Eager for bonds, the municipal market saw a variety of deals price on Tuesday, led by sales in the airport, housing and healthcare sectors.

Primary market

Jefferies priced the Metropolitan Washington Airports Authority (Aa3/AA-/AA-) $387.98 million of airport system revenue and refunding bonds. The issue is composed of Series 2019A bonds subject to the alternative minimum tax and Series 2019B non-AMT bonds.

Proceeds will finance the authority's $2 billion 10-year capital construction plan.

On Thursday, Ramirez & Co. is slated to sell $161.67 million of Series 2019A (A2/A-/NR) first senior lien revenue refunding bonds for the authority's Dulles Toll Road on Thursday.

“Both offerings are free of D.C. and Virginia income tax, although as noted a portion of the airport deal is subject to AMT,” Janney said in a comment.

Morgan Stanley priced the New York State Housing Financing Agency (Aa2/NR/NR) $129.975 million of Series 2019H affordable housing revenue climate bond certified and/or sustainability bonds for institutions after holding a one-day retail order period.

BofA Securities priced the New Jersey Higher Education Student Assistance Authority’s $282.65 million of student loan revenue bonds consisting of Series 2019A non-AMT and Series 2019B AMT (Aa1/NR/NR) and Series 2019C (A2/NR/NR) subordinate AMT bonds on Tuesday.

Citigroup priced the Maricopa County Industrial Development Authority, Arizona, (NR/AA-/AA-) $245.266 million of Series 2019B, C and D revenue bonds for Banner Health.

Morgan Stanley priced the Matagorda County Navigation District Number One, Texas, (Baa1E/A-E/NR) $100.636 million of Series 2001A pollution control revenue refunding bonds for the Central Power & Light Co. as a remarketing.

In the competitive arena on Tuesday, Arlington County, Virginia, (Aaa/AAA/AAA) sold $169.48 million of Series 2019 general obligation public improvement bonds.

Morgan Stanley won the bonds with a true interest cost of 2.4194%. Proceeds will be used to finance various public improvements. PFM Financial Advisors is the financial advisor; McGuire Woods is the bond counsel.

The county last competitively sold comparable bonds was on June 6, 2018 when Wells Fargo Securities won $153.555 million of Series 2018 GOs with a true interest cost of 2.99%.

Since 2009, the county has sold about 1.8 billion of bonds with the most issuance occurring in 2016 when offered $217 million. It sold the least amount of bonds in 2015 when it issued $77 million.

Travis County, Texas, (NR/AAA/NR) sold $153.96 million of securities in three sales.

Citigroup won all three issues: it took the $113.29 million of Series 2019B limited tax certificates of obligation with a TIC of 2.5273%, the $26.12 million of Series 2019 limited tax permanent improvement bonds with a TIC of 2.6593% and the $14.55 million of Series 2019 unlimited tax GO road bonds with a TIC of 2.6598%.

Proceeds of the certificates will be used to pay for civil and criminal justice facilities and jail facilities, various capital improvements and buying vehicles and heavy equipment. Proceeds of the permanent improvement bonds will be used to finance various capital improvements while proceeds of the road bonds will be used to pay for roads and turnpikes, road drainage, bike lanes, sidewalks and shared use paths and replacement and improvement of road bridges and culverts.

PFM Financial Advisors is the financial advisor; Bracewell is the bond counsel.

Tuesday’s bond sales

Secondary market

Munis were mixed on the

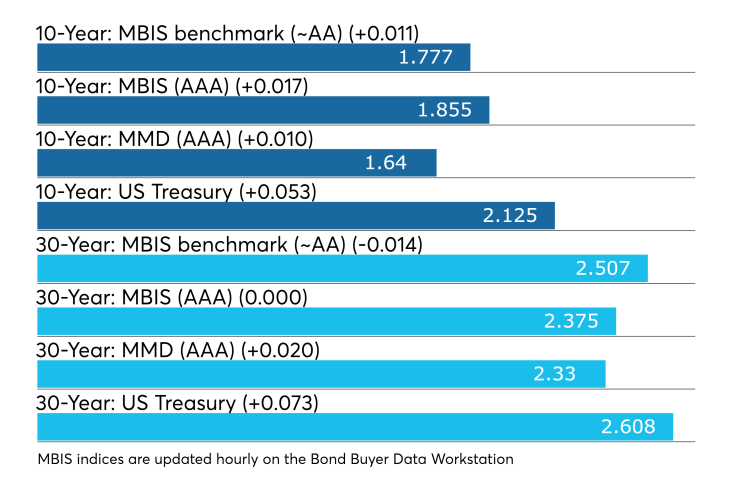

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO rose one basis point to 1.64% while the yield on the 30-year muni increased two basis points to 2.33%.

The 10-year muni-to-Treasury ratio was calculated at 77,3% while the 30-year muni-to-Treasury ratio stood at 89.4%, according to MMD.

Treasuries were weaker as stock prices rrose. The Treasury three-month was yielding 2.348%, the two-year was yielding 1.887%, the five-year was yielding 1.886%, the 10-year was yielding 2.125% and the 30-year was yielding 2.608%.

"The ICE Muni Yield Curve is one basis point higher as the markets take their direction from Treasuries," ICR Data Services said in a Tuesday market comment. "High-yield and tobacco bonds are flat today while taxable yields are up six to eight basis points in the belly of the curve."

Previous session's activity

The MSRB reported 37,161 trades Monday on volume of $12.13 billion. The 30-day average trade summary showed on a par amount basis of $12.36 million that customers bought $6.16 million, customers sold $4.06 million and interdealer trades totaled $2.22 million.

California, Texas and New York were most traded, with the Golden State taking 14.16% of the market, the Lone Star State taking 13.377% of the market, and the Empire State taking 8.298%.

The most actively traded security was the Fulton County, Ga., TANs Series 2019 2.5s of 2019, which traded 71 times on volume of $55.70 million.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $35.004 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.