In a break from its past practice, the lnternal Revenue Service has issued only a vague outline of its fiscal 2021 priorities for tax compliance and enforcement involving municipal bonds.

Instead, the IRS will post quarterly updates of its enforcement strategy

The initial focus for fiscal 2021 involves potential arbitrage violations of Internal Revenue Code Section 148 by the investment of bond proceeds in higher-yielding investments beyond the allowable temporary period under Treasury Regulation (Treas. Reg.)1.148-2(e).

In fiscal 2020, the top IRS enforcement and compliance priorities were public safety and jail bonds, sinking fund overfunding, and variable rate bonds.

Meanwhile, the IRS has separately announced that the regulatory relief it granted allowing telephonic public hearings to replace in-person public hearings for governmental approval of private activity bonds will continue through Sept. 30, 2021.

IRS

Public hearings are required for PABs issuance as part of the public notice requirements under the 1982 Tax Equity and Fiscal Responsibility Act (TEFRA).

NABL President Teri Guarnaccia sent a letter dated Oct. 2 to top officials of the Treasury and IRS requesting an extension through Dec. 31, 2021.

“The COVID-19 pandemic has also been and continues to be, the subject of numerous emergency declarations by state and local governments,” Guarnaccia wrote. The COVID-19 pandemic prompted state and local governments to severely limit or, in some cases, prohibit in-person gatherings by members of the general public.”

The letter noted that “even in areas where explicit restrictions have been relaxed, members of the public generally have been encouraged to continue to practice social distancing, and, while personal choices vary, certain members of the public continue to limit engagement with others.”

The pandemic also may be a reason for a shortened IRS enforcement and compliance agenda, according to Vicky Tsilas, a partner at Ballard Spahr who formerly headed branch 5 in the IRS chief counsel’s office.

“I don’t read too much into that,” Tsilas said in an email. “I think it is a difficult year with COVID. The IRS has said that they will add summary details online about compliance initiatives when they become approved.”

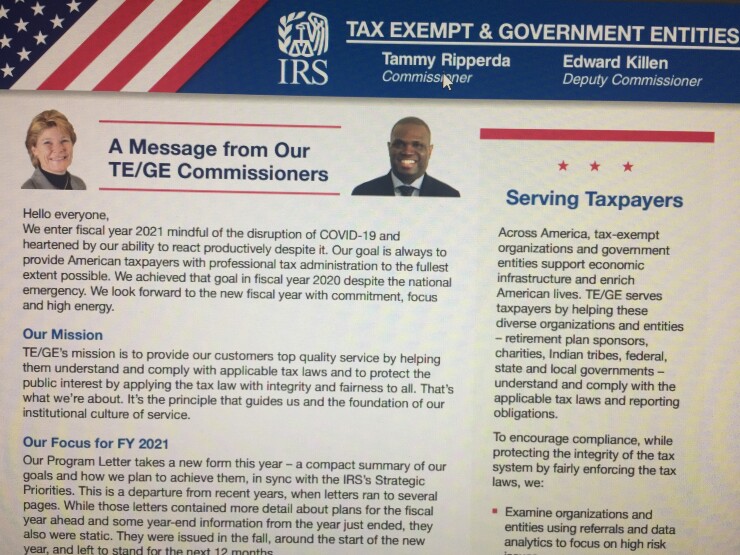

Tammy Ripperda, the former commissioner for the Tax Exempt and Government Entities Division, retired Sept. 30 but her photo and signature are part of

Ripperda and Killen described the new approach on the first page of a two-page document as “a compact summary of our goals and how we plan to achieve them, in sync with the IRS’s Strategic Priorities.”

The second page lists six priorities: strengthen compliance activities, improve operational efficiencies, maintain a taxpayer-focused organization, ensure awareness and collective understanding, leverage technology and data analytics, and develop our workforce.

Christie Martin, Chair of National Association of Bond Lawyers Tax Law Committee, issued a statement saying the shorter program letter appears to be an attempt “to avoid providing a plan for the year that would ultimately become stale.”

“It seems as if this year’s plan will be to update information as it occurs including compliance initiatives and other information about their general plan,” Martin said. “ We hope that noncompliance risks and issues are identified in a timely manner such that the larger community can adjust or otherwise review their processes where necessary.”