DALLAS - Despite enviable credit ratings, the growing Phoenix suburb of Glendale, Ariz., discovered additional value in insuring $85.2 million of taxable and tax-exempt bonds for commercial development around the city's two major-league sports venues.

The city added insurance from Financial Security Assurance Inc. to obtain triple-A enhanced ratings from Standard & Poor's and Moody's Investors Service. Even city officials were surprised to find some incremental savings over their natural AA-plus from Standard & Poor's and Aa3 from Moody's. Fitch Ratings does not provide underlying ratings.

"The city had some concerns about insurance, but when we penciled out the net-present-value, the rates were better than where they would have been without insurance," said Glendale chief financial officer Raymond Shuey.

The Thursday deal led by Banc of America Securities LLC included a $52.5 million taxable series, which matures in 2018, 2025, and 2033. Those bonds financed a parking garage and related developments for Westgate City Center, a hotel-retail-office center linked to the Phoenix Coyotes hockey arena and University of Phoenix Stadium, home of the National Football League's Arizona Cardinals.

The second tranche, $32.7 million series of revenue bonds, allowed the city to gain tax-exempt status on debt that had previously been taxable as a bridge loan from Bank of America NA, Shuey said.

Financial adviser Scott Nash of JNA Consulting Inc. said the city would have considered insuring only one of the two series, but found no benefits in partial coverage.

The idea of insuring the deal was prompted by information from Banc of America Securities, according to Nash.

"We talked to their traders and underwriters to find out how things are trading," he said.

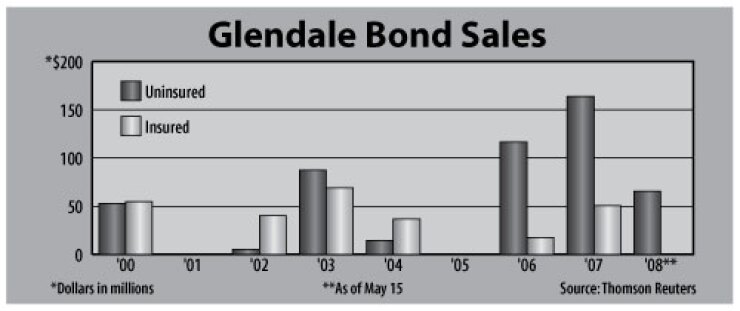

When Nash compared the two columns of figures on the maturities, insured versus uninsured, insured won out at the rates FSA was offering, he said. The rates were not available.

The tax-exempt series mature in 2011, and from 2015 through 2022, with term bonds in 2028 and 2032. Yields at pricing ranged from 2.73% with a 3% coupon in 2011 to 4.75% with a 4.5% coupon in 2032. The bonds are callable at par in 2018.

Benefits of insurance showed up more toward the long end of the yield curve, Nash said.

"If it wasn't attractive, we would have been happy to go without it," he said.

Glendale also bought FSA coverage on its previous bond deal this year, about $63 million of water and sewer bonds. On last week's deal, Glendale sought bids from Assured Guaranty Ltd., as well. Among seven bond insurers, FSA and Assured Guarantyare the only two with triple-A ratings from all-three ratings agencies. MBIA lacks a triple-A from Fitch.

FSA, a unit of European bank Dexia, lost $421.6 million during the first quarter, compared with earnings of $85.2 million during the same period the previous year.

FSA recorded an after-tax write-down of $317.9 million tied to its portfolio of credit derivatives. During the first quarter, FSA took an estimated 65% of the market for U.S. municipal debt insurance,

Although FSA offered rates that made insurance attractive on the Glendale deal, Nash said he sees it as a seller's market with only two top-rated insurers to choose from.