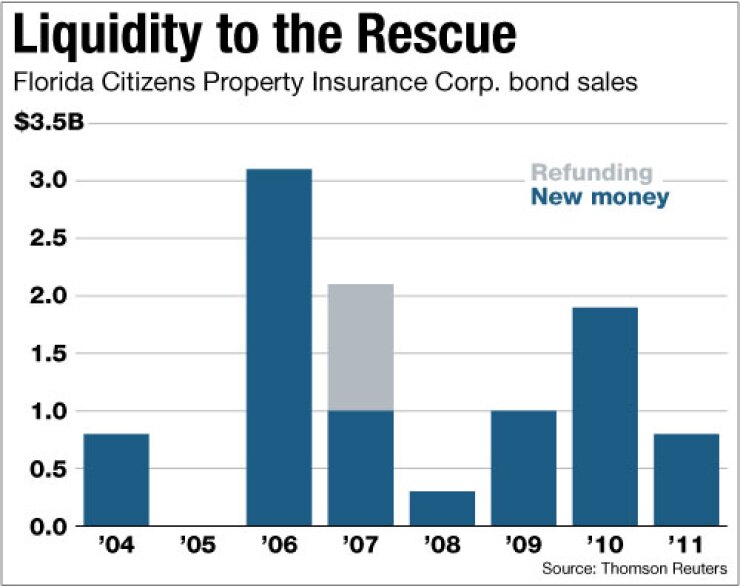

BRADENTON, Fla. — Florida’s Citizens Property Insurance Corp. will bring $1.25 billion of bonds and notes to market early next week in a deal that could be upsized to $1.5 billion if conditions warrant.

The CPIC transaction could be the largest single offering on next week’s negotiated sale calendar, and it is structured to maximize investor interest.

JPMorgan will be the book-runner of the nine-member syndicate pricing the bonds Monday and Tuesday.

Sales results will be detailed during Citizens Board of Governors meeting on Wednesday.

Bond proceeds will be used by the state-run, nonprofit insurer as liquidity to pay claims, if needed, during the hurricane season.

The liquidity is specifically for the corporation’s personal and commercial accounts, which provide property insurance coverage for all perils except windstorm policies along the coastline.

The personal line insures homes, mobile homes and individual condominiums, while the commercial account covers condominium associations, apartment buildings and residential home association buildings.

The hurricane season technically began June 1, and runs through November.

The tax-exempt transaction has been initially structured as $1.1 billion of bonds with maturities up to 2027, $250 million of short-term notes maturing in 2013, and $150 million of floating-rate notes that will not have put, tender, or demand features.

The tax-exempt bonds are expected to be sold with serial maturities. No term bonds are anticipated, according to Raymond James | Morgan Keegan, the insurer’s financial advisor.

The final structure will be determined during pricing, including whether to upsize the deal.

Citizens has received a guarantee for up to $900 million of insurance from Assured Guaranty Municipal Corp., which may be used for certain maturities.

The multi-tiered structure of the offering provides Citizens options to respond to investor demand during pricing, according to the agency’s chief financial officer, Sharon Binnun.

“We have been well-received by both retail and institutional investors in years past,” Binnun said. “The base of Citizens’ investors has steadily increased over the last several years…and we would welcome new investors to further diversify our investor base.”

Based on current market conditions, MMD analyst Dan Berger said the Citizens transaction could see some lower spreads next week.

An analysis of the insurer’s previous offerings for longer maturities, in the five-year to seven-year range, showed that some spreads for these bonds generally have been over 200 basis points, Berger said.

“We’ve seen constant lowering of quality spreads throughout the muni market,” he added. “But I must say that based on the light trading we have seen in this name that it’s possible [Citizens] bonds could come in to around 150 to 160 basis points.”

The long-term bonds were assigned ratings of A-plus by both Fitch Ratings and Standard & Poor’s, and an A2 rating by Moody’s Investors Service.

The short-term notes were assigned ratings of F1-plus by Fitch, MIG-1 by Moody’s, and SP-1-plus by S&P. All three rating agencies said the credit outlook is stable.

Binnun said she is optimistic that there will be capacity in the muni market for next week’s sale, at an interest rate that recognizes the strength of the insurer’s credit.

Along with JPMorgan, senior managers on the transaction are Bank of America Merrill Lynch, Citi, Goldman, Sachs & Co., and Morgan Stanley. Co-managers are Jefferies & Co., Loop Capital Markets LLC, Ramirez & Co. and RBC Capital Markets.

Squire, Sanders & Dempsey is bond counsel. Bryant, Miller & Olive PA is disclosure counsel.

Nabors, Giblin & Nickerson PA is underwriters’ counsel.

Though Citizens is typically in the market annually for liquidity needs, the last time it sold bonds for the two accounts serving the personal and commercial lines was in 2007.

The agency has grown since to become the largest property insurer in Florida, and it is in the midst of a political firestorm over its size, liability, and premium rates that some observers believe are insufficient.

Despite the fact that the state has not been hit by a major storm since 2005, reducing the publicly run insurance program has been difficult over the years because private insurers have continued to contract or leave Florida entirely due to the hurricane risk.

CPIC’s personal lines account has just over one million policies with $241.2 billion in exposure and $1.7 billion in annual premiums.

If a hurricane or several tropical storms hit the state Citizens could draw on bond proceeds as a liquidity bridge to pay claims.

The premiums and other revenues associated with the personal account, along with emergency assessments that can be placed on nearly all property insurance policies across the state if necessary, secure the bonds being sold next week.

The broad emergency assessment base is considered a credit strength by analysts.

The assessment base is available to support the personal and commercial lines, as well as a third Citizens account that contains policies providing windstorm coverage in coastal areas of the state.

The coastal account currently has 419,305 policies with exposure of $144.8 billion.

CPIC’s exposure in the three accounts has renewed calls to downsize the insurer, and reduce its liability. The agency has already eliminated coverage of most outdoor structures, aside from homes, and has formed a committee to step up private market interest in assuming more policies.

Gov. Rick Scott and some lawmakers are pushing for more reductions in Citizens, and may consider supporting increasing premium rates that have legislatively imposed caps.

Citizens president, Tom Grady, has been meeting with consumers and media across the state in recent weeks discussing the insurer and its liabilities.

Binnun said Grady’s tour is to demonstrate the organization’s commitment to reducing its size as well as solicit input from stakeholders.

“A reduction in Citizens’ size reduces the reliance on assessments after a very large storm,” she said. “There have been no suggestions to alter the assessment base.”

Florida statutes contain a strong non-impairment clause preventing legislative actions that would adversely affect bondholders, Binnun said.

“A significant element of Citizens’ strong credit is the requirement for the Board of Governors to levy assessments to cure any deficits,” she said.

The CPIC also relies on paying some claims through the purchase of reinsurance through the state-run, nonprofit Florida Hurricane Catastrophe Fund.

The size of the so-called Cat Fund and its reliance on the municipal bond market have also become a heated political topic.

The Cat Fund is also formulating plans to seek up to $1.7 billion of financing from the municipal market in the upcoming months to cover its own liquidity needs this hurricane season.

Because of its function providing coverage to the private insurance market, the fund sells taxable debt to secure its liquidity needs on a pre-event basis.

The Cat Fund also is structured to place assessments on policies statewide to repay its debts.

After a hurricane, both Citizens and the Cat Fund would potentially rely on selling long-term, tax-exempt bonds to pay claims.

The final structure of the Cat Fund’s upcoming offering, including the amount, has yet to be determined.