After seeing yields spike in recent days to close out the week, the muni market will see under $5 billion in the upcoming holiday-shortened week.

Ipreo forecasts weekly bond volume will decrease to $4.4 billion from a revised total of $8.1 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $3.6 billion of negotiated deals and $815.3 million of competitive sales.

The sales will be jammed into a two-day time frame during the shortened trading week. U.S. financial markets will be closed on Monday for Columbus Day.

“The sell-off we have seen recent caused by the sudden spike in Treasury yields, reminds us of what happened earlier this year in January,” said Jim Grabovac, senior portfolio manager at McDonnell Investment Management. “It seems like this time around, there was no particular catalyst, but after the January episode, we then saw seven straight months of trading all within a solid range.”

He added that earlier in the year, "we saw that 10-year Treasury breach that 3.00% and then it would retrace – this time around it just busted through."

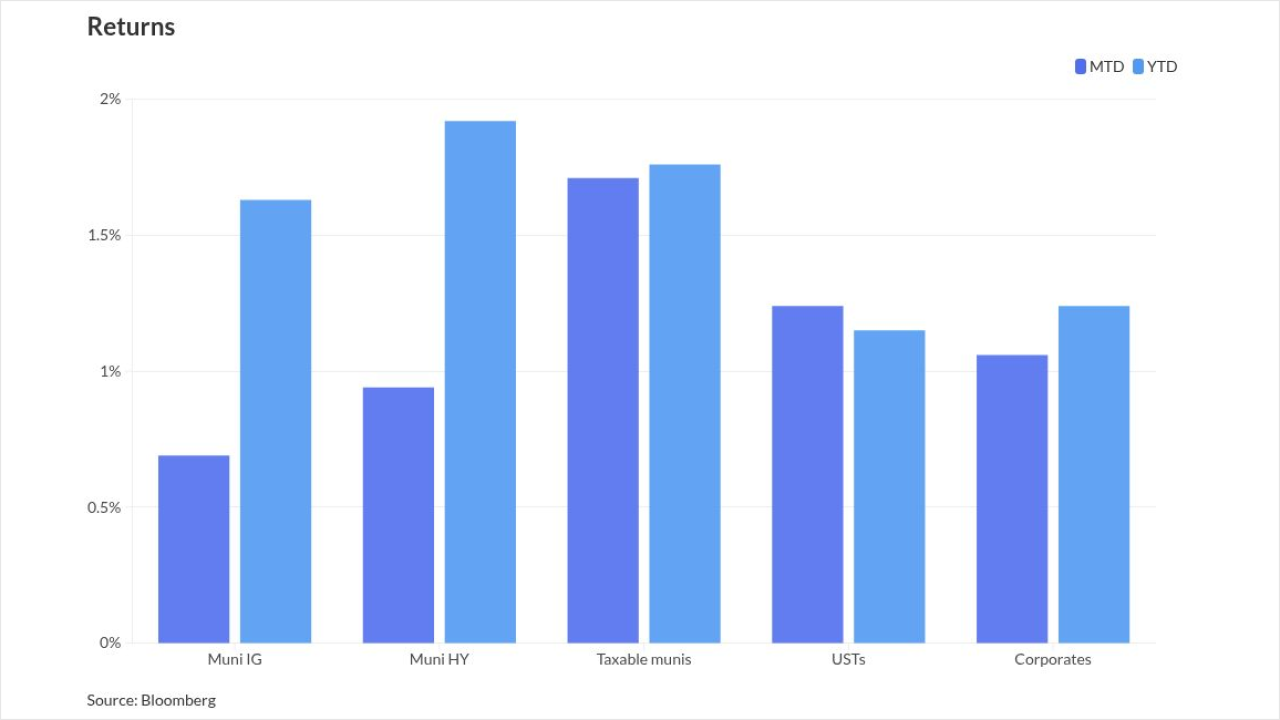

Dawn Mangerson, senior portfolio manager at McDonnell, said that despite the hiccup this past week, they still expect munis to outperform Treasuries.

“Munis are still very attractive and there is a lot of money to put to work – since there is little new issuance, and all are getting small allocations,” she said. “Munis should stay firm, but unfortunately, we don’t see a huge uptick in supply at least for the remainder of the year.”

Topping the negotiated sector, the Maricopa County Special Health Care District, Ariz., is coming to market with $400 million of general obligation bonds.

JPMorgan Securities is set to price the Series 2018C GOs on Thursday. Proceeds of the sale will be used for capital improvements or renovations to the district’s hospitals and ambulatory and outpatient facilities. The deal is rated Aa3 by Moody’s Investors Service and AAA by Fitch Ratings.

Siebert Cisneros Shank & Co. is expected to price the North Texas Tollway Authority’s $347 million of Series 2018 second tier revenue refunding bonds on Thursday. The deal is rated A2 by Moody’s and A by S&P Global Ratings.

In the competitive arena, the Fremont Unified School District, Calif., is selling $127 million of Series C Election of 2014 GOs on Wednesday. Proceeds are being issued to acquire, repair and build the district’s equipment, sites and facilities. The deal is rated AA-minus by S&P.

In the short-term competitive sector, the Louisville and Jefferson County Metropolitan Sewer District in Kentucky is selling $226 million of sewer and drainage system subordinated bond anticipation notes on Tuesday.

It may be a blessing in disguise that next week’s new issue calendar declines to $4 billion following the Treasury weakness that spooked the market on Wednesday and Thursday and was still causing reluctant investors to continue to pull back on Friday afternoon.

“The market activity has ebbed with the backup in rates,” said Peter Delahunt, managing director of municipals at Raymond James & Associates. “Most of the limited activity seems to be via tax loss swapping.”

Meanwhile, a New York trader said there were positive and negative aspects of the market weakness that may impact demand going forward.

“Higher yields will entice retail to some extent on the 4% coupons,” since that is considered a psychologically attractive magical number among the Mom and pop crowd, he said.

However, it may deter institutional accounts as ratios fall below 100%.

“With munis outperforming Treasuries, the ratios on the long end may discourage arb activity and the recent demand entry from the insurance companies.”

Secondary market

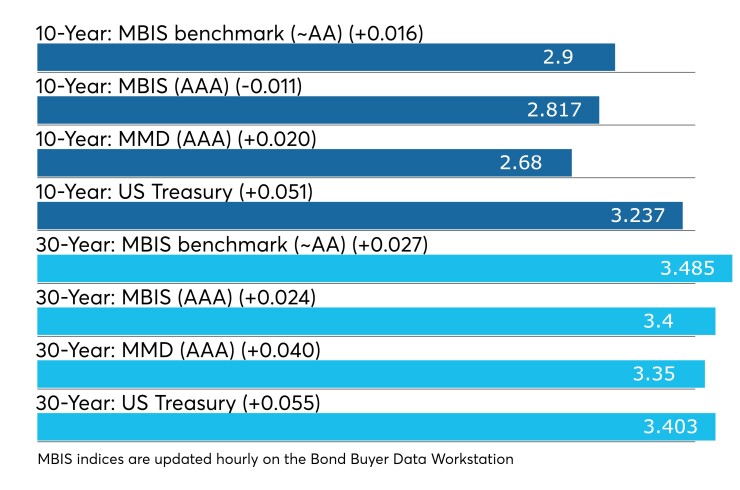

Municipals were weaker, according to a late read of the MBIS benchmark scale. Muni yields rose as much as two basis points in the one- to 30-year maturities.

High-grade munis followed right along as yields increased by no more than two basis points in the one- to 30-year maturities.

Municipals were also weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation two basis points higher and yields on the 30-year muni maturity jumped up by four basis points.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 83.2% while the 30-year muni-to-Treasury ratio stood at 98.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

ICI: Long-term muni funds saw $385M outflow

Long-term tax-exempt municipal bond funds saw an outflow of $385 million in the week ended Sept. 26, the Investment Company Institute reported.

This followed an inflow of $116 million into the tax-exempt mutual funds in the week ended Sept. 19 and inflows of 30 million, $4 million, $273 million, $531 million, $662 million, $723 million, $163 million, $600 million and $1.765 billion in the nine prior weeks.

Taxable bond funds saw an estimated inflow of $3.058 billion in the latest reporting week, after seeing an inflow of $4.223 billion in the previous week.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $1.011 billion for the week ended Sept. 26, after inflows of $13.145 billion in the prior week.

Treasury contagion

The impact of the Treasury weakness continued in the municipal market on Thursday as buyers reacted with some uncertainty, resistance, and skittishness, according to one New York trader.

“The market has undergone somewhat of a paradigm shift this week and psychological change,” he said. “The break in Treasuries is bringing about some speculation about the end of the 30-year bull market after Treasuries puked overnight,” he said. “That changes the psychology of the market without a doubt.”

With higher rates expected in the future, Treasuries bounced around and municipals felt the impact as yields rose. “We could go to between 3% and 3.50% on the 10-year Treasury in the next range and it will take a while until the new levels settle in,” he said.

Within that context, he said municipals are “doing OK” — despite seeing yields bump up as much as three basis points on Thursday afternoon. “Today the market opened up as if it needed to adjust to the down trade that it didn’t adjust to yesterday,” he said Thursday.

“There is still solid demand out there, but the demand is bifurcated … with the SMAs and individual retail on the front end, and the long end the institutional accounts,” he added. “If we were to gap lower in Treasuries the reaction would be to drop the bid substantially in munis.”

The trader noted the last time Treasuries were this volatile was two years ago in November 2016, following the presidential election. “When it moves that much for the first time in two years you back off a little bit,” he said of Thursday’s market skittishness.

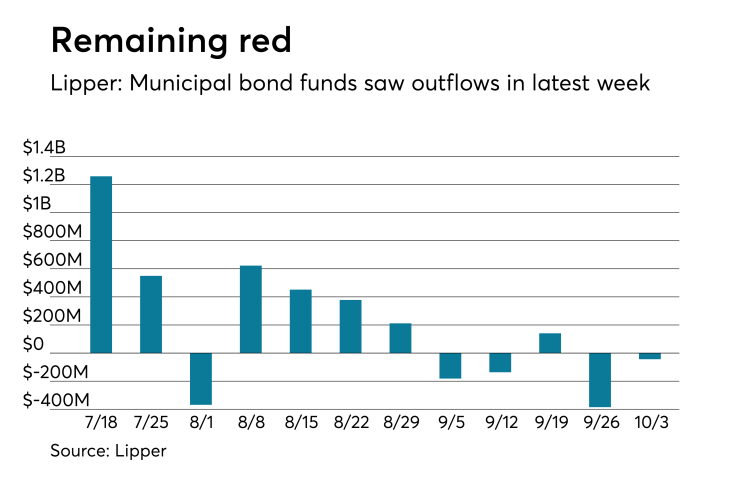

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds remained cautious and again pulled cash out of the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $43.626 million of outflows in the week ended Oct. 3 after outflows of $384.796 million in the previous week.

Exchange-traded funds reported inflows of $116.152 million, after outflows of $152.012 million in the previous week. Ex-ETFs, muni funds saw $159.778 million of outflows, after outflows of $232.784 million in the previous week.

The four-week moving average remained negative at -$106.017 million, after being in the red at $140.470 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $91.187 million in the latest week after outflows of $371.535 million in the previous week. Intermediate-term funds had outflows of $140.647 million after inflows of $131.732 million in the prior week.

National funds had inflows of $28.651 million after outflows of $346.384 million in the previous week. High-yield muni funds reported outflows of $113.789 million in the latest week, after outflows of $129.551 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.