The Ford Foundation came to market with a $1 billion taxable deal aimed at providing direct grants to nonprofit organizations, while deals from the Geisinger Authority in Pennsylvania and the Los Angeles Department of Water and Power rounded out Thursday’s slate.

In the week ended June 17, tax-exempt mutual funds saw $1.7 billion of inflows, according to data released by Refinitiv Lipper Thursday. It was the sixth week in a row that investors put cash into the bond funds.

Municipal prices were little changed on the day, as action focused on new issue supply.

Primary market

Wells Fargo Securities priced the New York-based Ford Foundation’s $1 billion of corporate CUSIP taxable bonds (Aaa/AAA/NR/NR).

The deal was one of the largest

The bonds were priced at par to yield 2.415% in 2050 [34531XAB0] and 2.815% in 2070 [34531XAC8].

“The fact that these bond proceeds will be used to fund organizations who are working on building a more inclusive capitalism, advancing operational justice, advancing reconciliation, improving police and community relations, I think that it is a very timely offering that converges with the social needs of this country in a very powerful and profound way,” Darren Walker, president of the Ford Foundation, told The Bond Buyer last week.

BofA Securities priced and repriced the Geisinger Authority of Montour County, Pa.’s (A1/AA-/NR/NR) $713.23 million of health system revenue bonds in three tranches.

The $482.605 million of Series 2020A revenue bonds were repriced to yield 0.54% in 2022 with a 5% coupon, 1.98% with a 5% coupon in 2035, 2.32% with a 4% coupon in 2039, 2.43% with a 5% coupon and 3% at par and 2.68% with a 4% coupon in a triple split 2050 maturity.

The $140.32 million of Series B seven-year PUT bonds were repriced to yield 1.35% with a 5% coupon in 2043 with a mandatory tender in 2027.

The $90.305 million of Series C 10-year PUT bonds were repriced to yield 1.67% with a 5% coupon in 2043 with a mandatory tender in 2030.

The Series 2020A bonds had been tentatively priced to yield 0.66% in 2022 with a 5% coupon, 2.08% with a 5% coupon in 2035, 2.47% with a 4% coupon in 2039, 2.48% with a 5% coupon and 3% at par and 2.73% with a 4% coupon in the triple split 2050 maturity.

The Series B PUTs were tentatively priced to yield 1.45% with a 5% coupon in 2043 with a mandatory tender in 2027.

The Series C PUTs were tentatively priced to yield 1.78% with a 5% coupon in 2043 with a mandatory tender in 2030.

Barclays Capital priced the Los Angeles DWP’s (Aa2/NR/AA-/NR) $433.08 million of power system revenue bonds.

The deal was priced with 5% coupons to yield from 0.41% in 2026 to 1.40% in 2036, 1.52% in 2039, 1.57% in 2040, 1.72% in 2045 and 1.78% in 2050.

Given the strong demand for new issue paper and the arrival of spring redemption season, there was brisk activity in the municipal market on Thursday — but also growing credit concerns and a division among investors and credits, according to one New York trader at a large Wall Street firm.

“There is tons of money around and it keeps coming in,” the trader said. “On the good deals it’s going to work.”

He noted deals that have been cheapened on the long end are garnering strong attention.

“Absolute yields are low right now — so it’s ridiculous on the short end, but percentages are attractive compared to governments,” he said.

Meanwhile, he said there is a dichotomy among the investor community when it comes to new-issue product given the overall absolute rate environment — and the ongoing impacts and volatility from COVID-19.

“You have lost retail in the front end of the curve because they don’t like to buy fractionals,” he said, adding investors are willing to stay intermediate or go long — depending on deals being attractively priced.

Institutional investors and banks are buying along the curve — including the short end since they are flush with cash, he noted.

“Institutional and bank money is huge and it’s gobbling up new issues, but retail is hesitant,” especially when it comes to buying one-year paper at 0.35%, the trader said.

Despite the strong appetite for paper, however, credit concerns impacting the market as result of the COVID-19 crisis are giving some investors pause, he said.

The concerns surrounding credits, like colleges, airports, and other pandemic-impacted sectors, are contributing to investor behavior, according to the trader.

“Everyone is more conscious of credits — it’s a different ballgame now,” he said. “You really have to question some credits because there are a lot of states that are in tough shape.”

Government assistance is a positive factor, but still fully uncertain, he noted. “There are so many questions left up in the air right now.”

JPMorgan Securities priced the Washington Health Care Facilities Authority’s (A2/NR/A+/NR) $232.925 million of revenue bonds for the Seattle Cancer Care Alliance.

The deal was priced to yield from 0.98% with a 5% coupon in 2023 to 2.37% with a 5% coupon in 2040. A split 2045 term maturity was priced to yield 2.46% with a 5% coupon and 2.66% with a 4% coupon; a split 2050 maturity was priced to yield 2.51% with a 5% coupon and 2.73% with a 4% coupon; and a 2055 term was priced to yield 2.66% with a 5% coupon.

Wells Fargo priced Riverside County, Calif.’s (NR/SP1+/F1+/NR) $340 million of tax and revenue anticipation notes. The TRANs, which mature June 30, 2021, were priced to yield 0.28% with a 4% coupon.

Citigroup received the written award on the Texas Transportation Commission’s (Aaa/NR/AAA/AAA) $794.235 million of taxable highway improvement general obligation refunding bonds. The bonds were priced to yield from 0.495% with a 5% coupon in 2022 to 1.99% with a 5% coupon in 2034; a 2042 term was priced at par to yield 2.562%.

Loop Capital received the official award on Ohio’s (Aa1/AA+/NR/NR) $780 million taxable and tax-exempt general obligation bonds.

The bonds consisted of $492.195 million of taxable Series 2020A higher education refunding bonds, common schools refunding bonds, infrastructure improvement refunding bonds and $287.815 million of tax-exempt Series 2020B higher education refunding bonds, common schools refunding bonds and infrastructure improvement refunding bonds.

Secondary market

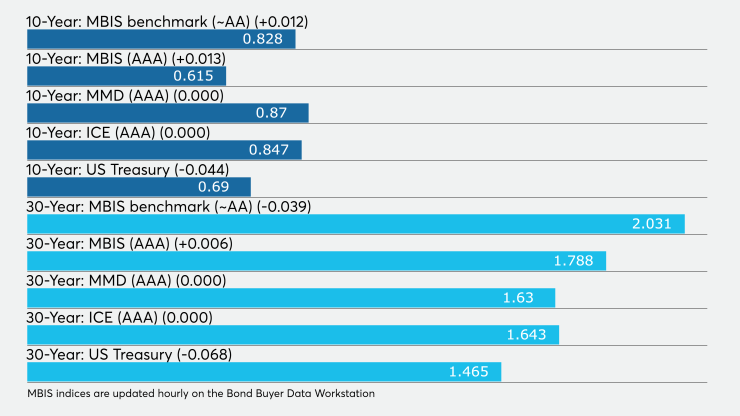

On MMD’s AAA benchmark scale, yields were unchanged throughout the curve. Yields on the 2021 and 2023 maturities were steady at 0.25% and 0.27%, respectively. The yield on the 10-year GO muni was flat at 0.87% while the 30-year yield was unchanged at 1.63%.

The 10-year muni-to-Treasury ratio was calculated at 125.7% while the 30-year muni-to-Treasury ratio stood at 111.5%, according to MMD.

The ICE AAA municipal yield curve showed yields were unchanged, with the 2021 and 2022 maturities at 0.230% and 0.247%, respectively. Out longer, the 10-year maturity was steady at 0.847% while the 30-year was flat at 1.643%.

ICE reported the 10-year muni-to-Treasury ratio stood at 130% while the 30-year ratio was at 110%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.21% and the 2022 maturity at 0.26% while the 10-year muni was at 0.88% and the 30-year stood at 1.63%.

Munis were weaker on the MBIS benchmark and AAA scales.

Treasuries were stronger as stocks traded lower.

The three-month Treasury note was yielding 0.160%, the 10-year Treasury was yielding 0.690% and the 30-year Treasury was yielding 1.465%.

The Dow fell 0.62%, the S&P 500 decreased 0.37% and the Nasdaq declined 0.12%.

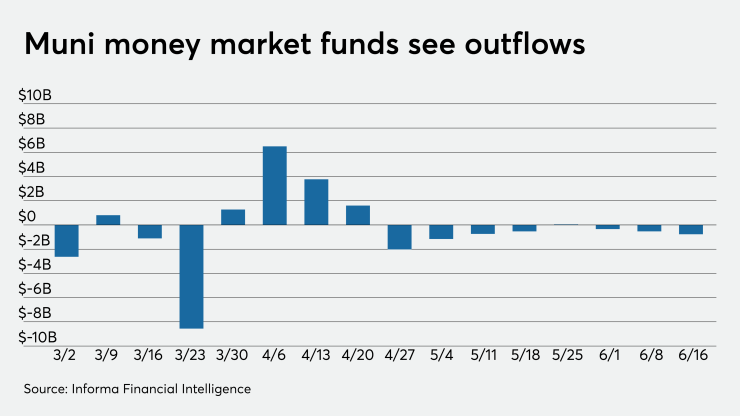

Money market muni funds fall $769M

Tax-exempt municipal money market fund assets fell $768.8 million, bringing total net assets to $133.18 billion in the week ended June 15, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds dipped to 0.03% from 0.04% in the previous week.

Taxable money-fund assets decreased $43.97 billion in the week ended June 16, bringing total net assets to $4.490 trillion.

The average, seven-day simple yield for the 793 taxable reporting funds dipped to 0.07% from 0.08% in the prior week.

Overall, the combined total net assets of the 980 reporting money funds dropped $44.74 million to $4.623 trillion in the week ended June 16.