The new federal prohibition of tax-exempt advance bond refundings will prompt New York Metropolitan Transportation Authority officials to tweak their issuance strategy, said finance director Patrick McCoy.

The MTA, one of the largest municipal issuers, realized about $534 million in present-value savings, or 9.7% of total refunded par of $5.53 billion of refunding transactions in 2017, McCoy told members of the board’s finance committee. That included $150 million of current refundings.

“We have typically used this tool to manage our debt portfolio and unfortunately this has been taken away,” McCoy said Monday during his annual

The state-run authority, which operates New York City’s subways and buses, the Long Island and Metro-North commuter railroads, and several bridges and tunnels, typically issues bonds with a 10-year par call, according to McCoy.

“So if we issue those bonds today, in 10 years we can refund them if the rates are attractive at that time.”

Responding to board member David Jones, McCoy said authority officials are exploring alternatives, “maybe a five-year call or a seven-year call, coming down the yield curve a little bit.”

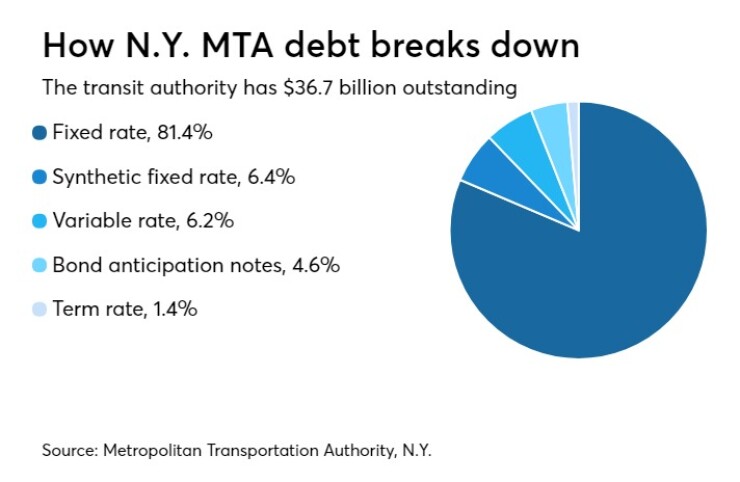

The MTA had $36.7 billion of debt as of Dec. 31. According to McCoy, the authority retired $965.3 million of long-term debt last year through normal amortization. About 81% of the debt it has issued is fixed rate, with the balance split among synthetic fixed rate, variable rate, bond anticipation notes and term rate.

Its workhorse credit, transportation revenue bonds, account for 62% of the MTA’s portfolio. Other credits are Triborough Bridge and Tunnel Authority senior and subordinate bonds – 20% and 15%, respectively – and dedicated tax fund bonds, 15%.

Fitch Ratings on June 7 upgraded its rating on the authority’s transportation revenue bonds two notches to AA-minus from A, with a stable outlook. The bonds are backed by a gross lien on the MTA's operating revenues.

“The strategic importance of the MTA transit network to the economy of the New York region supports Fitch's expectation for lower volatility user-based demand,” Fitch said at the time.

Fitch also upgraded the outstanding MTA transportation revenue BANs to F1-plus from F1.

“That was certainly good news,” said McCoy. “As you can see, we have strong ratings across the board here.”

S&P Global Ratings also rates the transportation revenue bonds AA-minus. Moody’s Investors Service and Kroll Bond Rating Agency rate them A1 and AA-plus, respectively.

The MTA issued just under $10 billion of debt last year, including $2.9 billion in new money; $1 billion in long-term fixed rate bonds to retire bond and revenue anticipation notes; and $759 million in remarketing of tendered obligations.

This year, said McCoy, the MTA intends to issue $6.1 billion, including this week’s planned $350 million TBTA sale. Earmarked for this year are $3.2 billion in new-money and BAN takeout; $2.4 billion of remarketing; and $574 million in current refunding.

MTA budget director Douglas Johnson said the $4.8 billion Gov. Andrew Cuomo allocated for the authority in his proposed fiscal 2019 budget represents an increase of $334 million.

In addition, the state has allocated $254 million to the authority’s operating budget for its half of MTA Chairman Joseph Lhota’s emergency subway action plan, plus $174 billion in capital funds.

The Tax Cuts and Jobs Act, enacted Dec. 22, also eliminates the authority to issue various forms of tax credit bonds; eliminates the corporate alternative minimum tax; increases the exemption amount and phase-out levels for individual alternative minimum tax, or AMT bonds; reduces the corporate tax rate to 21% from 35%; limits the deductibility of state and local taxes for individuals to $10,000; and retains issuers' ability to issue tax-exempt private activity bonds and tax-exempt bonds to finance professional sports stadiums.