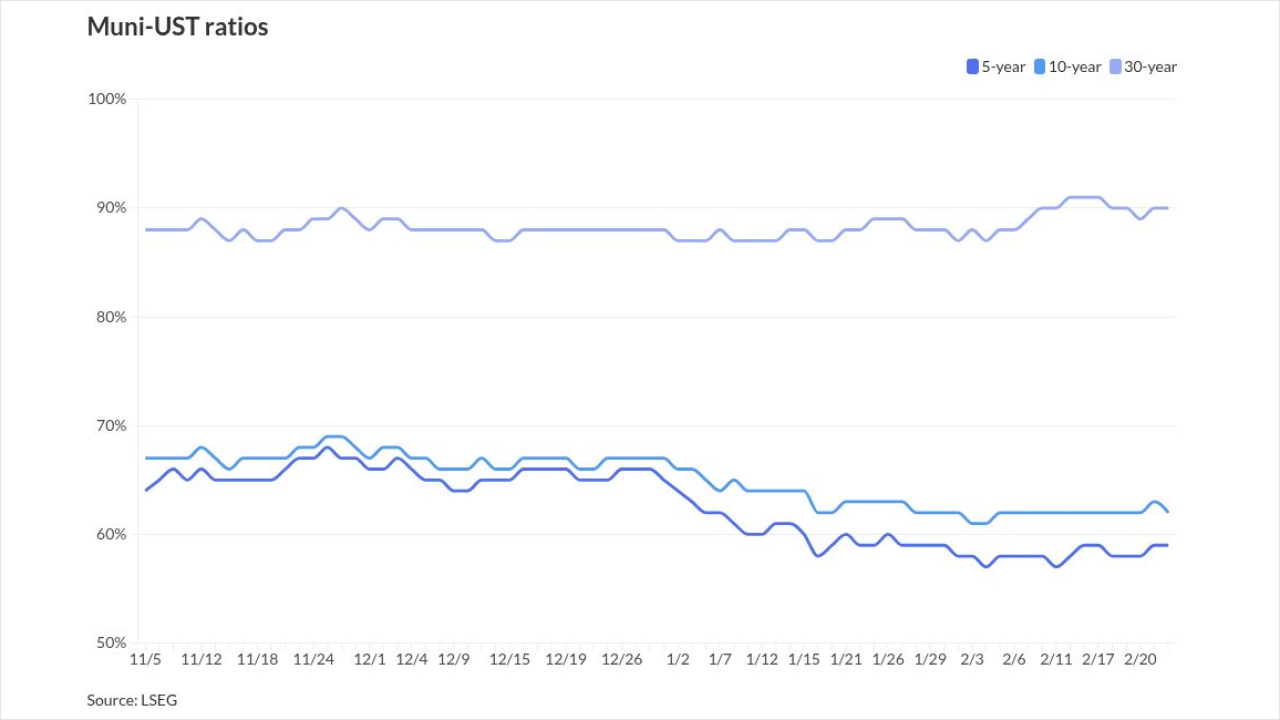

Muni-to-Treasury ratios on the short and intermediate part of the curve have risen as munis underperformed their taxable counterparts and became relatively cheaper throughout November. The five-year ratio increased to 86.6% on Monday from 77.4% on Nov. 1, but still remains below its 90-day trading average of 89.8%.

The 10-year ratio rose to 97.1% from 93.9%, but closed below its 90-day trading average of 98%.

Ratios on the long end of the curve fell as munis outperformed Treasuries and became relatively more expensive. The 30-year ratio slipped to 107.8% from 110%, and fell below its 90-day average of 112.2%.

“Over the past week, ultra long end municipals outperformed 30-year Treasuries fairly significantly and so did 10-year municipals,” wrote George Friedlander, municipal analyst at Citi. “We attribute this outperformance to thin supply while investors seem to be putting some of their significant cash holdings to work.”