The Treasury Department’s recommendation that Congress give state and local housing finance agencies the ability to use tax-exempt bonds for subprime mortgage refinancings would add more pressure to an area of private-activity bond financing that an annual survey shows is already increasingly pressured by housing needs. Yesterday, Treasury Secretary Henry Paulson held a press conference on the Bush administration’s proposal for subprime mortgage relief, which includes a plan to expand HFA bond issuance to not only new mortgages, but also refinancings. Outside of bonds, the package also would freeze interest rate increases on some subprime mortgages at their introductory rates.The changes proposed for private-activity bonds, the interest on which would be subject to the alternative-minimum tax, would require some legislative action by Congress. In addition to expanding the permissible uses for private-activity mortgage bonds, the administration’s proposal would reportedly include a three-year expansion of the volume cap to allow more such bonds to be issued. However, the size of the increase will be determined in conjunction with Congress. Treasury officials also say it is unlikely that additional public financing tools will be added to the package.An analysis of data collected annually by The Bond Buyer indicates that the volume cap — the federal limit placed on the amount of tax-exempt bonds that can be issued to benefit private entities, including HFAs — has been increasingly pressured by HFA needs over the last two years, and housing advocates say this year again presents a tight situation.Last year, municipalities issued $25.5 billion of private-activity bonds, an increase of $3.6 billion from 2005, largely driven by a 55.1% jump in issuance of bonds for single-family mortgages, which are currently limited to loans to first-time homebuyers. Further, last year was the first time in a decade that states carried forward less PAB volume cap than the prior year. Cap restrictions made 11 states unable to fund all their requests, up from the three states restricted by funding deficiencies under the cap in 2005.Data from the last two years also indicates that housing needs are taking up larger chunks of available volume cap. In 2005, housing bonds made up 60%, or $13.4 billion, of PAB issuance, while in 2006 they accounted for 68.2%, or $17.4 billion, of total issuance.This year, the subprime mortgage crisis has created even more demand for financing from HFAs, according to housing advocates.Barbara Thompson, executive director of the National Council of State Housing Finance Agencies, says that a “flight to quality” among first-time homebuyers has driven them to turn to HFAs in higher numbers.“First-time homebuyers who might have been entrapped in the subprime market are increasingly turning to HFAs,” she said. “The demand in terms of new homebuyers is very, very high, the highest the HFAs have seen in many years.”

-

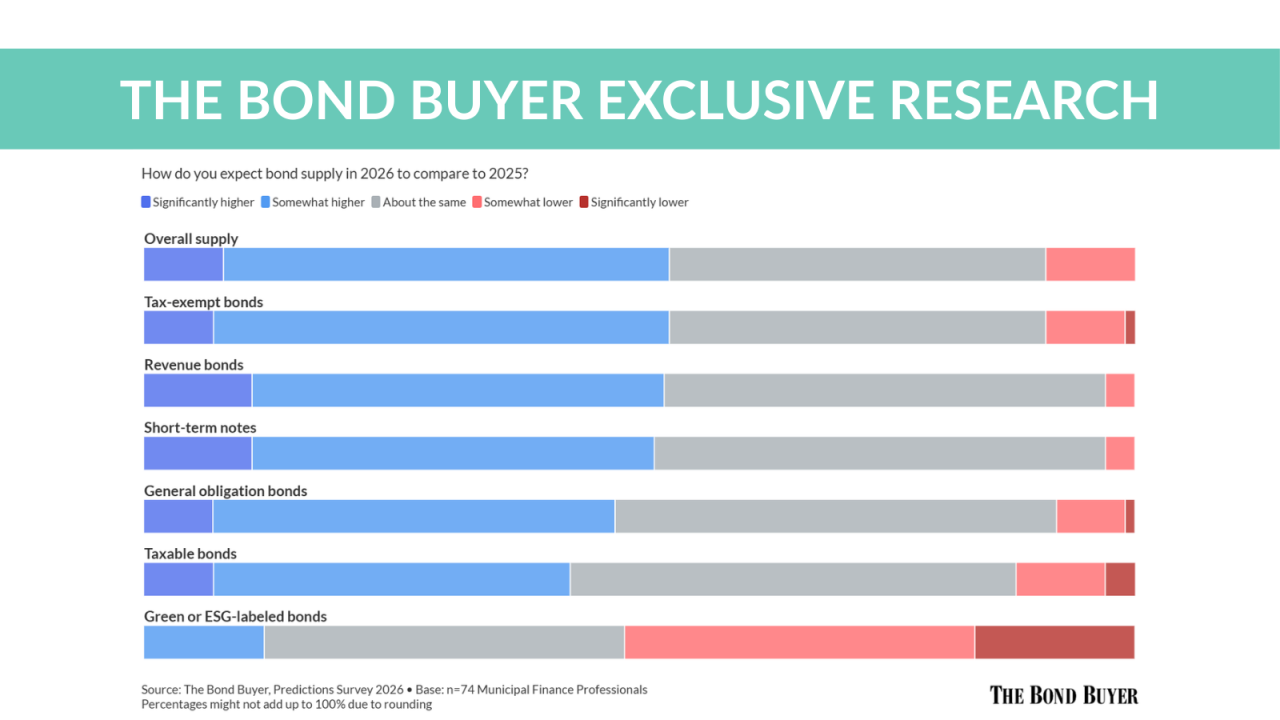

The latest research from The Bond Buyer predicts supply and issuance volume will grow in the months ahead.

47m ago -

The New York Metropolitan Transportation Authority says it has shaved more than $4 billion off construction costs in five years.

1h ago -

The offer was revealed in a disclosure statement and plan of reorganization in the Chapter 11 bankruptcy.

March 6 -

"We are still not overly concerned about the effect of the geopolitical concerns on municipals — in our view, the muni market is well insulated," said Barclays strategists.

March 6 -

A state judge ordered the Arizona Legislature to enact a system for funding public school facilities that is constitutional and set a timeframe for compliance.

March 6 -

BDA "strongly supports FINRA and the MSRB remaining independent self-regulatory organizations," Mike Nicholas said.

March 6