As the Federal Reserve began its two-day monetary policy meeting, the municipal bond market shook off any worries about interest rate changes and saw a slew of bond sales moved off the screens and into the arms of eager buyers.

The Federal Open Market Committee is gathering in Washington to decide on interest rates and while it’s not expected to lower rates on Wednesday, market participants will be looking for any signs of future easing.

In a press briefing Tuesday morning, Dominick DeAlto, CIO and head of fixed-income at BNP Paribas Asset Management, said he expected inflation and interest rates “to remain lower for longer” in the U.S.

He added that looking at historic economic cycles were not as helpful in forecasting as they had been in the past.

“Given the highly accommodative approach that most central banks have taken over the last 10 years, we as a market are effectively addicted to liquidity,” DeAlto said. “And that has denormalized cycles as we know them — meaning that even the slightest downtick in economic information, tends to make central banks very nervous, such that we no longer have the ebbs and flows of cycles.”

Primary market

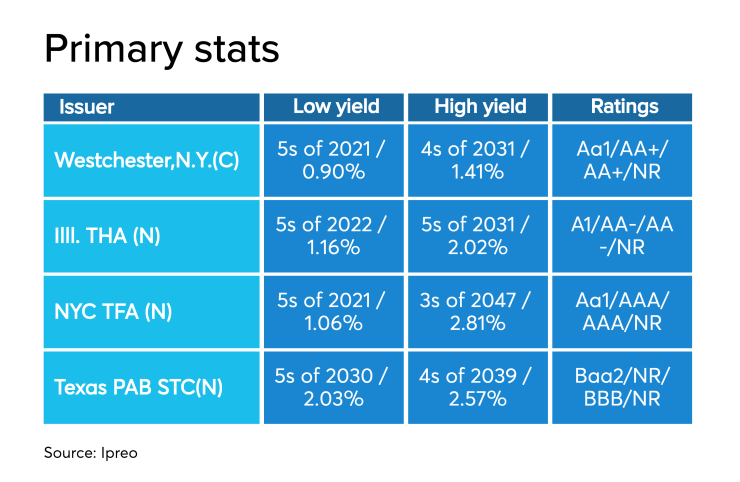

JPMorgan Securities priced the Texas Private Activity Bond Surface Transportation Corp.’s (Baa2/NR/BBB/NR) $1.2 billion of senior lien revenue refunding bonds, featuring non-alternative minimum tax private activity bonds and taxable bonds for the

Goldman Sachs priced the

Citigroup priced the Illinois State Toll Highway Authority’s (A1/AA-/AA-/NR) $699.105 million of senior revenue refunding bonds.

Morgan Stanley priced Rhode Island’s $203.805 million of consolidated capital development loan of 2019, Series C tax-exempts and capital development loan of 2019, refunding Series E tax-exempts.

JPMorgan Securities priced for retail the New York City Transitional Finance Authority’s (Aa1/AAA/AAA/NR) $850 million of future tax secured subordinate bonds, Fiscal 2020 Series B Sub-Series B-1 tax-exempts.

In the competitive arena, Westchester County, N.Y., (Aa1/AA+/AA+/NR) sold $133 million of Series 2019D unlimited tax general obligation bonds. Mesirow Financial won the issue with a true interest cost of 1.53%.

Capital Markets Advisors was the financial advisor; Hawkins Delafield was the bond counsel. Proceeds will be used to finance various capital improvements.

Since 2009, the county has sold over $1.5 billion of debt, with the most issuance occurring in 2010 when it offered $258 million. It sold the least amount of bonds in 2014 when it issued $9.2 million.

The Washoe County School District, Nevada, (Aa3/AA/NR/NR) sold $100 million of limited tax general obligation school improvement bonds. JPMorgan won the issue with a true interest cost of 2.785%.

JNA Consulting Group was the financial advisor; Sherman & Howard was the bond counsel. Proceeds will be used to acquire, construct, improve and equip the district’s school facilities.

Hayes: Same into 2020

Peter Hayes, head of BlackRock's municipal bond group, said he anticipates municipals will continue their current performance, at least in the first quarter of 2020, save for a major credit, political or Fed event — events he does not see happening.

Hayes spoke at BlackRock's 2020 Outlook media briefing Tuesday morning and outlined his strategies over the past few years and what to look for in 2020. Hayes said he anticipates a continuation of the same.

The elections likely will not have a large effect on the market in 2020, he said, and discussions around infrastructure or tax policy changes won't likely be strongly considered until well into 2021. "The outcome from the last election was different than the market expected and the market reaction was also different. This election there might not be as much positioning," he said.

The most under-appreciated risk in the municipal market in 2020? Hayes pointed to liquidity in the high-yield space.

He said that high-yield market, a fragmented, often including distressed credits, with at its core small specialty issuers, such as continuing care retirement communities, among others, have, and will continue to see significant spread compression. He said it is a top category to own and high demand will continue coupled with the very low supply that will persist in 2020, all will contribute to a continuation of current market conditions for that space.

"Why do municipal investors buy municipals? Income. This market has done quite well in 2019, so we manage our municipal portfolio by being flexible, pulling a lot of levers, dialing up credit in high-yield," he said.

Secondary market

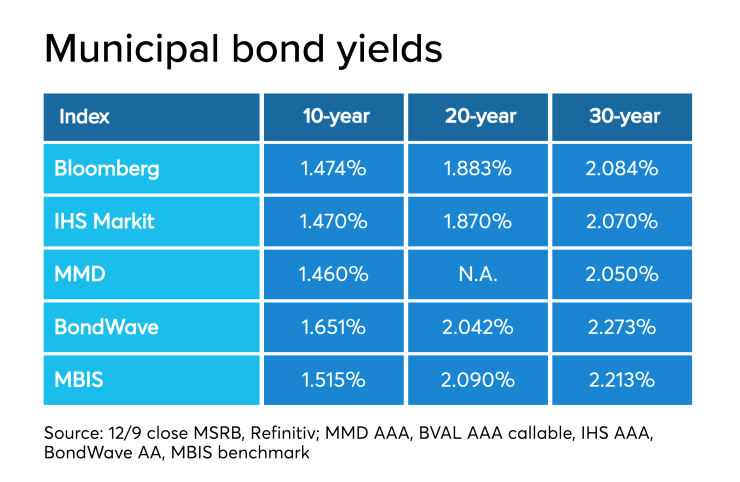

Munis were stronger on the MBIS benchmark scale, with yields falling by one basis point in the 10- and 30-year maturities. High-grades were also stronger, with yields on MBIS AAA scale falling by one basis point in the 10- and 30-year maturities.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO fell one basis point to 1.45% while the 30-year dropped one basis point to 2.04%.

“The muni market is outperforming Treasuries today with the ICE muni yield curve down one basis point,” ICE Data Services said in a Tuesday market comment. “Tobacco and high-yield are also one basis point lower.”

The 10-year muni-to-Treasury ratio was calculated at 78.9% while the 30-year muni-to-Treasury ratio stood at 90.2%, according to MMD.

Stocks were little changed as Treasuries weakened.

The Dow Jones Industrial Average was up about 0.01% as the S&P 500 Index inched up 0.02% while the Nasdaq gained 0.05%.

The Treasury three-month was yielding 1.554%, the two-year was yielding 1.658%, the five-year was yielding 1.681%, the 10-year was yielding 1.841% and the 30-year was yielding 2.265%.

Previous session's activity

The MSRB reported 32,065 trades Monday on volume of $8.58 billion. The 30-day average trade summary showed on a par amount basis of $11.30 million that customers bought $6.21 million, customers sold $3.10 million and interdealer trades totaled $1.99 million.

California, Texas and New York were most traded, with the Golden State taking 13.849% of the market, the Lone Star State taking 10.551% and the Empire State taking 10.492%.

The most actively traded security was Puerto Rico GDB Debt Recovery taxable 7.5s of 2040, which traded 38 times on volume of $27.74 million.

Treasury sells notes

The Treasury Department auctioned $27 billion of 9-year 11-month notes with a 1 3/4% coupon at a 1.842% high yield, a price of 99.168608. The bid-to-cover ratio was 2.43.

Tenders at the high yield were allotted 74.25%. All competitive tenders at lower yields were accepted in full. The median yield was 1.800%. The low yield was 0.880%.

The Treasury also said it will sell $40 billion of four-week discount bills Thursday. There are currently $40 billion of four-week bills outstanding. Additionally, Treasury will sell $35 billion of eight-week bills Thursday.

Lynne Funk and Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.