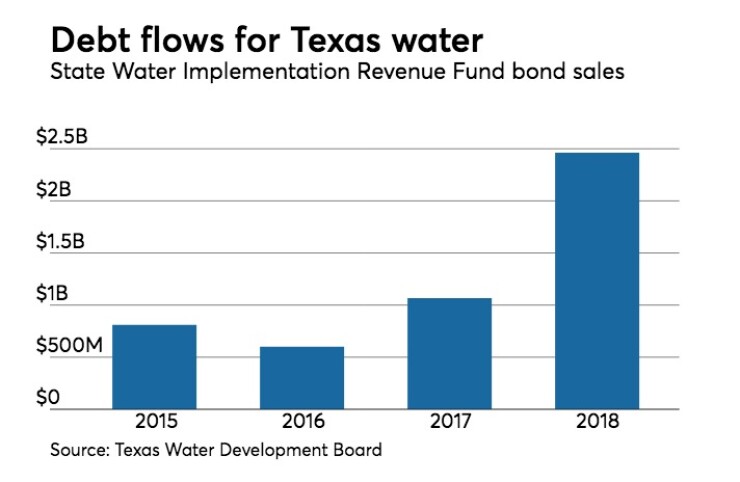

Solid investor demand from both here and abroad greeted the biggest municipal bond deal of the week – the Texas Water Development Board’s $1.7 billion offering.

Primary market

Citigroup priced and repriced the Texas Water Development Board’s tax-exempt revenue bond deal for institutions on Tuesday after holding a one-day retail order period on the tax-exempts on Monday.

The sale is composed of $1.666 billion of Series 2018B state water implementation revenue fund for Texas revenue bonds and $35.585 million of Series 2018C taxables.

The bonds were sold a program called SWIFT [State Water Implementation Fund for Texas]. Proceeds flow to a fund called SWIRFT [State Water Implementation Revenue Fund for Texas]. From there, the funds go toward local and regional borrowers that have qualified for the program and placed their own bonds with the TWDB.

"Despite a tricky Treasury market, we were able to get in and have a successful sale," said Peter Lake, chairman of TWDB. "Today's sale included over 65 institutional investors - including expanding our international investor base and yesterday's retail period we saw the largest retail presence in any transaction we have ever had."

The deal is rated AAA by S&P Global Ratings and Fitch Ratings.

"We were focused on investor outreach, making sure they understand the unique credit that it is and with the results, we are just proud to help secure the water future of Texas by implementing the state water plan," he said.

Sources said the demand for the Texas deal drove much of the primary marjet activity on Tuesday.

In the competitive arena, the Maryland Department of Transportation sold $605.355 million of Series 2018 consolidated transportation bonds, second issue.

Bank of America Merrill Lynch won the deal with a true interest cost of 3.0843%.

The financial advisors are PFM Financial Advisors and People First Financial Advisors; the bond counsel is Miles & Stockbridge.

The deal is rated Aa1 by Moody’s Investors Service, AAA by S&P and AA-plus by Fitch.

Since 2008, the Maryland DOT has sold about $4.7 billion of debt, with the most issuance occurring in 2015 when it sold $961.3 million. It sold the last amount of debt in 202014 when it sold $100 million.

Maui County, Hawaii, sold $108.55 million of Series 2018 general obligation bonds. BAML won the deal with a true interest cost of 3.1391%.

The financial advisors is C.M. de Crinis; the bond counsel is Hawkins Delafield. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

In the short-term competitive sector, the Broward County School District, Fla., sold $12 million of Series 2018 tax anticipation notes.

BAML won the BANs with a net interest cost of 1.8891%. The financial advisors is PFM Financial Advisors; the bond counsel is Greenberg Traurig. The deal is rated MIG1 by Moody’s.

Citi received the official award on the Great Lakes Water Authority’s $413.06 million deal.

Tuesday’s bond sales

Texas

Maryland:

Hawaii

Michigan

Bond Buyer 30-day visible supply at $8.56B

The Bond Buyer's 30-day visible supply calendar decreased $56.8 million to $8.56 billion for Tuesday. The total is comprised of $3.08 billion of competitive sales and $5.48 billion of negotiated deals.

Secondary market

Municipal bonds were weaker on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as two basis points in the one- to 30-year maturities.

High-grade munis were mostly weaker, with yields calculated on MBIS' AAA scale rising as much as two basis points across the curve.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising two basis points while the yield on 30-year muni maturity gained five basis points.

Treasury bonds were weaker as stock prices traded higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.7% while the 30-year muni-to-Treasury ratio stood at 100.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

“First thing this morning it appeared the Treasury market was slightly weaker and munis were neutral,” Peter Stare of Hilltop Securities noted Tuesday afternoon.

“As there was more talk about [President] Trump levying additional tariffs on China and China’s reciprocation, Treasuries weakened dramatically,” Stare said, noting that the 10-year Treasury was off a half point and the 30-year off a full point.

“As the morning wore on, MMD gave an early read that they would be adjusting their benchmark scale potentially two to four basis points higher in yield,” Stare said. “It was apparent it would be a challenging day,” he added.

He said investors had cash for the deals Hilltop was involved in. “It was just a function of finding the level that worked for the buy side,” he explained.

Previous session's activity

The Municipal Securities Rulemaking Board reported 35,676 trades on Monday on volume of $7.79 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 14.79% of the market, the Lone Star State taking 10.53% and the Empire State taking 10.364%.

Oppenheimer looks at interest rates

As the next Federal Open Market Committee meeting nears, Oppenheimer & Co. Inc. is focusing on the future of interest rates and how it will affect the municipal market through year end. At the same time, the firm suggests investors benefit from periods of market weakness and buy high quality securities while limiting purchases in the high-yield municipal market — even though it outperformed lately.

The firm says the municipal market must return its focus to technical factors amid the rate uncertainty, Jeffrey Lipton, managing director and head of municipal research and strategy and fixed income research, wrote in a Monday municipal report.

"Trade tariffs and a looming Fed meeting had plenty to do with U.S. Treasury bond behavior last week and munis found it difficult to break free from the hypnosis," he wrote, adding that he suspects the U.S. Treasury 10-year yield may find itself "more comfortably sustained above 3% with still episodic dips for the time being."

With respect to the impact on municipal rates, Lipton said the firm is questioning its expectations for modest single digit positive returns for munis by year-end. "We believe that the bond market has been downplaying the growing probability of two additional rate hikes for the year and this likely explains why bond yields have demonstrated limited conviction to break out of their trading ranges, until recently," he said in the report.

"We think that if bond yields can play catch up and reflect more reasonable levels that align with the Fed’s current tightening trajectory then perhaps a newly adjusted trading range can be established," he added. If that sentiment follows, and the market focuses on technical factors going forward, Lipton said the firm remains "cautiously optimistic that our performance target can still be met."

This week he said the weekly calendar will test the market's resiliency — especially given the arrival of over $7 billion in new issuance, after a second consecutive week of negative municipal bond mutual fund flows.

With the addition of a boost in weekly volume, investors can diversify investment portfolios with different credits and structures, he said. "If demand holds in with successful placement of new issue product and if mutual fund inflows emerge this week then perhaps momentum can lift muni performance to positive returns," Lipton predicted, however, he added that there is still a supply deficit over the next 30-day period, according to Bloomberg data.

"Much of our performance calculus derives from supply patterns to come during the final quarter of the year," he noted. "As we have been discussing, there are a number of variables and factors that could affect actual volume figures," he said. "These include views on Fed policy, competition for budgetary dollars, appetite to assume higher debt levels and geopolitical developments."

"We continue to encourage investors to take advantage of episodic periods of market weakness and acquire quality securities that are likely to demonstrate resiliency and outperformance during the next down cycle," he added.

Lipton suggested investors enhance liquidity and preserve tax-efficient cash-flow at the same time.

Meanwhile, he also cautioned sophisticated investors — high net-worth and institutional — who have been active in the muni high yield space recently. "It may make sense to lock in performance and systematically reduce such holdings," Lipton suggested. "High yield has been outperforming the broader muni market with extended inflows and we are not sure that further spread tightening is sustainable."

Ramirez looks at muni market

With the yield curve flat, demand for short maturities, resistance to the long end, upgrading credit quality, and limiting high yield exposure are current themes in the municipal market, Peter L. Block, managing director of credit strategy at Ramirez & Co., said in a weekly municipal report.

Strong retail demand continues to support municipals inside of 10 years due to the flatness of the Municipal Market Data yield curve, Block said in Monday’s report.

Meanwhile, intermediate and long-dated maturities of 15 years and beyond have weaker demand due to the absence of significant bank and insurance company participation following tax reform, he observed.

This week, Block noted that gross supply is again higher than average at $7.3 billion, “led again by a mosaic of different names in both the competitive and negotiated markets.” Gross supply year to date, he pointed out, is $227.6 billion — or negative 12% year over year — which Block said is surprising to the upside due to a 8% year over year increase in new money issuance.

Meanwhile, future demand hinges on the potential level of ratios and the rate forecast, according to Block.

“Ratios need to get cheaper by least another two to three points in the 15-year to 30-year part of the curve to materially entice investors to support longer duration given the still very flat MMD 2s-30s at only 132 bps,” he wrote. He said that cheaper ratios across the curve could occur due to an uptick in gross supply — most likely in 2019 — or, if a U.S.-China trade war results in a bearish U.S. economic outlook.

Treasury sells $55B 4-week bills

The Treasury Department Tuesday auctioned $55 billion of four-week bills at a 2.020% high yield, a price of 99.846778.

The coupon equivalent was 2.051%. The bid-to-cover ratio was 3.38. Tenders at the high rate were allotted 50.39%. The median rate was 1.990%. The low rate was 1.960%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.