SAN FRANCISCO — The Los Angeles Department of Water and Power’s Board of Commissioners late Thursday approved the first part of a big rate hike to fund the utility’s renewable energy efforts, and approved the sale of $720 million of power revenue bonds.

The nation’s largest municipal utility plans to raise rates by 22% over the next year to preserve its ratings while spending billions of dollars to increase the percentage of renewable power in its electricity portfolio and break its addiction to cheap, but dirty, coal.

“With the approval of this plan, we are one step closer to turning the Los Angeles Department of Water and Power into the cleanest utility in the country and Los Angeles into the greenest big city in America,” said Los Angeles Mayor Antonio Villaraigosa.

Villaraigosa appoints the LADWP commissioners and has been a chief proponent of the city’s drive to get 20% of its power from renewable energy by the end of this year, and 40%, with no coal, by 2020.

The commission approved the plan unanimously, but it must still be approved by the City Council. The utility plans to implement the full 22% rate hike in four steps over the next year, as LADWP increases the energy cost-adjustment factor by 2.7 cents per kilowatt hour. A carbon reduction surcharge will account for 0.7 cents of the increase.

The full rate hike will raise $648 million a year in revenue, including $168 million for a new Renewable Energy and Efficiency Trust Fund funded by the carbon reduction surcharge.

The rate hikes will allow the utility, which has about $5.1 billion of power revenue bonds outstanding, to spend fewer reserves to fund its ambitious capital program than previously planned. Drawing down reserves was a concern for credit rating agencies, and that was a key driver for board members debating the rate hikes.

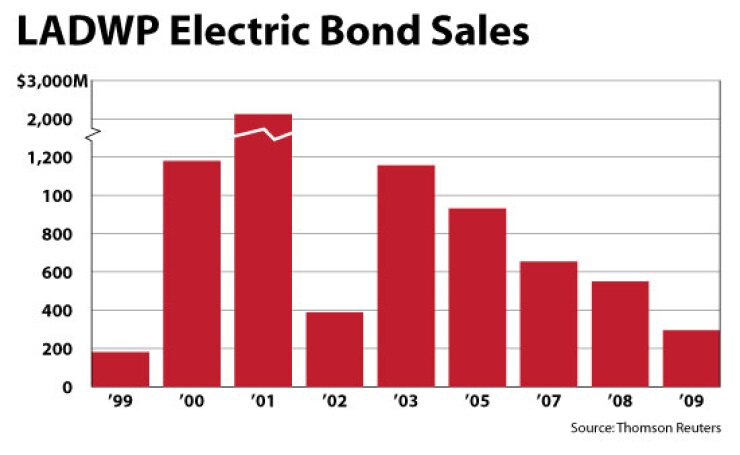

The board approved the sale of $720 million of power revenue bonds next month.

The issue is expected to include $616 million of Build America Bonds to fund this year’s capital improvement program and up to $104 million of tax-exempt bonds to refund debt issued in 2001 and 2003.

Fitch Ratings on Thursday affirmed its AA-minus on the power system’s revenue bonds ahead of the $720 million issue, calling the rate hike a “positive credit development in that it brings LADWP much closer to a position of full cost recovery on a timely basis.”

“LADWP no longer expects to draw down its unrestricted cash reserves to fund its capital spending, mitigating Fitch’s previous credit concerns regarding liquidity,” analysts Kathy Masterson and Mike Castracan said in the report.

Standard & Poor’s rates the power system’s outstanding revenue bonds AA-minus. Moody’s Investors Service rates them Aa3. Neither has reported on the upcoming issue yet.

Morgan Stanley, JPMorgan, and Siebert Brandford Shank & Co. are the senior book-running managers for the BABs. JPMorgan and Morgan Stanley are book-runners on the tax-exempt bonds.