Hawaii plans to price $550 million in general obligation bonds next week.

The state's finance team doesn’t expect the market’s volatility to hamper buyer interest.

The size of the deal from a state that has previously sold a $1 billion in one shot should make it easily digestible, said Roderick Becker, the state’s finance director.

Hawaii deals have sparked a lot of interest from institutional buyers in the past, but Scott Kami, administrator of Hawaii's Financial Administration Division, said he hopes the rising interest rates on the short end will garner interest from retail buyers.

The bonds are being sold in three tranches: a $454.2 million tax-exempt series, a $50 million taxable series, and a $45.7 million taxable series. A retail order period is planned for Feb. 5 followed by institutional pricing on Feb. 6.

Bank of America Merrill Lynch is lead book runner and Morgan Stanley is co-senior manager. Goldman Sachs & Co., Wells Fargo Securities, and Stifel Nicolaus & Co. are co-managers. PFM is financial advisor and Katten Muchin Rosenman LLP is bond counsel.

The state is likely to be a steady bond market presence given its substantial capital needs.

The state’s Department of Education reported in late 2018 that the state has an $868 million backlog of school maintenance projects. In contrast to other states, K-12 education is operated and funded entirely at the state level in Hawaii.

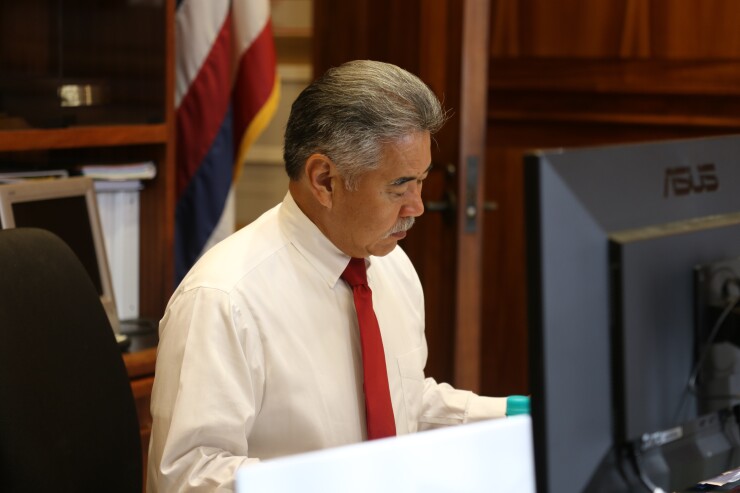

Gov. David Ige proposed spending $2 billion in fiscal year 2020 and $1.4 billion in fiscal year 2021 for state capital improvement projects in the budget plan he released in late December for the 2019-2021 biennium. General obligation bonds totaling $978.2 million and $731.5 million would be issued in the respective years to help fund the program.

A significant amount of the requested GO bond funds are for projects to “address health and safety, capacity, equity and program support issues at our public schools. We have also requested funding to convert 22 classrooms statewide to pre-kindergarten classrooms,” according to Ige’s budget proposal.

One of Ige's priorities has been to improve early childhood education.

Ige credits the state’s budget and financial policies for one-notch ratings upgrades from Moody’s Investors Service and S&P Global Ratings in 2016 and a revised outlook to positive from Fitch in 2017.

“It makes good financial sense to address these priority needs while our bond rating is at its highest, which will help reduce debt service costs,” Ige said in his budget proposal.

Ahead of the deal, S&P affirmed its AA-plus rating, Moody's affirmed its Aa1 rating and Fitch affirmed its AA rating. The state has stable outlooks from S&P and Moody’s and a positive outlook from Fitch.

Fitch analysts cited in a report ahead of the sale ongoing improvements in the state’s management of its substantial long-term liabilities and it’s expectation that the state will maintain its existing strong financial flexibility as it grapples with its pension and other post-employment benefit liabilities.

Fitch rates $7.2 billion of outstanding Hawaii GOs and $4 million in certificates of participation 2009A.

Analysts also highlighted the state’s strong economy with unemployment at 2%, the lowest in the nation, and evidence of increasing economic diversity. State officials calculate that tourism’s share of the economy has dropped to 17% today from 33% of general domestic product in 1988, according to Fitch.

The state has been dinged by rating agencies previously for its dependence on tourism.

The healthcare sector and business and professional services are the sectors that have experienced the most growth, Becker said.

“Hawaii has one of the highest rates of longevity,” Kami said. “That has resulted in increased demand for elderly healthcare. We have some other folks from Pacific Rim countries coming to Hawaii for healthcare services.”

The rating agencies also highlighted strides the state has made to deal with its pension liabilities and its sizable reserves.

The state increased its other post-employment benefits payment to 100% of the actuarially required contribution in fiscal 2019. It also adopted a schedule of increased pension contributions in 2017 with the aim of reached full funding within a 30-year horizon and attaining roughly $15 billion expected savings.

“Notably, in fiscal years 2014 through 2018, the state contributed more than the statutorily required amounts which will result in savings in future years,” Moody’s wrote. “The legislature also enacted, in 2017, higher employer pension contributions in response to a significant increase in the estimated pension liability.”

Historically, there have been a number of benefit decreases for new employees, requiring both employers and employees to contribute more, Becker said. The state recently raised contribution rates for employers from 17% to 24% for most employees.

“We are making lot of progress on contribution side right now,” Becker said.

The state has made 20% increases each year to its OPEB ARC funding over the past five years to hit 100% funding of it this year, Becker said.

“We will now make full payment of ARC until that liability is addressed as well,” he said.

The pension system has an unfunded pension liability of $13.4 billion for fiscal year 2018 and $9.4 billion in unfunded OPEB liability as of July 1, 2018.

Becker said the pension liability, which has grown from $12.4 billion in 2016, is being amortized and will slowly decline to zero over the next 25 years.

Moody’s cautioned that the state's fixed costs will remain among the highest in the country at least over the medium term, which, combined with the volatility of its tourism-based economy, will challenge it in the event of a downturn.

S&P lauded the state for its multi-year budget tracking, efforts to reduce pension liabilities and strong economy, but also called its pension and other long-term liabilities a constraint on upward movement on the ratings.

“We specifically do not expect to raise the rating until the state has shown a steady trend toward a well-funded pension system, which we believe is beyond the current outlook period,” S&P Global Ratings credit analyst Ladunni Okolo said.