CHICAGO - The Illinois General Assembly is expected to vote next week on a proposal from Gov. Pat Quinn to issue up to $2.23 billion of five-year general obligation bonds to fund a portion of the state's $4 billion pension payment owed to the retirement systems in fiscal 2010.

Under SB 415, now before the General Assembly, the state would use the proceeds of the sale to cover the general fund-supported portion of the payment that goes toward the $73 billion unfunded pension liability.

Quinn proposed in his budget skipping that portion of the payment as part of his plan to eliminate a $12 billion deficit in his $52.9 billion operating budget, arguing that such a move could be afforded because proposed pension reforms would bring down future costs.

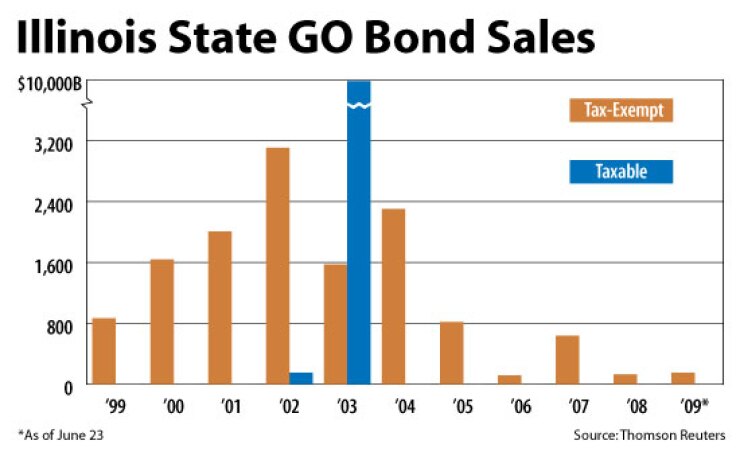

Lawmakers rejected any effort to skip the payment, prompting the state's finance team to look at financing options, including a private placement with the pension funds. The remainder of the $4 billion payment includes $1.2 billion for normal costs - which represents the present value of the benefits earned by pension plan members - and $500 million for debt service on the state's $10 billion 2003 GO pension obligation bonds and other non-general fund payments.

"This borrowing would free up general funds to avoid deep cuts to essential services," state debt manager Phil Culpepper said yesterday. Illinois would issue the debt in the first or second quarter of the new fiscal year beginning July 1 if a final budget agreement is reached.

It is not yet clear whether the debt or some piece of it would qualify for a tax-exemption under Internal Revenue Service working cash rules, Culpepper added.

Officials are referring to the bonds as notes to differentiate them from longer-term pension obligation bonding. In negotiations with the pension funds and legislative leaders, Culpepper said the five-year term, with level principal throughout, was the most acceptable as a means to provide short-term budget relief.

Illinois would pick a finance team from the list of qualified financial advisers, bond counsel, and underwriters that submit proposals to the state by July 2. Firms picked for various roles would work on deals over the next two years.

Quinn said he reached agreement with legislative leaders on the bonding proposal at a meeting late Tuesday. The House was expected to consider the legislation yesterday, but a vote by the full chamber was postponed until Monday after Minority Leader Tom Cross, R-Plainfield, sought additional details on spending plans. The Senate would consider the bill after House passage.

"The speaker supports the note issue," said Steve Brown, a spokesman for Democratic House Speaker Michael Madigan, D-Chicago. The House and Senate are controlled by Democrats but a three-fifths majority is needed for approval of any state borrowing and on all legislation, now that lawmakers are meeting in special session.

The Democratic governor and lawmakers are continuing meetings in an attempt to resolve differences over how to close what Quinn has tallied as a $9 billion deficit that remains in the fiscal 2010 budget. Lawmakers adjourned at the end of May after approving a spending plan with funding for just six months. Quinn has warned of deep spending cuts that would harm the state's social services network if an income tax increase is not approved.

Without a balanced 12-month budget in place, Illinois has put any immediate borrowing plans on hold. Officials had planned on selling $1.25 billion of cash-flow certificates before the end of the month to ease payment delays and close out the fiscal year in the black.

The certificate financing was part of a $2.25 billion deficit financing plan that called for the certificates to be repaid in the next fiscal year. The state sold the first piece, $1 billion, in April.

Rating analysts are watching the outcome of the budget mess closely. Moody's Investors Service lowered Illinois' long-term GO rating on $19 billion of debt one notch in April to A1. Fitch Ratings rates the state AA-minus but has it on negative watch. Standard & Poor's downgraded the credit in March to AA-minus.