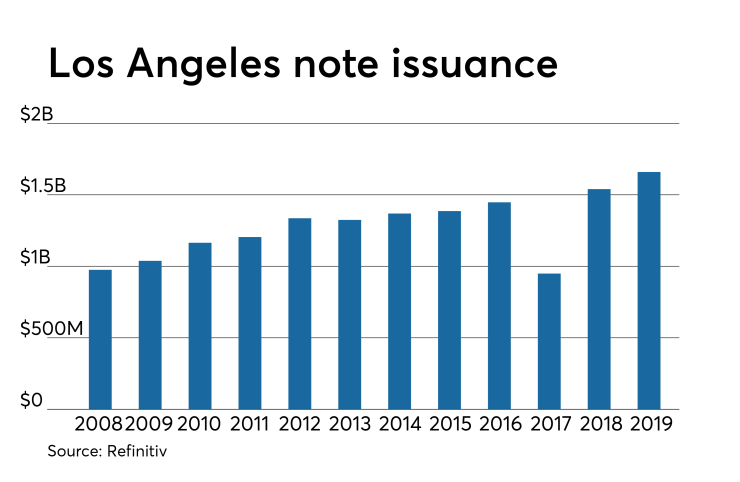

Buyers of short-term municipal paper were treated to over $1.5 billion of notes from a big California issuer on Wednesday as investors looking for some longer-term securities saw deals from North Carolina and Ohio issuers.

Primary market

The City of Los Angeles (MIG1/SP1+/NR) sold $1.66 billion of Series 2019 tax and revenue anticipation notes, dated July 9 and due June 25, 2020.

The TRANS were won by 11 different firms including BofA Securities, Barclays Capital, Citigroup, Goldman Sachs, Wells Fargo Securities, JPMorgan Securities, RBC Capital Markets, Morgan Stanley, TD Securities, UBS Financial Services and The Williams Capital Group. The municipal advisor was Montague DeRose and Associates. The bond counsel was Kutak Rock.

Proceeds will be used for cash-flow management for revenue and spending of the city’s general fund in fiscal years 2019-20 and to make the city’s fiscal 2019-20 annual contributions to the fire and police pension plans and the city employee retirement system.

The note deal captured the attention of conservative-minded and cautious investors who were looking for high-quality short paper to put cash to workamid an otherwise typically quiet summer day, according to a New York trader.

“The market feels fine, but no one’s reaching for anything,” the trader said on Wednesday afternoon. “I am sure the L.A. TRANs deal did very well because there’s so much cash out there and people are not sure what they are going to do with their money so they need to park it someplace,” he added.

He said separately managed accounts with billions of dollars to spend were enticed by L.A.’s solid credit and good name recognition. The timing of the L.A. TRANS deal arrived amid the strong and consistent inflows over 24 weeks and heading into the hefty July 1 redemption season, the trader noted.

Judging by the balance of about $500 million on the deal late Wednesday, investors were eager to snap up the notes, according to Peter Delahunt, managing director of municipals at Raymond James & Associates.

"It seems like lots of interest at 1.20%," he said, noting that the balance was not bad given the original size of the deal. "The best offer I'm seeing now is 1.18%," he said late Wednesday.

He said the notes were attractive compared to a one-year FDIC-insured certificate of deposit obtained at a 2.30% yield — which for a California resident in the top 37% federal tax bracket and 13% state bracket offers an after-tax rate of 1.15%.

The deal also stole the primary market spotlight and provided one of the largest deals year-to-date for investors preoccupied with political, economic and market uncertainty.

“We’ve been bouncing around talking about the trade deal with China, and whether the Fed is going to cut rates 25 or 50 basis points, so there’s a lot of uncertainty keeping people on the sidelines temporarily,” the New York trader said. SMAs for retail investors have a lot of cash to spend or reinvest and the notes offer a short-term conservative and defensive alternative to the long-term market for skittish investors waiting for the Fed’s next move to pan out, as well as stability in the political and economic climate, he said.

Also Wednesday, Citigroup priced the Ohio Air Quality Development Authority’s (B3/B/NR) $307.2 million of Series 2019 exempt facilities revenue bonds subject to alternative minimum tax for the AMG Vanadium project.

Goldman Sachs priced Long Beach, California’s (Aa2/NR/AA) $162.125 million of Series 2019A non-AMT harbor revenue bonds.

JPMorgan priced and repriced the North Carolina Medical Care Commission’s (Aa3/AA-/AA-) $307.25 million of Series 2019A healthcare facilities revenue bonds for the Novant Health Obligated Group. And JPMorgan received the award on the Ohio Housing Finance Agency’s (Aaa/NR/NR) $150 million of Series 2019B residential mortgage revenue non-AMT bonds for its mortgage-backed securities program.

Tuesday’s muni sales

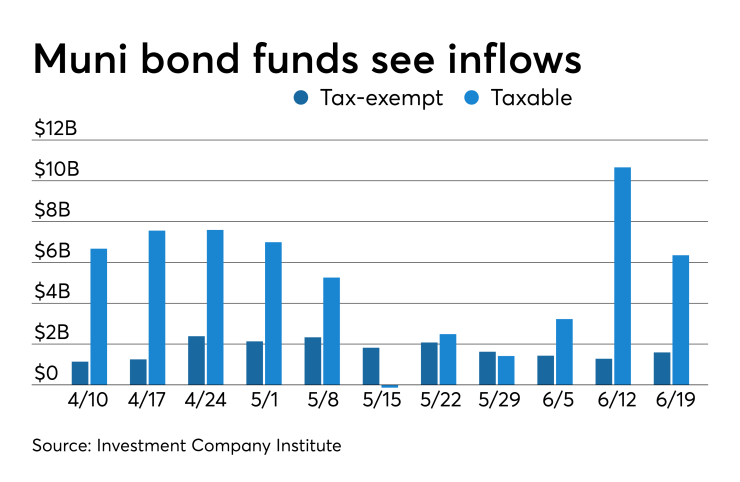

ICI: Muni funds see $1.6B inflow

Long-term municipal bond funds and exchange-traded funds took in a combined inflow of $1.590 billion in the week ended June 19, the Investment Company Institute reported on Wednesday.

It was the 24th straight week of inflows into the tax-exempt mutual funds and followed an inflow of $1.281 billion in the previous week.

Long-term muni funds alone saw an inflow of $1.414 billion after an inflow of $1.358 billion in the previous week; ETF muni funds alone saw an inflow of $176 million after an outflow of $77 million in the prior week.

Taxable bond funds saw combined inflows of $6.353 billion in the latest reporting week after inflows of $10.661 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $18.300 billion after inflows of $16.017 billion in the prior week.

Secondary market

Munis were stronger in late trade on the

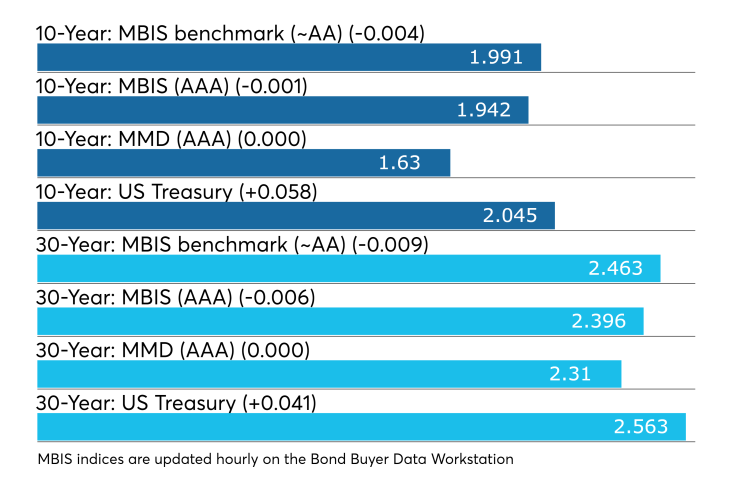

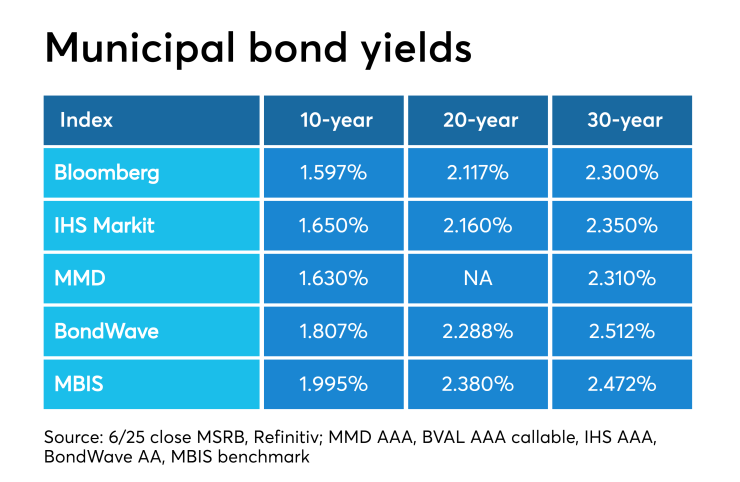

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year muni and 30-year muni GO remained unchanged at 1.63% and 2.31%, respectively.

"The ICE Muni Yield curve is steady around yesterday’s levels on muted volume," ICE Data Services said in a Wednesday market comment. "High-yield and tobaccos are likewise unchanged along with Puerto Rico. The taxable sector is 3.8 basis points higher."

The 10-year muni-to-Treasury ratio was calculated at 79.5% while the 30-year muni-to-Treasury ratio stood at 90.0%, according to MMD.

Treasuries were weaker as stocks were little changed. The Treasury three-month was yielding 2.144%, the two-year was yielding 1.776%, the five-year was yielding 1.795%, the 10-year was yielding 1.942% and the 30-year was yielding 2.563%.

Previous session's activity

The MSRB reported 41,112 trades Tuesday on volume of $11.53 billion. The 30-day average trade summary showed on a par amount basis of $12.70 million that customers bought $6.40 million, customers sold $4.20 million and interdealer trades totaled $2.10 million.

California, Texas and New York were most traded, with the Golden State taking 13.753% of the market, the Lone Star State taking 11.329% and the Empire State taking 10.70%.

The most actively traded security was the South Carolina Connector 2000 Association Inc. Series 2011C-1 capital appreciation revenue zeros of 2051, which traded eight times on volume of $35.18 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.