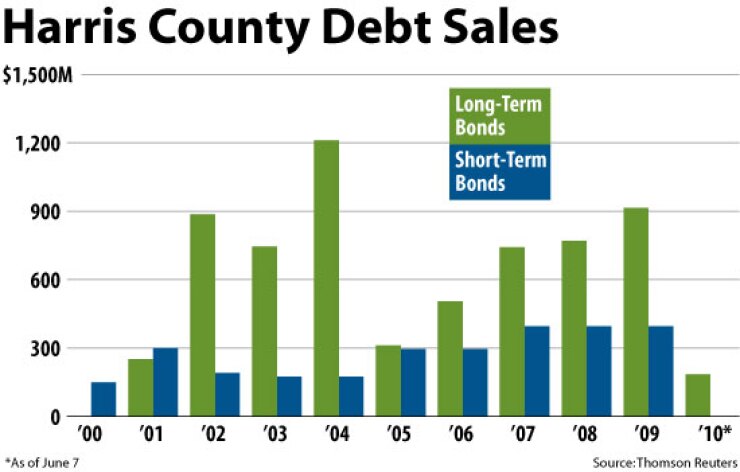

DALLAS — Houston and Harris County will be pumping about $1 billion of short- and long-term debt into the market this month as they seek to position themselves for leaner economic times.

Harris County will price $250 million of refunding bonds on Thursday with the aim of easing demands on property taxes that are expected to produce lower revenues, according to Edwin Harrison, director of financial services.

“Our book-runner, Jefferies & Co., came up with the idea where we will be able to shave approximately $30 million off our debt-service requirements for 2011 and 2012,” Harrison said. “We will have present-value savings of 2 to 3%, and we’ll actually have gross savings.”

The underwriting team includes Mesirow Financial Inc., Barclays Capital, Hutchison, Shockey, Erley & Co., JPMorgan, Loop Capital Markets, Piper Jaffray & Co., and Siebert Brandford Shank & Co. First Southwest Co. is financial adviser. Greenberg Traurig is bond counsel.

The general obligation bonds, rated triple-A across the board, will be issued as $100 million of Series 2010A road refunding bonds and $150 million of Series B permanent improvement refunding bonds.

Given the top ratings, Harrison said he expects “the appropriate response.”

“People have always been eager to purchase our bonds, and I don’t expect anything different this time,” he said.

This deal marks the beginning of a busy summer for the most populous county in Texas, which includes Houston.

On June 26, the county will issue about $550 million of tax revenue anticipation notes to ease cash flows over the fiscal year that began March 1. The note deal is about $100 million higher this year than last, a fact Harrison attributes to the softening economy.

Before the end of August, the county expects to sell bonds to refund $250 million of commercial paper for the Port of Houston, take out $100 million of put bonds for the County Hospital District, and $200 million of put bonds for the Harris County Toll Road Authority. The county will also issue $200 million of debt to convert commercial paper for flood control to fixed-rate bonds.

Houston, meanwhile, is preparing for the competitive sale of $230 million of Trans through Grant Street Auctions on June 16. First Southwest is financial adviser on the deal.

Harris County’s and Houston’s notes carry top ratings. Houston’s GO rating is AA from Standard & Poor’s and Fitch Ratings, and Aa2 from Moody’s Investors Service.

Both the city and county base their tax rates on assessments from the Harris County Appraisal District, which has projected a drop in valuations of 3% to 4% this year, Harrison said.

“If they’re down 3% to 4%, then we will get less tax money, so we have to make preparations for our budget,” Harrison said.

While Houston and Harris County were spared the worst impacts of the recession that began in 2007, they are now facing the effects of a weakening energy sector with the dramatic fall of record oil prices in 2008 and 2009. Adding to the uncertainty are restrictions on deep-sea offshore drilling in the Gulf of Mexico after the BP oil spill that continues to gush crude into the fragile ecosystem. The sprawling urban area continues to grow, despite rising unemployment, analysts noted.

“Although ample total taxing margin remains, political considerations and the allocation of taxing capacity to numerous component units will continue to restrict the taxing flexibility for county operations,” analysts for Fitch Ratings said. “A projected modest decline in taxable values will further limit financial flexibility in the next fiscal year; however, management has expressed its commitment to maintaining a balanced budget. Additionally, the recently reinstated public improvement contingency (PIC) fund will serve as a valuable buffer in the interim.”