Municipals resumed their rally on Thursday, with yields falling on the AAA scales by as much as four basis points.

The last of the week's hefty supply surged into the market and into the eager arms of buyers.

In the week ended July 15, muni tax-exempt mutual funds saw $857.321 million of inflows, according to Refinitiv Lipper, marking the 10th straight week investors put cash into the funds.

Primary market

In the backdrop of a typical summer day, new issues did well despite being fairly aggressively priced on Thursday, according to John Mousseau, president and chief executive officer of Cumberland Advisors.

The New York New Jersey Port Authority and New York Urban Development Corp. deals were a case in point — though he expected the deals to get done.

“You have definitely entered the second half of the year with the market favoring issuers over investors,” Mousseau said Thursday afternoon.

That means plenty of supply coming — both from traditional issuers, but also those more pandemically affected as those yields have declined with the market, according to Mousseau.

“We will have some opportunities as issuers will no doubt be like shoppers all going through the revolving doors,” Mousseau added.

BofA Securities priced and repriced the New York State Urban Development Corp.’s (Aa1/NR/AA+/NR) $2.225 billion of Series 2020C tax-exempt general purpose state personal income tax revenue bonds after a one-day retail order period.

The deal was repriced to yield from 0.21% with a 5% coupon in 2021 to 2.15% with a 4% coupon in 2045 and from 2.02% with a 5% coupon in 2047 to 2.05% with a 5% coupon in 2050.

The deal had been tentatively priced to yield from 0.21% with a 5% coupon in 2021 to 2.20% with a 4% coupon in 2045 and from 2.02% with a 5% coupon in 2047 to 2.05% with a 5% coupon in 2050.

Ramirez & Co. priced and repriced the Port Authority of New York & New Jersey’s (A3/A+/AA-/NAF) $1.099 billion of consolidated bonds after holding a one-day retail order period.

The $653.505 million of 221st Series bonds, subject to alternative minimum tax, were repriced to yield from 0.39% with a 5% coupon in 2021 to 2.33% with a 4% coupon in 2040, 2.47% with a 4% coupon in 2045, 2.55% with a 4% coupon in 2050, 2.65% with a 4% coupon in 2055 and 2.75% with a 4% coupon in 2060.

The 221st Series had been tentatively priced to yield from 0.39% with a 5% coupon in 2021 to 2.40% with a 4% coupon in 2040, 2.55% with a 4% coupon in 2045, 2.60% with a 4% coupon in 2050 and 2.70% with a 4% coupon in 2060.

The $437.915 million of 222nd Series bonds were repriced to yield from 0.26% with a 5% coupon in 2021 to 2.08% with a 4% coupon in 2040. The bonds had been tentatively priced to yield from 0.26% with a 5% coupon in 2021 to 2.15% with a 4% coupon in 2040.

Montgomery County, Md., (Aaa/AAA/AAA/) competitively sold about $850 million of general obligation bonds in three offerings.

Citigroup won the $366.105 million of Series 2020C taxable GO consolidated public improvement refunding bonds of 2020 with a true interest cost of 1.4799%.

The taxables were priced to yield from 20 basis points over the comparable Treasury security in 2022 to 120 basis points over the comparable Treasury in 2032.

Morgan Stanley won the $320 million of Series 2020A GO consolidated public improvement bonds of 2020 with a TIC of 1.4216%.

The bonds were priced to yield from 0.18% with a 4% coupon in 2021 to 2.04% with a 2% coupon in 2040.

JPMorgan Securities won the $163.95 million of Series 2020B GO consolidated public refunding bonds of 2020 with a TIC of 0.7398%.

The bonds were priced to yield from 0.20% with a 4% coupon in 2023 to 1.05% with a 4% coupon in 2032.

Davenport & Co. was the financial advisor; McKennon Shelton was the bond counsel.

Citigroup priced the Virginia College Building Authority’s (Aa1/AA+/AA+/NR) $344.48 million of Series 2020A tax-exempt educational facilities revenue bonds for the 21st Century college and equipment programs.

The exempts were priced to yield from 0.14% with a 5% coupon in 2021 to 1.71% with a 4% coupon in 2040.

Citi also priced the authority’s $341.455 million of Series 2020B taxable revenue and refunding bonds.

The taxables were priced at par to yield from 0.345% in 2021 to 2.165% in 2034 and 2.509% in 2040.

BofA priced Tampa, Fla.’s (Aaa/AAA/AAA/NR) $266.875 million of Series 2020A water and wastewater systems revenue bonds.

The deal was priced to yield from 1.02% with a 5% coupon in 2032 to 1.66% with a 4% coupon in 2041, 1.74% with a 4% coupon in 2044, 1.60% with a 5% coupon in 2046, 1.84% with a 4% coupon in 2048, 1.65% with a 5% coupon in 2050 and 1.75% with a 5% coupon in 2054.

BofA also priced Tampa’s $92.04 million of Series 2020B taxable water and wastewater systems refunding revenue bonds. The bonds were priced at par to yield from 0.349% in 2021 to 1.518% in 2031.

BofA priced the Board of Governors of Wayne State University’s (Aa3/A+/NR/NR) $115.515 million of Series 2020A taxable general revenue bonds.

The bonds were priced at par to yield from 0.897% in 2021 to 2.76% in 2035, 3.392% in 2040 and 3.492% in 2050.

Morgan Stanley priced the Maine Health and Higher Educational Facilities Authority’s (A1/A+/NR/NR) $214.46 million of Series 2020A revenue bonds for MaineHealth.

The bonds were priced to yield from 0.92% with a 5% coupon in 2026 to 2.28% with a 4% coupon in 2040, 2.38% with a 4% coupon in 2045 and 2.43% with a 4% coupon in 2050.

Citi received the written award on the Upper Santa Clara Valley Joint Powers Authority, Calif.’s (NR/AA/AA-/NR) $251.075 million of Series 2020A revenue bonds and Series 2020B taxable revenue bonds.

Raymond James & Associates received the official award on the Oxnard Union High School District of Ventura County, Calif.’s (Aa2/NR/NR/NR) $20 million of Election of 2018 Series B tax-exempt and taxable GOs.

Money market muni funds fall $4.3B

Tax-exempt municipal money market fund assets fell $4.3 billion, bringing total net assets to $125.79 billion in the week ended July 13, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds was steady at 0.02% from the previous week.

Taxable money-fund assets decreased $61.36 billion in the week ended July 14, bringing total net assets to $4.413 trillion.

The average, seven-day simple yield for the 791 taxable reporting funds slipped to 0.05% from 0.06% in the prior week.

Overall, the combined total net assets of the 978 reporting money funds fell $65.66 billion in the week ended July 14.

Secondary market

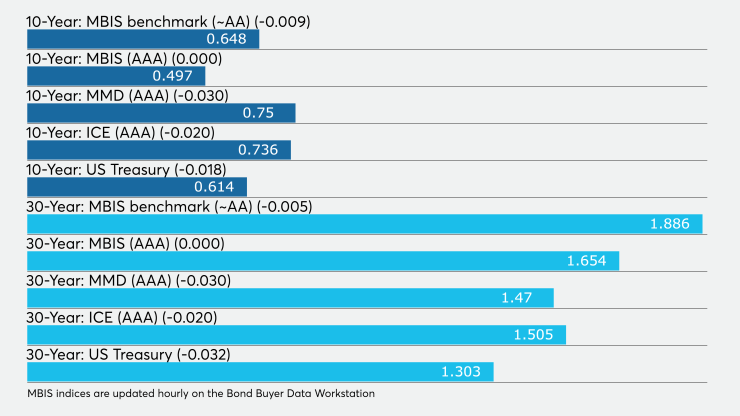

Municipals strengthened all across the curve Thursday, according to readings on Refinitiv MMD’s AAA benchmark scale. Yields on the 2021 and 2023 GO munis fell four basis points to 0.15% and 0.17%, respectively. The yield on the 10-year GO muni dropped three basis points to 0.75% while the 30-year yield lost three basis points to 1.47%.

The 10-year muni-to-Treasury ratio was calculated at 123.0% while the 30-year muni-to-Treasury ratio stood at 112.8%, according to MMD.

The ICE AAA municipal yield curve showed short yields falling two basis points to 0.150% in 2021 and 0.172% in 2022. The 10-year maturity was off two basis points to 0.736% and the 30-year was down two basis points to 1.505%.

ICE reported the 10-year muni-to-Treasury ratio stood at 128% while the 30-year ratio was at 113%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.15% and the 2022 maturity at 0.18% while the 10-year muni was at 0.75% and the 30-year stood at 1.48%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were stronger as stock prices traded lower.

The three-month Treasury note was yielding 0.119%, the 10-year Treasury was yielding 0.614% and the 30-year Treasury was yielding 1.303%.

The Dow fell 0.96%, the S&P 500 decreased 0.71% and the Nasdaq lost 0.98%.

BlackRock: Look at sectors less impacted by virus

Supply-demand dynamics are likely to remain favorable in the near term, according to BlackRock’s municipal market update, which said the firm is maintaining a neutral stance on duration in its municipal bond exposure.

“While we continue to hold an overall high quality bias, we are tactically seeking to take advantage of opportunities in lower-rated credits offering attractive spreads within sectors less impacted by the COVID pandemic,” write Peter Hayes, head of BlackRock’s municipal bonds group, James Schwartz, head of municipal credit research, and Sean Carney, head of municipal strategy.

It has a barbell strategy that prefers zero to 5 years and 20 years and longer, BlackRock said in This week's report.

BlackRock overweights higher quality states and essential-service bonds, school districts and local governments supported by property taxes, flagship universities and strong national and regional health systems, and select issuers in the high-yield space.

It underweights speculative projects with weak sponsorship, unproven technology or unsound feasibility studies, senior living and long-term care facilities, small colleges, student housing, and single-site hospitals, and credits highly correlated to the hospitality, travel and leisure sectors.