Municipal traders described the market as slightly firmer on Tuesday, though they said the lack of new supply was still curtailing opportunity for investors. The dearth of new paper was exacerbated by the shortened trading week ahead of the Good Friday holiday, they said.

“The market is suffering from a lack of supply, but it feels a little firmer,” a New York trader said just after noon. “Stocks are going up and bond yields are going down,” he added, pointing to the 10-year Treasury yield at a 2.81%.

“It feels OK, but there are not a lot of deals,” he continued. “There is a lot of cash out there, but also a lot of uncertainty.”

One of the uncertainties, he said, was the outcome of the $617 million Connecticut fixed-rate general obligation deal pricing for retail investors ahead of Wednesday’s institutional pricing.

The New York trader, who said Connecticut bonds were once considered extremely high-quality, noted that some of the long 4% bonds priced at par should be of some attraction for in-state retail buyers looking for state exemption.

“It’s going to be interesting to see how that will be received” the trader said, referring to fiscal, budgetary, and pension shortfalls, which have led to multiple downgrades to the state's current A-plus from S&P Global Ratings and Fitch Rating, A1 rating from Moody's and AA-minus from Kroll Bond Rating Agency.

The downgrades came last year amid budget strife, declining revenue, and controversy over pension funding.

Primary market

Municipal bond market participants saw some supply price on Tuesday even as buyers awaited huge tobacco bond deal next week from New Jersey.

Jefferies will price the biggest bond deal of the year to date when it brings the New Jersey Tobacco Settlement Financing Corp.’s $3.22 billion of Series 2018A senior and Series 2018B subordinate tobacco settlement bonds to market next Wednesday.

The deal will refund all of the corporation’s outstanding tobacco bonds, which were issued in 2007. The issue will carry various ratings depending upon series and maturity.

On Tuesday, Loop Capital Markets priced

The

RBC Capital Markets priced

The deal is rated Aa2 by Moody’s and AA by S&P.

Since 2008, the Buckeye state has sold about $11.95 billion of securities, with the most occurring in 2008 when it sold $2.13 billion and the least in 2013 when it sold $259 million.

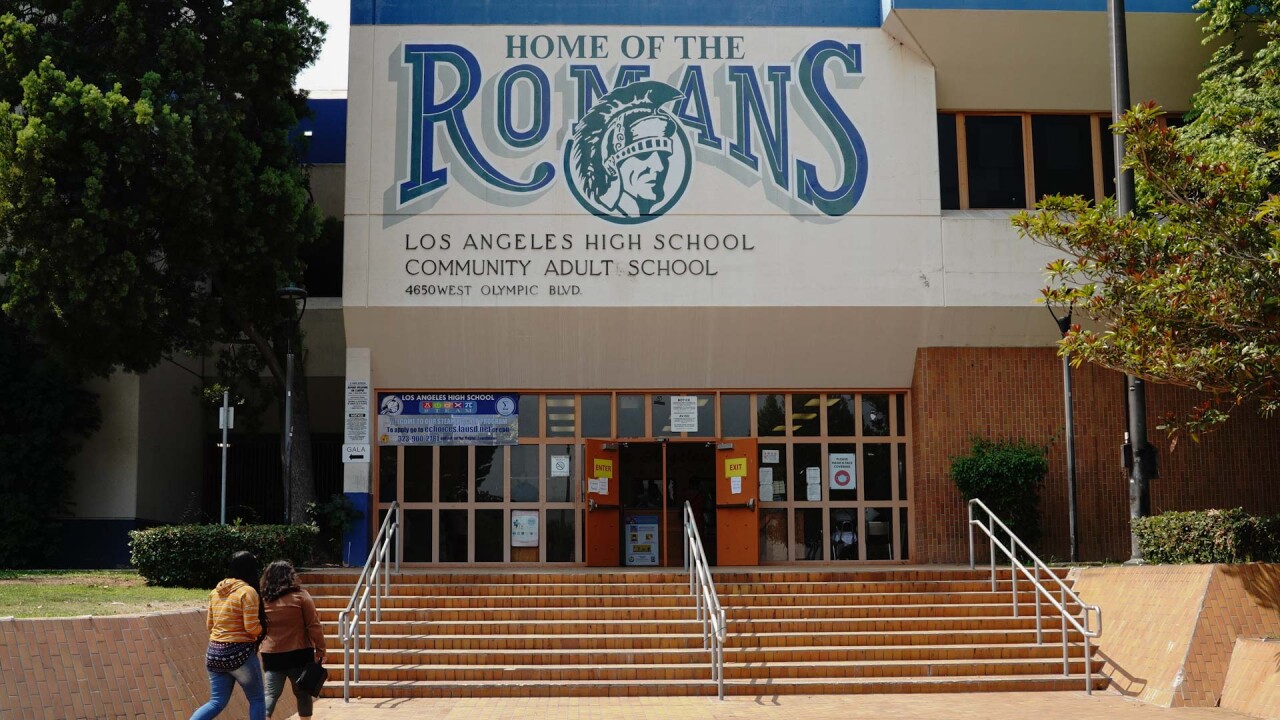

Siebert Cisneros Shank priced the Los Angeles Department of Water and Power’s $358.53 million of Series 2018A power system revenue bonds. The deal is rated Aa2 by Moody’s and AA by S&P and Fitch

Morgan Stanley priced $1.29 billion of bonds in two deals for

Goldman Sachs priced the Chicago O'Hare International Airport’s $119.74 million of Series 2018 senior special facilities revenue bonds for the TrIPs Obligated Group. The deal, which is subject to the alternative minimum tax, is rated BBB by S&P. In the competitive arena on Tuesday, Oklahoma City sold $123.74 million of general obligation bonds.

Citigroup won the $82.75 million of Series 2018 tax-exempt GOs with a true interest cost of 3.1659%. Raymond James won the $40.99 million of Series 2018 taxable GOs with a TIC of 3.4092%. The deals are rated triple-A by Moody’s and S&P.

Tuesday's bond deals

Connecticut:

Ohio:

California:

Chicago:

Los Angeles:

Bond Buyer 30-day visible supply at $10.99B

The Bond Buyer's 30-day visible supply calendar increased $3.33 billion to $10.99 billion on Tuesday. The total is comprised of $3.11 billion of competitive sales and $7.88 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 38,452 trades on Monday on volume of $10.01 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 15.203% of the market, the Empire State taking 9.864% and the Lone Star State taking 9.129%.

Treasury auctions

The Treasury Department Tuesday auctioned $24 billion of 364-day bills at a 2.070% high yield, a price of 97.907000. The coupon equivalent was 2.132%. The bid-to-cover ratio was 2.99. Tenders at the high rate were allotted 80.28%. The median yield was 2.030%. The low yield was 1.995%.

Treasury also auctioned $65 billion of four-week bills at a 1.705% high yield, a price of 99.867389. The coupon equivalent was 1.731%. The bid-to-cover ratio was 2.71. Tenders at the high rate were allotted 57.88%. The median rate was 1.670%. The low rate was 1.645%.

Treasury also auctioned $35 billion of five-year notes, with a 2 1/2% coupon, a 2.612% high yield, a price of 99.478566. The bid-to-cover ratio was 2.50. Tenders at the high yield were allotted 57.18%. All competitive tenders at lower yields were accepted in full. The median yield was 2.570%. The low yield was 2.500%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.