BRADENTON, Fla. — The Municipal Electric Authority of Georgia this week plans to sell $178.1 million of new and refunding subordinated revenue bonds.

The MEAG deal comes after one rating agency changed its outlook for the credit to negative from stable due to repercussions from the nuclear disaster in Japan.

Bond proceeds will finance various capital improvements as well as refinance commercial paper and refund certain bonds. The deal is structured as six series with maturities from 2013 to 2021. While most of the issue is tax exempt, two of the series totaling just over $3 million are being sold as taxable bonds.

Retail sales are expected to take place on Wednesday with institutional sales on Thursday, depending on market conditions, according to MEAG chief financial officer Jim Fuller.

The bonds are rated A-plus by Fitch Ratings, A2 by Moody's Investors Service, and A by Standard & Poor's. Fitch and Standard & Poor's assign stable outlooks.

Moody's said it changed its outlook to negative due to the potential for cost pressures from heightened political and regulatory risks associated with new and existing nuclear plants in the wake of the Japanese nuclear crisis.

MEAG was created by Georgia to own electric generation and transmission facilities. It supplies bulk power to 48 cities and one county, and has ownership interests in various facilities, including an existing nuclear plant.

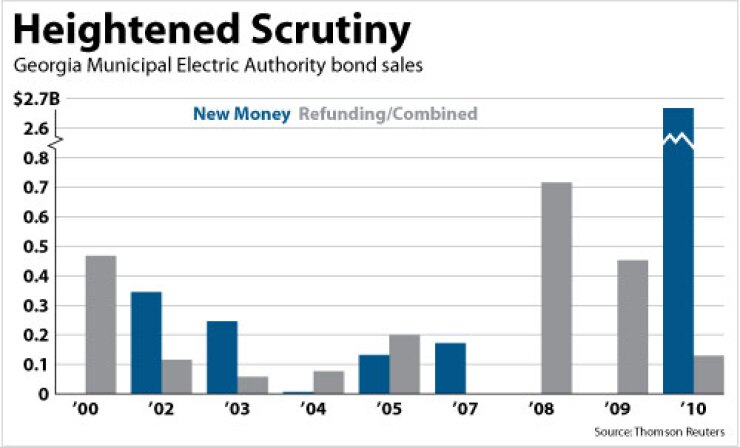

The authority also has a 22.7% stake in two new nuclear units under development at Plant Vogtle and sold over $3 billion of bonds last year to finance a portion of the construction. The bonds have redemption provisions with full cost recovery should the project be delayed or cancelled.

"Negative pressure exists" as to whether MEAG's participants can raise rates sufficiently to protect the authority's credit profile and metrics, according to a report by Moody's analyst Dan Aschenbach.

"MEAG Power is as well positioned as one could expect with strong financial liquidity, the execution of a sound financing program for the Vogtle nuclear expansion project, and the expectation that the Vogtle expansion remains a strong achievable project," Aschenbach said.

Fuller agreed that added regulatory scrutiny of nuclear generation should be expected, while adding that MEAG's nuclear plants are not exposed to the same risks as in Japan. They are located well inland, in a low seismic activity zone, and have added regulatory oversight, he said.

The existing units received 20-year extensions of their operating license, which means MEAG has a vested interest in maintaining them to the highest safety standards, Fuller said, adding that the authority is well-positioned financially.

"MEAG Power has approximately $4 billion in cash and investments, access to an additional $1.8 billion of funds under the Department of Energy's federal loan guarantee program, and has dramatically declining debt service on its existing units over the next 10 years, leaving ample room for debt service related to new generation projects, including the Vogtle expansion project," he said.

The authority's participants are legally obligated to pay under court-validated take-or-pay contracts and have provided general obligation pledges to support the debt, according to Fuller.

Morgan Stanley is the book-runner for this week's sale. Others in the syndicate are Bank of America Merrill Lynch, Barclays Capital Inc., BMO Capital Markets, Citi, First Southwest Co., Goldman, Sachs & Co., JPMorgan, U.S. Bancorp Investments Inc., and Wells Fargo Securities.

Public Financial Management Inc. is financial adviser. Orrick, Herrington & Sutcliffe LLP is bond counsel. Underwriters' counsel is King & Spalding LLP.