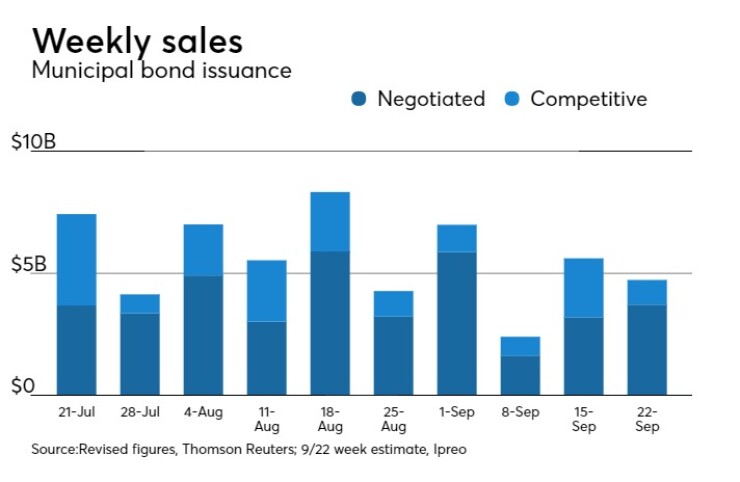

Weekly volume in the primary municipal bond market is expected to drop below $5 billion for the third time in five weeks as Federal Reserve policy makers weigh another interest rate increase.

Ipreo estimates volume will sink to $4.72 billion from the revised total of $5.61 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $3.71 billion of negotiated deals and $1.01 billion in competitive sales.

There are 10 sales scheduled $100 million and larger, with two of them coming from via the competitive route. While supply has been down this year, it has been especially slow of late.

“We just continue to suffer from low-supply,” said Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management. “During [the past week] there were a few deals that got sloppy, as they were priced aggressively at the same time the market sold off and yields spiked. The market is still in good shape. You just have to be careful when chasing values that appear to be pretty rich [at the time].”

He said the Federal Reserve and what it does with interest rates could affect the muni market.

“The market is not anticipating a fed funds rate increase this year but the team here at U.S. Bank, we do believe one will take place this year, but not until December,” he said. “If the Fed becomes more aggressive in their quest to raise interest rates and shrink the balance sheet, coupled with pick-up in supply and higher inflation rates and treasury rates across the board, it would put some pressure on the short end of the curve.”

The FOMC is scheduled to hold a two-day meeting on Tuesday and Wednesday followed by a press conference by Chair Janet Yellen.

“While it is expected that they will hold interest rates for now, it could lend us clues as far as their plans for not only the rest of this year but into 2018 as well,” Heckman said.

Barclays is scheduled to price the Regents of the University of California’s $854.285 million of limited project revenue bonds including both tax-exempts and taxables on Tuesday. The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

Citi is slated to price New York Metropolitan Transportation Authority’s $500 million of revenue climate certified green bonds on Tuesday after a one-day retail order period. The deal is rated A1 by Moody’s and AA-minus by S&P and Fitch.

Goldman Sachs is expected to price the State of Ohio’s $341.87 million of general obligation highway capital improvement bonds also on Tuesday. The deal is rated Aa1 by Moody’s, AAA by S&P and AA-plus by Fitch.

There is a tie for the largest competitive bond sale of the week, both deals coming from school districts. First, on Tuesday Brookland-Cayce School District No. 2 S.C. is scheduled to sell $100 million of GO bonds. The deal is rated Aa1 by Moody’s and AA by S&P. Then on Thursday, Cherry Creek School District No. 5 Colo., is slated to sell $100 million of GO bonds. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Secondary market

Top-shelf municipal bonds finished mixed on Friday. The yield on the 10-year benchmark muni general obligation rose one basis point to 1.89% from 1.88% on Thursday, while the 30-year GO yield was unchanged from 2.76%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Friday. The yield on the two-year Treasury rose to 1.38% from 1.36% on Thursday, the 10-year Treasury yield was unchanged from 2.20% and the yield on the 30-year Treasury bond decreased to 2.77% from 2.78%.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 85.8%, compared with 85.6% on Thursday, while the 30-year muni-to-Treasury ratio stood at 99.5% versus 99.3%, according to MMD.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Sept. 15 were from California, New Jersey and Texas issuers, according to

In the GO bond sector, the Marin County Healthcare District, Calif., 4s of 2043 were traded 43 times. In the revenue bond sector, the New Jersey Economic Development Authority 3.375s of 2030 were traded 57 times. And in the taxable bond sector, the University of Texas 3.354s of 2047 were traded 33 times.

Week's actively quoted issues

New Jersey and California names were among the most actively quoted bonds in the week ended Sept. 15, according to Markit.

On the bid side, the South Jersey Port Corp. taxable 7.365s of 2040 were quoted by 129 unique dealers. On the ask side, the California GO 4s of 2047 were quoted by 188 dealers. And among two-sided quotes, the California taxable 7.3s of 2039 were quoted by 21 unique dealers.

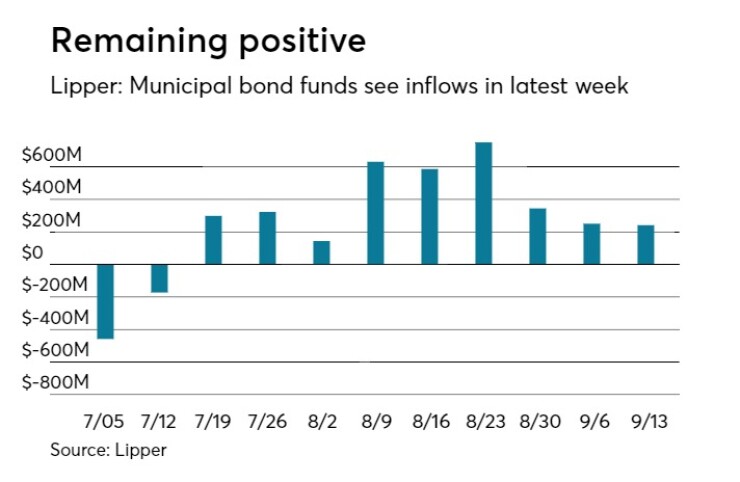

Lipper: Muni bond funds see inflows

Investors in municipal bond funds once again put cash into the funds, according to Lipper data released late Thursday.

The weekly reporters drew $241.383 million of inflows in the week of Sept. 13, after inflows of $250.368 million in the previous week.

Exchange traded funds reported outflows of $71.425 million, after inflows of $2.169 million in the previous week. Ex-EFTs, muni funds saw $312.807 million of inflows, after inflows of $248.199 million in the previous week.

The four-week moving average was positive at $396.692 million, after being in the green at $483.038 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $289.549 million in the latest week after inflows of $105.638 million in the previous week. Intermediate-term funds had inflows of $84.525 million after inflows of $74.141 million in the prior week.

National funds had inflows of $347.544 million after inflows of $290.814 million in the previous week.

High-yield muni funds reported inflows of $293.763 million in the latest week, after inflows of $165.070 million the previous week.