The municipal bond market is set for a surge in issuance this week, with 19 deals $100 million or larger including the $1.3 billion Chicago securitization transaction.

Ipreo forecasts weekly bond volume will increase to at least $6.5 billion from a revised total of $5.7 billion in the prior week, according to updated data from Thomson Reuters. Ipreo’s estimates were calculated before the Chicago deal was approved for sale. The calendar is composed of $5.8 billion of negotiated deals and $703.3 million of competitive sales.

The Securitization Corp. was established last year to leverage city sales tax revenue to refund outstanding debt. Loop Capital Markets will be the lead manager on the deal, which is expected to price on Wednesday in the third sale since its inception.

The offering is comprised of $917.64 million of Series 2018C sales tax securitization bonds and $388.56 million of Series 2018D taxables sales tax securitization bonds and carries ratings of AA-minus by S&P Global Ratings and AAA by Fitch Ratings and Kroll Bond Rating Agency.

“With the $1.3 billion Chicago deal on the horizon, the municipal market was mildly firmer by two to three basis points on Friday,” said one New York trader. “Bid lists shrank as well, as the market was and is focused on the Chicago deal whose selling points include: size, and the name recognition, and possibly yield. Demand will be a function of price; size creates interest.”

Siebert Cisneros Shank and Co., priced the city of Los Angeles's $360.20 million of wastewater system subordinate revenue bonds for retail on Monday, ahead of Tuesday's institutional pricing. The deal is rated AA by S&P and AA by Fitch and Kroll.

Monday's pricing

Secondary market

Municipal bonds were mostly weaker on Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 13-year and 15- to 26-year maturities. The remaining maturities were stronger by less than one basis point.

High-grade munis were also mostly weaker, with yields calculated on MBIS' AAA scale increasing as much as a basis point in the two- to 13-year and 18- to 30-year maturities. The remaining maturities were stronger by less than one basis point.

Munis were unchanged on Municipal Market Data’s AAA benchmark scale, which showed steady yields on both the 10-year muni general obligation and the yield on 30-year muni maturity.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 87.0% while the 30-year muni-to-Treasury ratio stood at 99.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

With no large new issues pricing for institutions on Monday, there was a fairly quiet tone amid slow trading activity and continued growth of bid wanted lists flooding the secondary market, according to a New York trader.

"Lackadaisical" is how he described the muni market before it closed on Monday.

“It’s pretty apathetic,” he said. “There is just an overriding feeling of underperformance. There’s no real entry point in here.”

He said the “real money” buyers, such as large institutional accounts, are being cautious.

“Outflows are starting to put some of these guys on the sidelines, and these trading accounts are suffering” as they continue to lose money, especially the arbitrage accounts, he said. “There doesn’t seem to be any urgency to buy munis right now."

The trader added that the mood is linked to year-end as it was a difficult trading year for most investors.

“We continue to be range bound in the Treasury market and that doesn’t help us," he said. The availability of 4% coupon bonds backed up to grab retail’s focus has waned a bit in the last week, he added. “Retail has stalled because they aren’t able to buy bonds at the right prices since we are locked in lower rates than you had in the last week and a half.”

With lots of cross-currents afflicting the municipal market, he looked to the midterm Presidential election next week to ease some of the tension, though not all.

“It’s been a tough year and I don’t think anyone sees any real move on the horizon to change that," the trader said.

“Once you clear the elections you take away a little of the haze about coming into year end. But people are still nervous about the outcome, so they are playing it a little close to the vest,” he said.

Week's actively traded issues

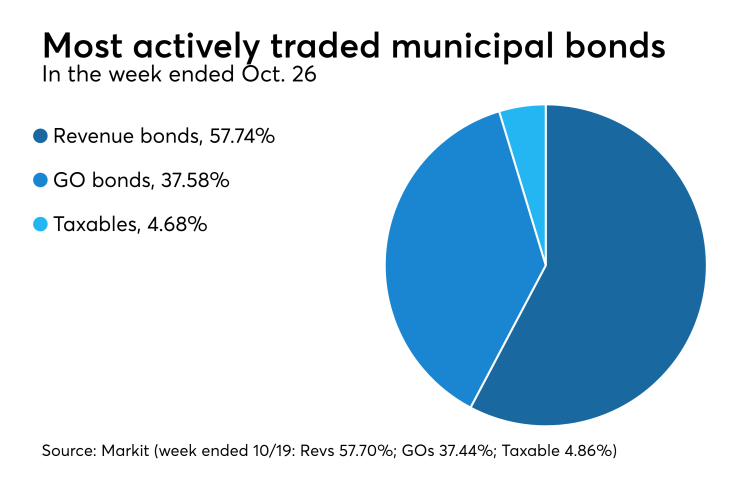

Revenue bonds comprised 57.74% of total new issuance in the week ended Oct. 26, up from 57.70% in the prior week, according to Markit. General obligation bonds made up 37.58%, up from 37.44% while taxable bonds accounted for 4.68%, down from 4.86%.

Some of the most actively traded munis in the week ended Oct. 26 were from Puerto Rico and Ohio issuers, according to Markit.

In the GO bond sector, the Puerto Rico 8s of 2035 traded 66 times. In the revenue bond sector, the Lucas County, Ohio, 4.125s of 2042 traded 49 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp. 6.35s of 2029 traded nine times.

Prior week's top underwriters

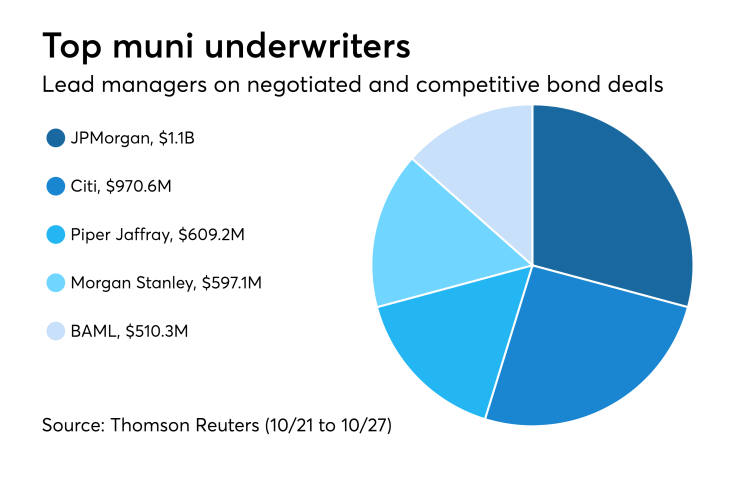

The top municipal bond underwriters of last week included JPMorgan Securities, Citigroup, Piper Jaffray & Co., Morgan Stanley and Bank of America Merrill Lynch, according to Thomson Reuters data.

In the week of Oct. 21 to Oct. 27, JPMorgan underwrote $1.1 billion, Citi $970.6 million, Piper Jaffray $609.2 million, Morgan Stanley $597.1 million and BAML $510.3 million.

Prior week's top FAs

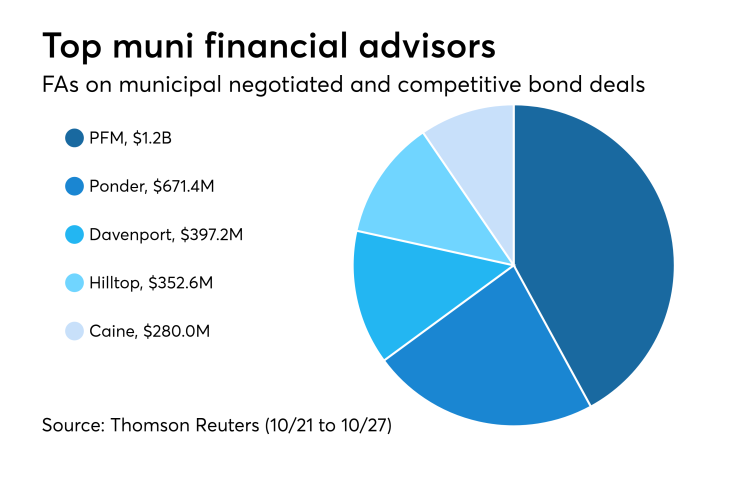

The top municipal financial advisors of last week included PFM Financial Advisors, Ponder & Co., Davenport & Co., Hilltop Securities and Caine Mitter & Associates, according to Thomson Reuters data.

In the week of Oct. 21 to Oct. 27, PFM advised on $1.2 billion, Ponder $671.4 million, Davenport $397.2 million, Hilltop $352.6 million and Caine $280.0 million.

Treasury to sell $45B 4-week bills

The Treasury Department said on Monday that it will sell $45 billion of four-week discount bills Tuesday. Treasury also said it will sell $25 billion of eight-week bills on Tuesday.

Treasury auctions discount rate bills

The Treasury Department sold $45 billion of 91-day and $39 billion of 182-day discount bills on Monday.

The three-month bills incurred a 2.305% high rate, with a coupon equivalent of 2.351%. The price was 99.417347.

The median bid was 2.290% while the low bid was 2.250%. Tenders at the high rate were allotted 79.09%. The bid-to-cover ratio was 2.90.

The six-month bills incurred a 2.430% high rate, with a coupon equivalent of 2.494%. The price was 98.771500.

The median bid was 2.410% while the low bid was 2.390%. Tenders at the high rate were allotted 92.54%. The bid-to-cover ratio was 3.01.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation. Click here for a brief tour of the Workstation, or contact Ziad Saba at 212-803-6079 for more information.